Factory orders and a terrible ISM report are in the news today. But numbers that would have been shocking in January, no longer are.

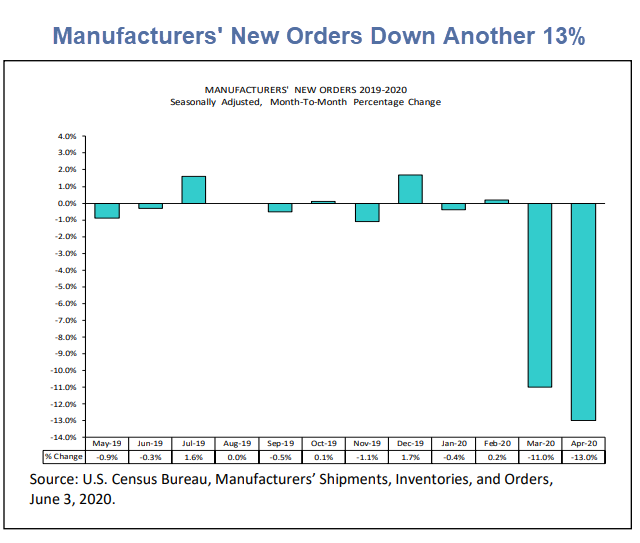

Factory Orders Plunge Another 13.0%

The Census Department’s report on Manufacturers’ Shipments, Inventories, and Orders for April was bad, as expected.

New Orders

New orders for manufactured durable goods in April, down three of the last four months, decreased $36.3 billion or 17.7 percent to $168.7 billion, down from the previously published 17.2 percent decrease. This followed a 16.7 percent March decrease. Transportation equipment, also down three of the last four months, led the decrease, $24.3 billion or 48.3 percent to $26.1 billion. New orders for manufactured nondurable goods decreased $21.2 billion or 9.0 percent to $215.6 billion.

Shipments

Shipments of manufactured durable goods in April, down three of the last four months, decreased $42.4 billion or 18.2 percent to $191.2 billion, down from the previously published 17.7 percent decrease. This followed a 5.5 percent March decrease. Transportation equipment, also down three of the last four months, led the decrease, $31.7 billion or 43.1 percent to $41.8 billion. Shipments of manufactured nondurable goods, down four consecutive months, decreased $21.2 billion or 9.0 percent to $215.6 billion. This followed a 5.4 percent March decrease. Petroleum and coal products, also down four consecutive months, led the decrease, $11.9 billion or 32.0 percent to $25.4 billion.

Unfilled Orders

Unfilled orders for manufactured durable goods in April, down two consecutive months, decreased $17.6 billion or 1.6 percent to $1,107.6 billion, unchanged from the previously published decrease. This followed a 2.1 percent March decrease. Transportation equipment, also down two consecutive months, led the decrease, $15.7 billion or 2.0 percent to $759.6 billion.

Inventories

Inventories of manufactured durable goods in April, up two consecutive months, increased $0.6 billion or 0.2 percent to $425.3 billion, unchanged from the previously published increase. This followed a 0.5 percent March increase. Transportation equipment, up twenty-one of the last twenty-two months, led the increase, $0.4 billion or 0.3 percent to $143.0 billion. Inventories of manufactured nondurable goods, down four consecutive months, decreased $3.2 billion or 1.2 percent to $261.2 billion. This followed a 3.5 percent March decrease. Petroleum and coal products, also down four consecutive months, drove the decrease, $3.7 billion or 12.1 percent to $27.1 billion. By stage of fabrication, April materials and supplies increased 2.3 percent in durable goods and decreased 1.2 percent in nondurable goods. Work in process decreased 0.7 percent in durable goods and 1.5 percent in nondurable goods. Finished goods decreased 1.2 percent in durable goods and 1.1 percent in nondurable goods.

Shocking? No

The Econoday consensus estimate was -14.0% nearly on the mark.

ISM Non-Manufacturing Index

The Econonday consensus was nearly on the mark a 44.0 ve the report NMI of 45.4.

The most noteworthy item was supplier deliveries slowing for 12 months.

That item tells you the economy was cooling rapidly even before Covid-19 hit.

Construction Spending

Yesterday, the Census Department published the Construction Spending Report for April.

It was a little better than expected. The Econoday consensus was -5.5% and the report came in at -2.9%.

But the Census Department revised March down to 0.0% from +0.9% so the consensus estimate was close to the mark.

Here it is June, and we are looking at economic reports or revisions for March in the midst of a Covid-19 pandemic.

Complaints

Reader complaints are pouring in. People want me to talk about the economy even though most of the reports are useless.

Economic Synopsis

The reports are universally bad, understood in advance to to be bad, yet most will improve.

I am out of ways to talk about unermployment. I have talked about the V-Shaped recovery or lack thereof numerous times.

What’s Important

- Like it or not, it’s the election.

- Like it or not, it’s military threats by president Trump.

- Like it or not, one cannot easily sepearate the economy from political actions.

- Like it or not, Trump is acting in many ways like a third-word dictator.

- Like it or not, the unfortunate fact is many of my readers cheer Trump’s actions even though anyone with an ounce of sense is distancing themselves from Trump.

It you want to pretend this is not happening, or worse yet, you want to cheer Trump for actions that disturb a former chairman of the Joint Chief of Staff and even the current Secretary of Defense (more on that coming up), then bury your head in the sand or turn on Fox news.

But if you are concerned about what is really important, then tune in here.

Threats Don’t Bother Me

I don’t care how many readers threaten to leave. I will continue to discuss what I believe is important.

