Fed Minutes

The Minutes of the Latest FOMC Meeting are out. For a change they are interesting, and also very long.

Eight Key Points

- Treasury market functioning was severely impaired. Market depth was extremely thin, and bid-ask spreads widened sharply.

- Financing conditions for nonfinancial firms were strained.

- Corporate bond issuance came to a near standstill around late February. Speculative-grade issuance and leveraged loan issuance virtually stopped.

- Financing conditions in the commercial real estate (CRE) sector worsened late in the intermeeting period, as issuance of CMBS slowed and spreads widened notably to around levels seen in 2016.

- Real GDP was forecast to decline and the unemployment rate to rise, on net, in the first half of this year.

- A stronger dollar, weaker demand, and lower oil prices were factors likely to put downward pressure on inflation in the period ahead and observed that this meant that the return of inflation to the Committee’s 2 percent longer-run objective would likely be further delayed.

- A few participants also remarked that lowering the target range to the Effective Lower Bound (ELB) could increase the likelihood that some market interest rates would turn negative, or foster investor expectations of negative policy rates.

- Such expectations would run counter to participants’ previously expressed views that they would prefer to use other monetary policy tools to provide further accommodation at the ELB.

PIMCO Estimates 30% GDP Decline

If you are looking for guesses, here’s another one: U.S. GDP will contract 30% in second quarter, 5% in 2020

The forced closure of businesses across the United States and surge in unemployment due to the coronavirus pandemic will force U.S. growth to contract by 30% in the second quarter and 5% overall in 2020, Pacific Investment Management Co (PIMCO) wrote on Wednesday.

Richmond Fed on Restoring Consumer Confidence after COVID-19

Richmond Fed president Tom Barkin discusses Restoring Consumer Confidence after COVID-19.

This pandemic is new for all of us, creating unprecedented uncertainty. First and foremost, families are asking how best to protect their health and safety. But Americans are also asking about the health of the economy. How deep will this downturn be? How long will it last? How fast will we recover?

The answer to the first question is now clear: it will be deep. The service sector is 70 percent of the US economy and broad swaths of it are shut down, including travel, non-food in-store retail, restaurants, sports and entertainment. Last week’s initial unemployment claims exceeded 6 million, nearly doubling the previous week’s 3.3 million. The previous high had been 695,000 in 1982.

The duration is of course not fully knowable, but — absent a remission or treatment of the virus — it is hard to imagine social distancing moderating until there is a significant slowdown in new cases.

With rates at zero and fiscal support at historic scale, there is significant financial stimulus to help bring the economy back. But that will only meet its full potential when customers are ready to spend. Businesses and governments will need to innovate to make them comfortable doing so.

Barkin Misses the Fundamental Setup

We do not know the recession duration. But the fundamental setup is easy to see.

Consumer balance sheets were generally poor heading into this crisis. Too many people were already living paycheck to paycheck.

Barkin does have some interesting questions worth reviewing.

- Could restaurants offer explicit deep cleaning protocols for their tables, less server contact or less dense seating to allay health concerns when eating out?

- Should airlines fly with middle seats empty and boarding/deplaning protocols that preserve social distance?

- Should personal services pivot to an at-home delivery model?

- Is there a screening protocol for anyone who enters a hotel or a restaurant or a bar?

If any of those are done, to any extent, it means less profit for business.

Importantly, even if none of those things are done, the likelihood things quickly return to normal are nonexistent.

Sure, there will be a sudden wave of eating out once people can, simply to get the hell out of the house.

But following that initial surge, what then? Will people resume pre-virus habits?

Boomers vs Millennials

- Boomers had a quarter of their retirement blow up in a month.

- Millennials have seen two economic crises in 10 years, at the beginnings of their careers.

Things will not quickly return to normal and stay there even if there is some initial appearance of a recovery.

How High Will the Unemployment Rate Rise in April?

Tiffany Wilding, a North American economist at PIMCO, said today “evidence from recent jobs reports suggests the unemployment rate may rise as high as 20%.”

That is essentially my base forecast.

On April 6, I asked (and answered) How High Will the Unemployment Rate Rise in April?

