Barron’s has an interesting article How Investors Should Navigate Globalization’s Decline.

A decadeslong drive toward freer trade across borders has begun to reverse. Globalization is being overwhelmed by populism, nationalism, and protectionism.

Brexit threatens to erect new trade barriers between the United Kingdom and the rest of Europe. India just moved to limit foreign operators selling goods online.

“I probably never would have said it was going to end, but I’m starting to wonder,” says Don Allan, chief financial officer at Stanley Black & Decker. “The trend seems to be heading that way. Countries are becoming more focused on protecting their world and less on how to work together as a global economy.”

China Decreasing Influence Percentagewise

GoerTek , a Chinese company that makes Apple’s AirPods, reportedly told suppliers last year that it was moving production to Vietnam. It will join companies like LG Electronics (066570.South Korea) and Samsung Electronics (SSNLF). And it’s not just tech: Chemical company Huntsman (HUN) announced last summer that it had opened a plant in Vietnam, its first in Asia outside China. In fact, manufacturing grew more in Vietnam than in any other major Asian country last year, IHS Markit has calculated.

Misleading Percentages

The above chart and a focus on percentages is misleading. The US trade deficit with China has been hitting fresh highs.

Tariffs, Robotics, Wages, Transportation Costs

The article concluded “The tectonic plates of global trade are in motion. Even a handshake between Trump and Xi won’t stop that shift.”

I agree, but shifts were underway before Trump became president. But as the article notes, Trump’s tariffs definitely accelerated the trend.

It was a rise in labor costs in China that led to China losing manufacturing jobs not only to robots but to Vietnam.

Manufacturing Employment

Thanks to robots, some manufacturing has returned, but without the jobs. It takes fewer and fewer people to do anything. Minus wages and transportation costs, it makes sense for manufacturing to be close to the end buyer.

Yesterday’s Battle

Trump is fighting a losing battle. Manufacturing those jobs are gone and they won’t return.

Real Problem

Trump has his eyes in the rear view mirror. He wants to bring back manufacturing jobs when those jobs are in decline for the long haul.

More problematic for the US is China’s new focus on high-end technology as opposed to routine assembly.

Huawei, a Chinese corporation, is the world’s reader in 5G technology.

Trump seeks to put an end to that by claiming Huawei is an espionage threat. For discussion, please see Real Reason Trump Wants to Ban Huawei: US Wants to Spy and China Won’t Cooperate.

The US needs to focus on the jobs of the future, not the jobs of the past.

Trade talks with a spotlight on soybeans, phone assemblies, etc will not do the US a damn bit of good. Tariffs have not and will not solve a single problem.

Meanwhile, somehow the US has fallen behind on 5G. That’s not good to say the least.

Mike “Mish” Shedlock

Jobs of future?! Try to get professional plumber!!!

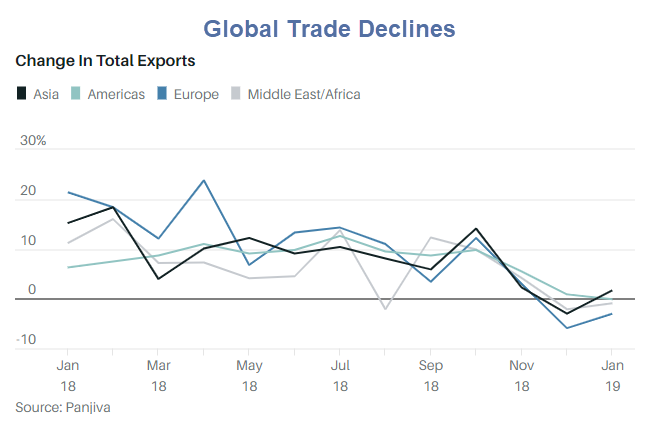

That first chart is all but meaningless. It only covers the last 12 months. It could easily show the onset of global recession and not the Decline of Globalization..

I got the nephews a 3D printer for Christmas. I was a little concerned that it might be a little too advanced for them, but they seem to have figured it out. They’re using it in their school robotics club, for building Lego pieces and they made birthday presents for grandpa. They’ll be just fine if my sister can keep them off drugs.

Even the web servers are fooled!

It will be interesting to track changes in domestically sources goods and services over time. And don’t expect a transition to domestically sourced to happen overnight.

AS long as the global labor arbitrage persists, no manufacturing jobs will be coming back. Even China sifting towards cheaper zone like Vietnam!