Unconstitutional or radical threats and actions by president Trump are at the top of my list.

If you disagree that Trump crossed the line, then open your eyes and read this: Something Changed for the Better: Trump’s Bubble Just Shattered.

If you still support those actions, I pity you.

Mish

You are exactly right.All economic activity,is directly or indirectly tied to the occupant of the wh.He took an oath to UPHOLD the Constitution,but,and it was obvious what his real intentions were during the campaign,he decided to use the oval to enrich himself at the cost of everyone else.His tactics are very similar to ones use in Germany in the 30’s.We have the opportunity to stop his in his tracks,similar to a roach motel,but people have realize NOW this chance lost will be the demise of our country as we knew it.

It’s your blog Mish, write what you want.

Your knowledge of the economy and factors that have an impact on it, is outstanding and that is what I’m interested in and read your articles for.

Thank you!

Olde 20th century manufacturing/construction data, but we have a financialized economy, and the stock market is up. /s

A few more months of this and folks may decide they prefer it.

Riots stimulate the economy?

Carpet bombing would also in that case! I say, let it begin in California!

That is because when it comes to economics, Mish is a libertarian, whether he knows it or not. He states the truth based on facts and logic. It is only politics where he allows his feelings to override his common sense.

If I remember correctly, Mish used to write a lot about Austrian Libertarianism.

Wait until the next video of a cop killing a citizen without a weapon. The next one will cause Washington to burn to the ground.

The problem is when you measure in percentages you have to have a much higher positive percentage to make up for a large negative percentage to just get back to break even.

Don’t ignore the stimulative effect of youths going about the land breaking windows.

“Mr. Bastiat, call on line one. Mr. Bastiat.”

But the economy reports are LESS WORSE than expected, so that is what keeps the markets trending higher.

As for Trump, I am just stick of hearing about his antics. I’ve given up on watching The Daily Show and the other late night talk shows as instead of jokes, all I hear night after night is criticism of the latest Trump foolery.

And what is a good expectation, pray tell? If the expectation is always set to GDP at zero, well yeah, we will ALWAYS beat expectations.

Let’s not fool ourselves, this is Powell’s doing, nothing more.

I don’t disagree. But when you read the financial news, it is ALWAYS “wasn’t as bad as expected”.

The Things That Used to Matter to Stock Investors Don’t Anymore

By Lu Wang

June 3, 2020, 4:02 PM EDT

During the campaign in 2016, I posted here in disagreement with Mish that Trump was the most unlibertarian presidential candidate, maybe ever, and was more a threat to libertarian principles than HRC. Mish gave the best possible reason to prefer Trump: less warlike. Mish has proved correct in narrow sense, that Trump has not started an avoidable war, although he came close once or twice, nor been trigger happy as HRC would have been. Unfortunately, war doesn’t only result from neo-con aggression. It also emerges from a sufficiently serious breakdown of the institutions and norms that unite, and that incentivize peaceful cooperation domestically and internationally. Trump has made this breakdown his means of gaining and maintaining power, and so he has increased the likelihood of a major war, internationally or conceivably even domestically. Against the less-of-a-warmonger rationale for having supported Trump, Trump’s history in word and deed of contempt for law and for freedom were obvious. That he would destroy our freedom under the law and the civic virtues under which freedom can be exercised peacefully and prosperously, with the consequences that have come to pass, was foreseeable. This is not a case of hindsight being 20/20; foresight need only have been 20/400.

I need less skewed political insight in my life and more economic/business perspective. If your going to gravitate in the political direction, I won’t threaten to leave but I will check in less often.

The markets will never come down again. Powell knows this is the end game i.e. without the stock market, we have … NOTHING. Well except the worlds biggest and bestest toilet walls i.e. Twitter, Facebook, etc. Every asset has been stripped down, our infrastructure is crumbling away.

The meteor could hit New York City tomorrow, and the stock market will rally.

“The markets will never come down again.”

…

Never say never.

Billionaires (Buffet, Tepper, Druckenmiller, etc) sitting on the sideline with dry powder … retail running amok.

True, but the markets will have to go down at least 70% to get those guys buying again. That’s almost impossible.

If a meteor destroyed New York City, just think of the construction contracts to rebuild it! What could be more bullish than that. 😉

“Bad Economic Reports? Yes, But They Were Supposed to Be Bad”

…

Exactly.

Early on I said numbers for March / April / May would be ignored.

June onward would be the test. Still hard to tell as more stimulus will be coming. Might be deep into Q3 before lags of defaults / delinquencies rear up.

I’m not Libertarian. While I would like Mish to cover more economics, its also true that many readers come to Mish to try and game the stock market. Mish has a point – stock market is disconnected from reality right now. All the economic numbers are terrible, but stocks are going up. Politics is important to cover.

I see no problem.

Mish can discuss whatever he wants.

You get what you pay for …

Mish your commentary attracts a libertarian readership. Libertarianism now is 90% culture war non-sense, ie white male grievance. Not surprised they are rallying around their big wet-boy president

Trump is not a Libertarian.

Rest assurred when Biden wins I will bash him to although I see a chance for praise in two areas.

I support the right to choose albeit with some limitations, and I support the agreement we had with Iran.

And yet the market powers higher. Go figure. If and when this bubble bursts it will not be pretty. Trump will view the strong stock market as a sign that the economy is recovering (It’s not) and an endorsement of his presidency.

If one presumes that the market accounts for all available information, the logical conclusion is that the market likes the political trends. Why? That’s another question.