by Mish

The Empire State report turned in a composite reading of -1.0 vs an Econodayconsensus expectation of 8.0.

Econoday calls this welcome news.

Activity in the New York manufacturing region is flattening out this month following a run of unusually strong growth. May’s Empire State index came in at a lower-than-expected minus 1.0 with new orders also moving into the negative column to minus 4.4. Unfilled orders, which were very strong in April and March, also moved below zero to minus 3.7.

But the strength in prior orders is keeping production up, at a very solid plus 10.6 this month, and is also keeping hiring up, at 11.9 and only 2 points slower than April’s 2-year high. Delivery times continue to slow though to much a lesser degree than prior months which points to easing congestion in the supply chain. Inventories are flat and price pressures still increasing though, once again, less than before.

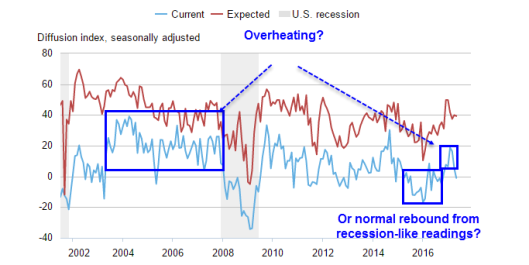

The slowing in this report is actually welcome news, giving time for supply constraints to ease and reducing risks of overheating. This report points to easing for Thursday’s Philly Fed where another month of enormous strength is currently the expectation. Yet despite the strength of anecdotal reports like Empire State and Philly, definitive factory data out of Washington have yet to show outsized acceleration. Watch for the manufacturing component of tomorrow’s industrial production, definitive data where only a moderate rise is expected.

Industrial Production Manufacturing

Concerns about overheating seem more than a bit ridiculous in light of actual manufacturing production.

Once again, economic parrots are squawking about diffusion indices that have no basis in reality. The graph makes it pretty clear that the “strong rebound” was exaggerated by a lengthy period in recession-like negative territory.

Tomorrow we see actual industrial production numbers for April.

Mike “Mish” Shedlock