Not an uncommon opinion. But economics is not science, its sociology at best. Likewise, accounting is not science, but based on mutable conventions. Countries have always protected domestic industries through various means including subsidies, one-sided regulations, and yes, tariffs. it is disingenuous to expect any efforts to de-internationalize an economy to show immediate results, whilst internationalization efforts have taken time to get to where we are.

Lets not give “high tech” all this love. Beyond all the media hype and pop-culture delusions that computers and robots can do everything, the overwhelming majority of humans in this country are pretty simple in their needs (especially as they get older). We all need housing, food, furniture, clothing, phones, cars, entertainment etc. Im sure the countryside will be blanketed with virtual reality amusement parks soon enough, but in the meantime, the basics rule. And, universal basic income covers this need as well.

FREE LUNCH to every one! Hurrah!

Bloomberg refuses although I proved that I an NOT robot!

“Universal Basic Income” was only ever intended to cover increased rents and mortgage payments. All progressive policy, is by banksters and for banksters.

An immediate end to all zoning and land use laws; along with suspension of all activity (income and sales) taxes to be replaced by property ones, and ending the Fed and money printing; WILL cover all needs. In splendor, in fact. Which is why you won’t ever hear a word about it, from the pliant, well indoctrinated dupes given teevee time and presented as “radicals” by the bankster class.

I see the decline in globalization as a passing trend. It sounds good to create jobs doing things in your own country until you discover it costs a lot more to do so.

Replacing human labor with automation is always a good thing. The world will not be a handful of super wealthy and everyone else dirt poor with no job. As long as people have money, they find away to spend it. And much of the money is spent on things humans do.

Globalization means growth and rising standards of living. If globalization really declines, it will mean shrinkage and falling standards of living. The only time where we saw massive declines in global trade was in the 1930’s, and I am skeptical that we will repeat that error, but if we do, we know what we can expect.

What will the value-added jobs of the future be? And I’m not questioning that there will be niches with value-added jobs (at employers who are way more dependent on the right capital than on employees), but where will the millions of jobs be for disenfranchised manufacturing and office workers, not to speak of landless peasants??

Wait till you mouth off to the mcdonald’s drivethru speaker then get to the window and discover it’s a 6’4″ 350lb ex trucker. Well, until that job is gone, too. Isn’t a large portion of mcdonalds business from lower income people? Of course, if your job gets automated also you won’t need to worry about this scenario.

Customization. We all live in a world where uniformity is desirable. We’ve hit a top when it comes to identical widgets. Smartphones and devices seem to be identical at first glance but I’m 100% certain that no two smartphones have the same home screen icons. The day is coming when we’ll be ordering a Ford that’s just a shell. We’ll get our dealer/outfitter to build it out for us, using 3D printing, “desktop” CNC mills, and automatic sewing machines to build us the vehicle we want. But instead of struggling to cram an aftermarket stereo head unit into a DIN slot, he’s going to 3D print a dashboard.

Yup.

Customization and personalization. Cars could be made much more efficiently, if they were all black Model Ts from then to eternity. But with increased wealth, people can increasingly afford to stray from the narrowest of efficiencies to scale paths.

It’s not just increased wealth though. It’s the incredible decrease in manufacturing that will bring this about. Today it’s possible for someone to get a very custom vehicle, but not affordable due to the specialization of labor. Most cities have custom homebuilders who work from standard plans, which is possible due to the long term mortgage and basically every home is built to the lot. A top designer will be able to sell his 3D print files to anyone, who will then be able to adapt and adjust as needed. The cost of manufacturing will be the cost of raw materials and an operator’s time. The operator could easily be the store owner, much like a blacksmith owns his shop.

Good bye to Apple spy phones in China and brics,

But there it is the consumer that boycotts USA made products, that they make themselves making 5 $ an hour.

Keep going Trump, and the next thing that will be Boycottet is the US$, as people realize the scam of F.i.a.t paper money enslaving the world.

Soon south America will wake up, and be freed from US $ slavery.

The USA is already BANK-RUPT, merely creating more fake money to pay interest on 22…23…TRILLION $ of Debt + future liabilities. + 1 trillion $ + of deficits.

Could they have conned the world on a true gold/silver standard, at 15 $ silver

when there is less than 1 billion oz produced each year….

NO.

They have already lost control of Palladium, which is now more EXpensive than gold, because they can NOT sell palladium paper shorts to manufactures that need the actual metal.

next up is silver.

