by Mish |

His reply was interesting but not at all unexpected. Pettis labeled Wolfgang Schaeuble’s comments “utter lunacy”.

Schaeuble Recap

Germany has no plans to reduce its export surplus, Finance Minister Wolfgang Schaeuble said on Friday, as the European Central Bank (ECB) has not changed its monetary policy which has led to a weaker euro which in turn boosts German exports.

“Even before the European Central Bank decided its policies of unusual monetary policy, which also led to the euro exchange rate falling significantly, I said that we will increase German export surplus,” Schaueble told reporters.

When asked whether he had any plans to decrease Germany’s export surplus, Schaeuble said: “I haven’t heard that the ECB is changing its monetary policy.”

Pettis Comments

What utter lunacy. It is one thing to defend the existing surplus by pretending to believe that it was not caused by income distortions at home but rather by foreign laziness, but to say that it is German policy to grow the surplus further is outrageous. Now that they have bankrupted Europe, and developing countries are in trouble, who but the US can possibly be forced into absorbing it?

If the US were ever to decide that it cannot continuing absorbing everyone else’s deficient demand at the expense of becoming more like peripheral Europe, the consequences for Germany (and China and Japan) would be devastating.

Michael

Bankrupt Europe

Some people blame Spain, Italy, Greece and Portugal for self-imposed problems. It’s not all that simple. The Euro and German policies were both managed in a manner guaranteed to create a crisis in peripheral Europe.

Spain did not have a choice in interest rates. Nor did Italy, Portugal or Greece. Fundamental flaws in the Euro exacerbated huge productivity differences.

Greece was allegedly bailed out three times, but there is no way it can ever pay back the hundreds of billions it owes. Each bailout compounded the problems of the previous bailout, but pile on they did.

On top of it all, the Eurozone Target2 Payment System says internal trade imbalances don’t matter, and all sovereign debt is deemed to have zero risk.

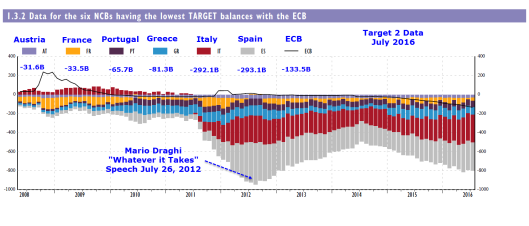

Target2 Imbalances

Target2 stands for Trans-European Automated Real-time Gross Settlement System. It is a reflection of capital flight from the “Club-Med” countries in Southern Europe (Greece, Spain, and Italy) to banks in Northern Europe.

Pater Tenebrarum at the Acting Man blog provides this easy to understand example: “Spain imports German goods, but no Spanish goods or capital have been acquired by any private party in Germany in return. The only thing that has been ‘acquired’ is an IOU issued by the Spanish commercial bank to the Bank of Spain in return for funding the payment.”

Target2 is also a measure of capital flight. The Italian banking system is effectively bankrupt, and outflows from Italy have been picking up.

Those needing a further explanation of Target2 may wish to consider Discussion of Target2 and the ELA (Emergency Liquidity Assistance) program; Reader From Europe Asks “Can You Please Explain Target2?”

Four Largest Target2 Creditor Countries

Look closely at the six countries with the highest balances. Only four countries are positive: Germany, Luxembourg, the Netherlands, and Finland.

The six largest deficit countries owe a collective 797.3 billion euros to the four creditor countries. The ECB itself is in hock for another 133.5 billion euros.

Monetary policy can help external balances but it cannot fix internal target2 balances.

Every county in the Eurozone is stuck with the Euro and the ECB’s interest rates whether it makes any sense or not (and it doesn’t). Rates suitable for Germany were not suitable for Spain, Ireland, Greece, and many other countries. An enormous property bubble in Spain and Ireland was the result.

Italy Target2 Soars to €327 Billion

The above numbers are the most current posted on the ECB’s website, updated September 1 (for the period ending July 31). They are not current. I presume on purpose.

On September 7, ZeroHedge posted Italy Funding Panic? Target2 Liabilities Unexpectedly Soar To Record High

Bank of Italy’s liabilities toward other eurozone nation soared by €35 billion in August, just shy of the biggest monthly increase on record, and reached an all time high of €327 billion, surpassing the previous records set in 2012, just prior to Draghi’s infamous “whatever it takes” speech.

In July, the Bank of Italy said that the recent increase in its Target 2 position was driven by foreigners selling Italian assets, especially bonds, and Italians buying foreign assets, movements which were only partially offset by Italian banks raising more funds on international markets.

In August this trend accelerated dramatically, prompting questions just how dire is the true state of Italy’s banks.

Capital Controls in Italy? Depositor Bail-Ins?

Prime minister Matteo Renzi is desperate to come up with a solution other than a bail-in of depositors, but schemes to date have been laughable.

There are several hundred billion in nonperforming loans at Italian banks on top of all the above messes we have been discussing.

I expect capital controls or depositor bail-ins at some point. With that, let’s return to Schaueble.

Wolfgang Schaueble Statements

Schaueble also stated “Even before the European Central Bank decided its policies of unusual monetary policy, which also led to the euro exchange rate falling significantly, I said that we will increase German export surplus,” Schaueble told reporters.

Germany cannot possibly collect on what it is owed, in undiluted euros, but it seeks even bigger surpluses.

As I have noted before, there are only three possible paths at this point.

Three Alternative Paths

- Germany and the creditor nations forgive enough debt for Europe to grow

- Permanently high unemployment and slow growth in Spain, Greece, Italy, with stagnation elsewhere in Europe

- Breakup of the eurozone

Germany will not allow #1. It is unreasonable to expect #2 to last forever. The only door left open is door #3.

The best move would be for Germany to leave the eurozone. Germany is in the best shape to suffer the consequences.

Unfortunately, the most likely outcome is a destructive breakup of the eurozone, starting in Italy or Greece.

Mike “Mish” Shedlock