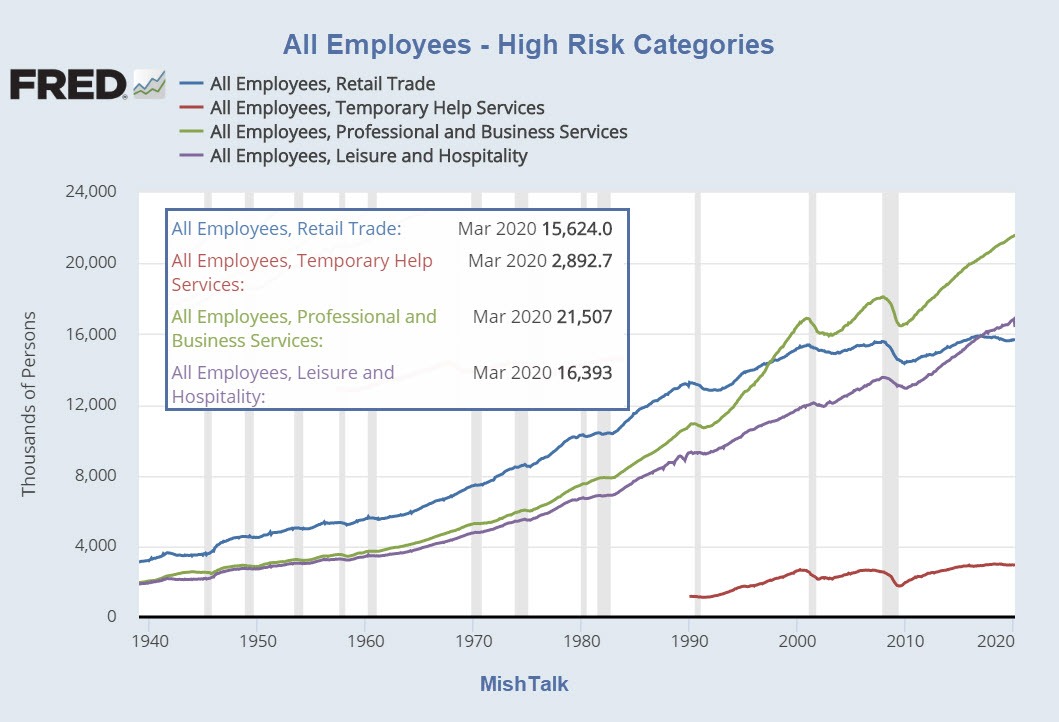

I estimate 20-22% a couple ways. I do not know Wilding’s rationale, but I look at high risk job categories and put percentages on them.

The scars of 20% unemployment will last a long, long time. And even when employment returns, hours worked remains another issue.

Car Sales, Airline Travel, Eating Out

With the stock market down and consumer savings wiped out, will car sales quickly recover?

The same question applies to eating out and airline travel.

Will business meetings be in person or will corporations reduce costs with more teleconferencing?

For a 20-point discussion of what to expect, please see Nothing is Working Now: What’s Next for America?

No V-Shaped Recovery

Add it all up and you should quickly arrive at the correct viewpoint: The Covid-19 Recession Will Be Deeper Than the Great Financial Crisis.

Simply put, a quick return to business as usual is not in the cards.

Mike “Mish” Shedlock

Less contact with servers? I had nothing to eat driving from Oregon to Florida for 8 days except Dominoes because that was the only place delivering where i stopped. In a few places they put the pizza on the floor (or sidewalk EWWWWWWWW) before they knocked. That is going too far. They can hand over the box without making contact, in fact in my whole life I have accepted hundredss of pizzas without ever making contact with the delivery person. Fortunately I am now so sick of pizza that I am unlikely to ever order it again anyway.

Look, when the Fed is buying everything including junk bonds it is time to panic. Wall Street seems to believe that they need to buy at any price because 2-3-5-10 years from now 20k plus n the Dow will look dirt cheap because of the inflation this will stimulate. That is the only possible rational explanation for recent market activity. What they don’t seem to understand is that with this new additional money/credit in the system that is NOT going to get into the hands of Joe Sixpack beyond a pitiful $1,200 one time shot something like 60% of the nation is going to die financially.

