by Mish

Bloomberg reports Bank of Japan Owns More Than Half of Nation’s ETFs.

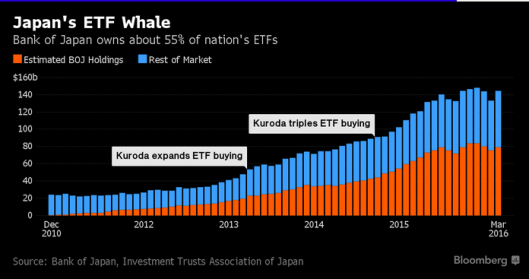

The Bank of Japan may become an even bigger shareholder of the nation’s equities if policy makers decide to boost stimulus this week. The central bank’s holdings have been rising since it began buying Japanese exchange traded funds at the start of the decade, and now account for more than half of those ETFs.

ETF Whale

Clearly 50+% is inadequate. Japan’s central bank needs to corner 100% of the market. After it does, it can then institute rules that share prices can only go up in price, never down.

For my sarcastic take on cornering the bond market, please see Bank of Japan Corners 33% of Bond Market: All Japanese Bonds, 40 Years and Below, Yield 0.3% or Less.

Mike “Mish” Shedlock