by Mish

She also claims weak economic data is “transient”.

Meanwhile, the market increasingly believes the economy is weakening and rate hikes are less likely.

Federal Reserve Bank of Kansas City President Esther George said on Tuesday the U.S. central bank needs to press forward with rate rises, adding it should also begin reducing its massive balance sheet later in the year.

She said both inflation and unemployment “are in range” of where the Fed would like to be, adding urgency to the need to push short-term borrowing costs higher. “The economy looks to be on solid footing,” Ms. George said, and “there is a sense that outcomes could actually be better than expected, rather than worse.” She added the prospect of greater government stimulus by way of taxation, regulatory and spending changes could also improve the outlook.

Ms. George added that it is important for the Fed to press forward with its increases and not be dissuaded by transient shifts in the economic data. “I am encouraged by the start of the normalization process and want to see it continue,” she said, explaining “resisting the temptation to react to near-term fluctuations in the data will be necessary.”

At the same time, given the Fed’s need to press forward with interest-rate rises, so too must its attention turn to its massive $4.5 trillion holdings of cash and securities, which grew rapidly in recent years as a result of the central bank’s efforts to stimulate growth in the economy in the wake of the financial crisis, the official said. Many Fed officials have expressed interest in starting to allow those holdings to shrink passively later in the year.

“I would support beginning the process of reducing the balance sheet this year,” Ms. George said. “The process should be on autopilot and not necessarily vary with moderate movements in the economic data,” in a view that also echoed that of her colleagues.

“I do not favor prolonging action for the purpose of allowing inflation to overshoot the 2% goal or to press labor markets into a condition where they are overheating,” Ms. George said. “Inflation that persistently deviates above or below the 2% objective would be cause for concern, but monetary policy need not react to temporary deviations” in the level of price pressures, she said.

Ms. George also said she doesn’t share her colleagues’ hopeful view about rising inflation. “I am not as enthusiastic or encouraged as some when I see inflation moving higher, especially when it has been driven by a sector like housing,” she said.

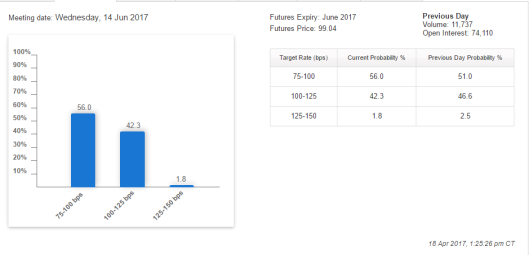

June Rate Hike Odds Sink

A few weeks ago, most forecasters (not me), considered a June rate hike a given. With weak retail spending and faltering housing starts, the odds of a hike in June are now under 50%.

The futures market believes the second and only subsequent hike this year will happen in September.

The CME odds of “no hike” are 50.4% in July dropping to 36.7% in September. But looking at the December futures, the market has still priced in only one more hike this year.

December Rate Hike Odds

One More Hike?

I doubt if there will be another hike this year, and the market is moving in that direction.

By the way, this is not a suggestion for the Fed to not hike, it is a prediction as to whether or not they will.

I do not know where interest rates should be, and clearly, neither do they. Fed policy has sponsored three major bubbles in the last 17 years.

The words for the day are, “transient”, “transitory” and “second-half recovery”.

Mike “Mish” Shedlock