by Mish

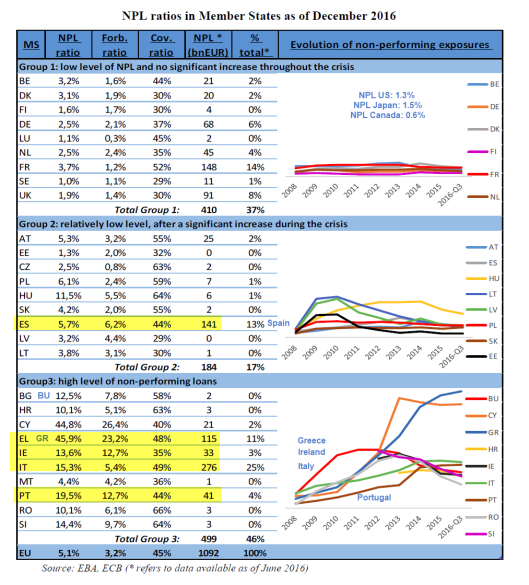

The average non-performing rate in the EU is 5.1%, down from 5.7% in 2015. For comparison purposed, a World Bank Report has the US at 1.3%, Japan at 1.5%, and Canada at 0.6%

In contrast, Greece and Cyprus have NPL ratios of 46% and 45% respectively. Bulgaria, Croatia, Hungary, Ireland, Italy, Portugal, Slovenia, and Romania all have NPL ratios between 10% and 20%.

Non-Performing Loans

Notes

- I am unsure why the graphs sometimes use different country codes than appears in the first column. Where different, I show both symbols. The list of country codes is shown below.

- Forb ratio stands for forbearance ratio.

- Cov ratio stands for coverage ratio: (Loans – Reserve balance)/Total amount of non-performing loans. It’s a measure of how prepared a bank is for losses.

Country Codes

Italy, Greece, Spain, Portugal, and Ireland have a combined €606 billion in non-performing loans.

Clearly, the EU banking system is quite troubled.

Mike “Mish” Shedlock