by Mish

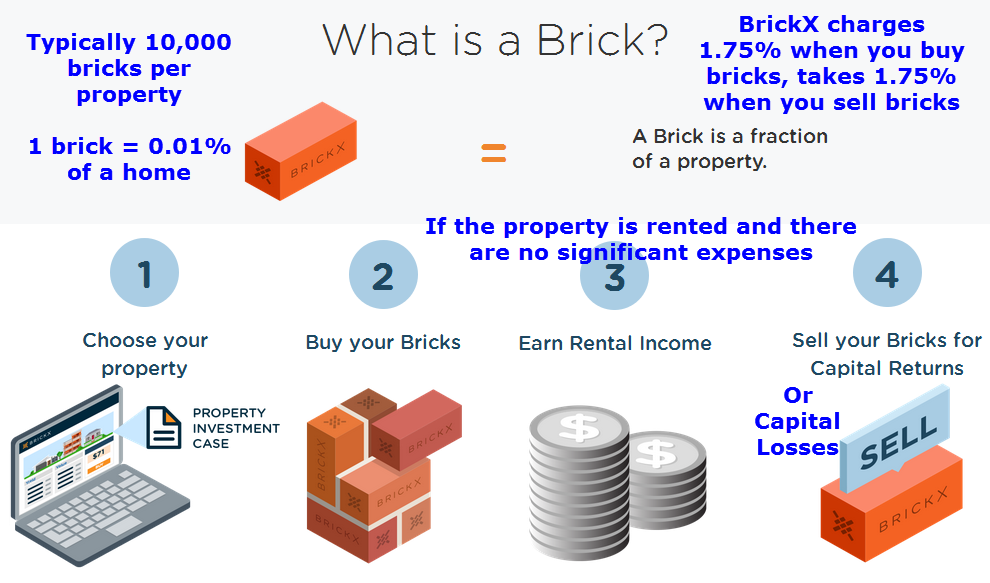

Can’t afford a home? BrickX will let you buy a single “brick” of a designated house for a mere $100 or so. You pay $1.75% buying bricks and another $1.75% when selling bricks.

Fractional Home Ownership

Please consider New Breed of House Buying: No Inspection, No Auction, $100 a Brick

WANNABE property investors now have another option for getting a toehold in the booming Sydney property market. A new company is selling houses just one brick at a time.

The BrickX investment scheme which launched officially today is billed as Australia’s first stock exchange for residential property, offering part ownership via buying single ‘bricks’, which start at $67, under a system called ‘fractional ownership”.

BrickX works by buying a property, then splitting it into 10,000 ‘bricks’. Prospective investors can go onto their website to check out the properties (currently there are five, including in Sydneys Enmore, Mosman and as of last week, Double Bay, and Melbourne’s Prahan, and the aim is to have 100).

Example BrickX Property

The Rent per week on this property is currently $750 per week, $39,000 a year. The last brick dividend was $0.24.

Assuming the house is rented every week of every year, at $750 per week, property taxes do not go up, and there are no expenses, one would recoup a $100 investment in 34.7 years and still own the brick.

BrickX CEO Anthony Millet says “There are no funds under management. The only other expenses are the specific expenses that would relate to any standard property. like strata, water, council rates etc, and these are administered before investors get their dividend.”

Excuse me, what about maintenance costs?

Expect maintenance costs to rise over time. Expect property values to sink over time.

Who’s buying? “The bulk of the earliest stakeholders are those in the under-34 year old age group,” said Miller.

Analysis

- BrickX makes 1.75% upfront on each house.

- If the property has debt, the first x% of rental income goes to interest on the debt. One BrickX property did have debt (very dangerous in this model IMO).

- The next 3% of rental income goes to property taxes, based on a CNBC Property Tax Report that covered Sydney.

- The next x% goes to maintenance, local fees, water, utilities, etc.

- The next x% goes to BrickX and/or a third party for management fees.

- Whatever is left is divided up by brick.

- When you sell, BrickX takes another 1.75%.

Good Luck!

Mike “Mish” Shedlock