Alhambra Investments posted a set of interesting charts and comments in Italy Went Boom A Long Time Ago (and that’s the point).

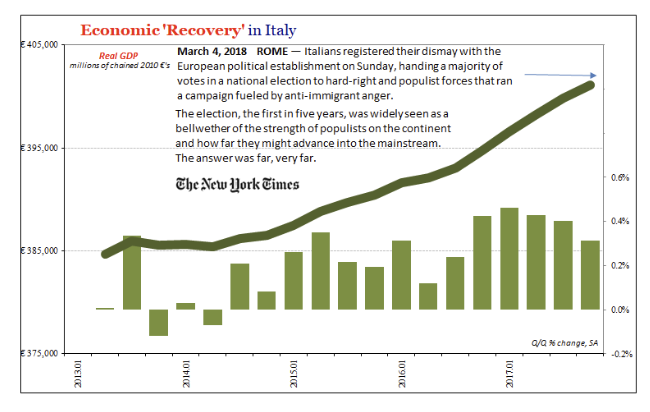

The consensus mainstream view and one the ECB likes to portray is that Italy is undergoing a strong economic recovery. Close inspection shows that thesis to be an illusion.

Zombie Banks

At some point, they [banks] stop acting like banks and head in direct line toward zombie status. That was true for Italy almost immediately during the 2008 panic. Italian banks just stopped lending altogether; it is stunningly remarkable to witness the trend for Italian loans over the space of just about an entire decade, to see it as an almost perfect straight line recalls only the unnaturalness of it.

The first stage of zombification was straight up liquidity preferences. Italian banks didn’t stop expanding the size of their overall balance sheet, it’s more that they did so by buying as much Italian government (almost all central government) debt as they could.

By the time Italian authorities last year finally authorized the “bad bank” option, Italian banks had accumulated €200 billion of bad debts. And I’m only including those loans that have already been reported as soured, there is another ~€120 billion of NPL’s that can be easily classified as unlikely to ever be paid off.

Real GDP is growing again, and has been positive for fifteen consecutive quarters, just shy of four years. There was even some acceleration indicated during this latest “reflation.”

And yet, Italians opted for a radical change in their government as a result of Parliamentary elections held earlier this year. An entirely populist government has engendered almost total mainstream condemnation.

Might not Italians have some very good reason for being upset with the EU?

This weekend it was announced that an obscure formerly leftist lawyer has been named Italy’s next leader (awaiting approval of Italy’s President, Sergio Mattarella). Giuseppe Conte was apparently the compromise candidate most palatable to the League (dominating the North of Italy) and M5S (South).

In Brussels, Conte’s nomination to be PM was met with puzzlement. “Nobody knows who he is and he is not even a high-profile academic,” said one EU official, noting that even Italians had been joking that the man who could be their next prime minister was less well-known than his namesake, the Chelsea FC manager Antonio Conte.

Something is Really Wrong

A novice, populist politician in charge of Europe’s third largest economy isn’t some far-fetched dystopian nightmare. The nightmare has been the last decade under the thumb of the thoroughly and irredeemably conventional. Why not try something very different, something possibly less corrupted?

What is happening in Italy is not unique nor is it really all that far in the extreme. That’s the point. You can dismiss the politics of it, but you can only do so by denying the clear economic reality. So long as this continues, and it doesn’t seem to be abating, rather intensifying in denial, it will (can?) only become more problematic.

Time’s Up

That’s an excellent article by Alhambra Investments. Here is my short synopsis:

Time has expired. The ECB, EU, and Eurozone fiddled away the last 10 years kicking the can.

Not a single structural change was made. Nor will there be, at least to Germany’s liking.

Italy will veto anything and everything Germany wants.

Mike “Mish” Shedlock

With Italy’s bonds taking a hit and the country facing political turmoil it is clear this did not occur overnight. All in all, it might be fair to say Italy is a European debt bomb waiting to explode.

Much like what happened in Greece the situation is not sustainable and will not go away.

Italy has been held together only because of the direct intervention of the ECB which made over 102 billion euros of Italian bond purchases in 2011-2012 alone. The article below presents an overall look at how things got this bad.

link to brucewilds.blogspot.com

EU to Italy….. “Veni, vedi, vici”

It’s well known over here that Italy hit a skid patch just around the time the Euro was launched but it has been most pronounced since the last Euro crisis. The wagons will be circled as the French will not allow Italy to move outside the EU. Eurozone may be a different matter. It could become so intense that there will be attempts to change the Government. This is existential to the whole European project.

Dear Italy, if you’re going to produce nothing but debt, you must have reserve currency status…like us.

Winning bigly or ugly? Bugly?

When it comes to fake recoveries, we are winning bigly.

You call this interesting times? Clearly, you were not around back in 1971. Those were damn interesting times.

Interesting times, indeed.