by Mish

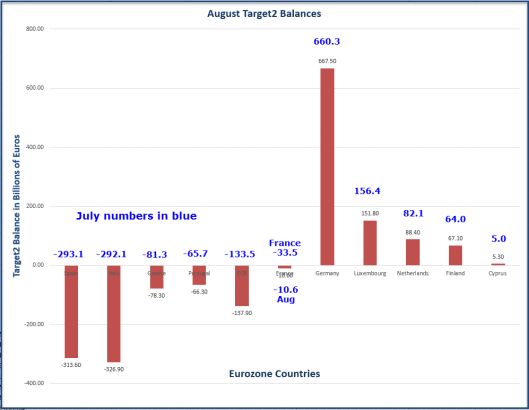

The above charts shows most of the major countries, not all of them.

Italy’s target2 hit a record low -€326.9 billion in July. This is a 6th consecutive monthly record for Italy, minimum, possibly dating back to 2nd quarter of 2015.

Spain’s target2 deficit hit -€313.6 billion. In 2012 Spain hit -€337.3 billion.

Target2 Discussion

No discussion of eurozone problems would be complete without a discussion of Target2, an abomination created by the eurozone founders and one of the fundamental flaws of the euro.

Target2 stands for Trans-European Automated Real-time Gross Settlement System. It is a reflection of capital flight from the “Club-Med” countries in Southern Europe (Greece, Spain, and Italy) to banks in Northern Europe.

Pater Tenebrarum at the Acting Man blog provides this easy to understand example: “Spain imports German goods, but no Spanish goods or capital have been acquired by any private party in Germany in return. The only thing that has been ‘acquired’ is an IOU issued by the Spanish commercial bank to the Bank of Spain in return for funding the payment.”

This is not the same as an auto loan from a dealer or a bank. In the case of Target2, central banks are guaranteeing the IOU.

Target2 also encompasses people yanking deposits from a bank in their country and parking them in a bank in another country. Greece is a nice example, and the result was capital controls.

If Italy or Greece (any country) were to leave the Eurozone and default on the target2 balance, the rest of the countries would have to make up the default according to their percentage weight in the Eurozone.

Mike “Mish” Shedlock