I would love to see the discussion on the topic of “future jobs”. What are these? Where, by whom? What nature?

YouTube stars and camgirls?

Ok, but hear me out: Today Hollywood dumps out a few hundred shows, films and other drivel a year. YouTube uploaders put up 500 hours a minute (2015 number). Most of it isn’t likely to generate any money at all, but a fair number of “stars” are able to earn a reasonable living creating videos. Some of them are quite simple: a pair of hands on a workbench and a voiceover, while others are full-blown productions created with cellphones, DSLRS, drones and GoPros. Most of it is drivel. Much of it is quite interesting and would never ever get a time slot on a broadcast or cable network. Sure, they aren’t going to be millionaires, but the attractive ones are starting to get the attention of the paparazzi.

It that was knowable, the jobs would not be “future.”

People adapt to their environment. Whatever that environment happens to be. As long as they are free to do so, of course. Plantation niggas, and American children born into debt servitude, to a future as sharecroppers twelve to a San Francisco apartment for the benefit of the Fed’s favored welfare queens, are different, of course. At least until they grow up, and realize Mogadishu is a lot hipper than what San Francisco has deteriorated into.

Looks like globalization is leading to a worldwide average wage equilibrium of $2.17/hr without benefits.

Globalization per se, can only increase wages. Financialization, concerned as it is solely with stealing all gains from anything, for the benefit of a small, well connected clique of self promoting, negative-value-add incompetents; can easily steal enough to overpower all net gains from all other sources. As experienced in the US, after Nixon removed the last bulwark anyone had against its encroachment.

$2.17 an hour. What country you are from? My labor cost went from $12 to $15 just this year alone and I can’t get workers for simple masking tape application! You people live in fantasy world!

You fail to see my sarcasm, although I am well experienced to know first hand that you don’t need to import stone age IQ people into the US (as per Latkes statement) because US corporations are currently exporting the jobs to ‘stone age’ (read low wage) countries. How often do you see stuff now made in Vietnam, SriLanka, Cambodia, India, etc. When their wages become too high for corporations, Africa will be the next place to build manufacturing plants. The company I owned serviced many major OEM firms with a history of 70+ years of service. The first job we lost we had run for 23 years. It went to China. The next job we lost we had run for 26 years. It went to Korea. The final straw was our biggest account (Fortune 500 based in OH) with 270 plants worldwide. We made over 100 different parts for them for over 20 years running. They had us quote on a high volume component. I flew to OH to talk to the purchasing manager directly. He laid it on the line. Our company was the most competitive of any quote he had coming from a US firm, but unfortunately he was issuing the contract to a firm in India because there price was 35% less than ours. I’ve seen it first hand. I lived it first hand. Our firm has suffered it first hand.

Bingo! Globalization has brought massive change and enabled billions of people to raise their sights from grinding poverty to higher hopes for themselves and their kids, something we’ve always taken for granted.

The downside effects of globalization need attending to. Our political slicks are not up to it.

There’s no votes in saying, “Thirty percent annual technology price erosion on the world market means that the product you’re making today for $371 using that technology will be sold by either you or your competitor(s) for only $100 five years from today. We in the Beltway cannot protect you from that unless we stop trade by tariffs, taxes, embargoes, and trade wars. These will all drastically lower living standards for everyone.

Our only hope is to compete. We need everyone doing their part in that effort. We, your politicians, cannot shield you from the heat that’s coming except by leading you backwards into mediocrity, second class national status, and eventual irrelevance.”

Try that pitch against the likes of AOC and Bonkers Bernie.

“Our only hope is to compete. We need everyone doing their part in that effort.”

But noone will, as long as all money made from effort is debased, taxed, regulated, mandated and sued away. With the loot being handed out, in exchange for sitting idly on the couch, cheering for Massa to keep on robbing others, to ensure “my house goes up,” “my portfolio goes up”, “my bonus goes up” and “my pension is secure.”

Lotta broke people out there. Hard to sustain global trade when it’s increasingly just the beneficiaries of money printing pushing paper back and forth. We can only break so many windows, build so many empty commercial/residential units, start so many wars, etc.

You have Trump all wrong. He doesn’t want to bring back manufacturing jobs. He wants to feel perceived as a winner and in this case it’s by those people who want to bring back manufacturing jobs. The guy is a total shell of a human. I suppose it doesn’t change your analysis, but let’s at least recognize what it is.