by Mish

On October 3, 2008, Section 128 of the Emergency Economic Stabilization Act of 2008 allowed the Federal Reserve banks to begin paying interest on excess reserve balances (“IOER”) as well as required reserves. The Federal Reserve banks began doing so three days later.

As interest rates have risen, so has the free money to banks.

Interest Paid on Excess Reserves

At 1% interest, banks receive $22 billion in free money every year, nearly all of that goes to the largest banks.

Banks Paid $22 Billion to Not Lend?

Some argue that banks have an incentive to not lend, simply to collect interest.

Mathematically, it does not work that way. Excess reserves are a function of the Fed’s balance sheet and those reserves do not change whether a bank lends more or not.

A discussion of Interest on Excess Reserves and Cash “Parked” at the Fed on the New York Fed Liberty Street website explains.

“Reserve balances that are in excess of requirements are frequently referred to as “idle” cash that banks choose to keep “parked” at the Fed. These comments are sensible at the level of an individual bank, which can clearly choose how much money to keep in its reserve account based on available lending opportunities and other factors. However, the total quantity of reserve balances doesn’t depend on these individual decisions. How can it be that what’s true for each individual bank is not true for the banking system as a whole?

The resolution to this apparent puzzle is that when one bank decides to hold a lower balance in its reserve account, the funds it sheds necessarily end up in the account of another bank, leaving the total unchanged.

In the aggregate, therefore, these balances do not represent “idle” funds that the banking system is unwilling to lend. In fact, the total quantity of reserve balances held by banks conveys no information about their lending activities – it simply reflects the Federal Reserve’s decisions on how many assets to acquire.”

Lending Excess Reserves Is Impossible

The above Liberty Street explanation is precisely why the ECB’s negative interest rate policy cannot possibly work.

Bank loans do not change the total amount of excess reserves.

Nonsense from the Minneapolis Fed

Curiously, the Minneapolis Fed article Should We Worry About Excess Reserves?by consultant Christopher Phelan comes to the wrong conclusion.

“Since each dollar of bank deposit requires approximately only 10 cents of required reserves at the Fed, then each dollar of excess reserves can be converted by banks into 10 dollars of deposits. That is, for every dollar in excess reserves, a bank can lend 10 dollars to businesses or households and still meet its required reserve ratio. And since a bank’s loan simply increases the dollar amount in the borrower’s account at that bank, these new loans are part of the economy’s total stock of liquidity. Thus, if every dollar of excess reserves were converted into new loans at a ratio of 10 to one, the $2.4 trillion in excess reserves would become $24 trillion in new loans, and M2 liquidity would rise from $12 trillion to $36 trillion, a tripling of M2.

Could this happen (and if so, why hasn’t it happened already)?

In a recent paper (Bassetto and Phelan 2015), Marco Bassetto and I provide a theoretical justification for why such a run on the Fed by banks could happen, but is not certain to happen, and we thereby furnish an explanation for why it has not happened yet. The idea is that paying interest on excess reserves sets up a game between banks that has multiple equilibria, meaning it can result in more than one stable outcome”

Nonsense from the Cleveland Fed

Ben Craig, senior economic advisor for the Cleveland Fed contributes to the mindless economic chatter in Excess Reserves: Oceans of Cash.

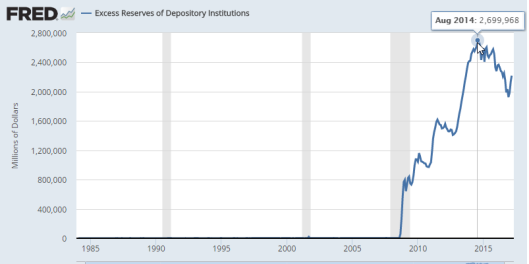

“Since the financial crisis, American banks have increased their excess reserves, that is, the cash funds they hold over and above the Federal Reserve’s requirements. Excess reserves grew from $1.9 billion in August 2008 to $2.6 trillion in January 2015.

Why are U.S. banks holding the liquidity being pumped into the economy by the Federal Reserve as excess reserves instead of making more loans? The answer to this question has implications for monetary policy and the real economy, but it is elusive because the current economic environment is complex and still new. However, a first step toward an answer is understanding why banks choose to hold excess reserves in the first place and how their choices have been affected by new Federal Reserve policies introduced in the wake of the financial crisis.

The increased demand for reserve assets has been matched by the Fed’s willingness to supply them.

The fact that banks are holding excess reserves in response to the risks and interest rates that they face suggests that the reserves are not likely to cause large, unexpected increases in their loan portfolios. However, it is not clear what banks are likely to do in the future when the perceived conditions change or which conditions are likely to bring about a massive change in their use of excess reserves. Recent history is not much help in determining the answer to this question because no balances this big have been seen in recent times.”

Mathematical Nonsense

The above paragraphs are complete mathematical nonsense, yet the Minneapolis Fed and the Cleveland Fed published them.

The Cleveland Fed article went so far as to say “increased demand for reserve assets has been matched by the Fed’s willingness to supply them.”

There is no “demand” for excess reserves. Rather, the Fed has crammed excess reserves into the system and has decided to pay interest on them.

Conclusions

- Mathematically speaking, excess reserves cannot spur lending.

- Banks are not paid $22 billion to “not lend” $2.2 trillion as many contend.

- Banks are paid $22 billion because the Fed decided to do so.

Whether or not banks lend has nothing to do with interest on excess loans. Rather, the decision to pay interest on excess reserves is simply $22 billion in free money to banks every year, at taxpayer expense.

At best, paying interest on excess reserves was a purposeful backdoor bailout of insolvent banks.

The ECB arguably compounded European banks’ problems by forcing excess reserves into the system, then charging interest on them, weakening banks in the process.

Steve Keen Addendum

Mish @MishGEA nails the nonsense about banks wanting “excess reserves” still spouted by @federalreserve economists https://t.co/Iln2jmZ3lX

— Dr. Steve Keen (@ProfSteveKeen) April 18, 2017

Mike “Mish” Shedlock