As to Gen X and younger people getting snookered out of their retirements, well, boomers like me faced 30% plus unemployment and gasoline rationing along with double digit inflation for years. The the crash of 87, the recession of 93, then Y2K and the DotCom crash, then 911 and the GFC, now this. With no time left to rebuild. At least younger people can learn a lesson about who and what to trust and have decades to rebuild. Right now their biggest worry should be that when Covid is over the elderly that got wiped out will be back in the job market as a matter of survival. Not all of them of course, but millions and they will be willing to work for less. This disease is going to wipe out a lot of the middle class.

Just before all this happened, we were planning to do a bit of remodeling. We just nixed that permanently. I’m sure we aren’t alone in our change of sentiment. A wave of buy less and save more will take a long time to fade again. This is especially true among those that can’t afford food for the first time. My parents both grew up in the depression, and were quite frugal. My dad talked about shadow soup. It got its name because you could see your shadow in the bottom of the bowl. Hunger leaves an impression.

Fed’s buying junk bonds. As I said, they will eventually OWN everything.

Don’t they call that a monopoly?

Not if it’s the Fed.

“Boomers had a quarter of their retirement blow up in a month.”

My retirement was blown up a long time ago. How about we go back to 1987. I have virtually ZERO trust in Wall Street.

Martin Armstrong goes on about how this has been the most hated bull market in history. I see it as being the most fraudulent bull market in history. As Mises said, the final outcome of a debt fueled boom, is that the debt collapses or the value of the money does. Either you don’t have money to buy anything or the money is so worthless that it doesn’t buy anything. Take your pick.

Zero Hedge headline: “UK Unleashes Helicopter Money: In Historic Move, BOE Becomes First Central Bank To Openly Monetize Deficit”

The Fed bailouts will go to markets first. The market may never represent reality during this crisis.

The market doesn’t represent reality at all. Companies borrowed collectively billions and billions of dollars to buy back stock and artificially pump up their stock price. They now have billions and billions of debt they must service from their income. Throw a recession into the mix.

Yep. I saw a chart somewhere saying the biggest component to stock market runup the last 10 years was companies buying their own stock. If you take that out, stocks were flat until this crisis. So take away corporates buying stock and you have a market that goes back to 2009 levels. Yes you heard me right. The Fed is indirectly buying stocks right now because they know corporations need their cash to survive. This shell game has to end at some point IMO and it will end badly. I believe the Fed is up to $10T now. The US market is roughly $34T. They need to drop another $15T in the market to keep the market up.

If the Fed goes no farther than replacing wages folks would have earned absent the coronavirus unemployment, inflation, defined as too much money chasing too few goods and services, should not be any more likely than before coronavirus. But if the gov perfectly replaces lost wages, which is unlikely, and there is an extreme shortfall in available goods and services, quite likely, then rut-roh. But if the prior coronavirus equilibrium returns, should be status quo inflation, except for assets.

Shucks we should just chuck the near $6 trillion in SS Trust Fund into an account at Goldman and see what they can do with it.

Are we going to fight the FED? Think we are at 10,000,000,000,000 bailout so far. Still more to come. Last bail out was just shy of a trillion but the banks participated for years after multiplying this amount. And we got the present bubble now this corona bubble has the potential to dwarf the last one.

Look at Japan it’s not good but they have survived massive debt. We still have a long way to go in comparison.

They will not leave a dollar “un-loaned” on the table in an effort to keep the current system going!

Find me someone in government that cares about debit?

FIVE. Weep when the government seizes private gold/silver

So CGO will be a thing then? Collateralized Gold Obligation that is.

“Should airlines fly with middle seats empty and boarding/deplaning protocols that preserve social distance?”

What about airplane ventilation systems?

“Could restaurants offer explicit deep cleaning protocols for their tables, less server contact or less dense seating to allay health concerns when eating out?”

Restaurant profits are so marginal, there is little room to cut back. Robot servers won’t be here soon enough for smaller restaurants. In a couple of years there will probably be certificates of vaccination or past COVID19 infections.

Restaurants that survive the virus will be those that own their property (not renting) and aren’t in debt.

The restaurant industry has also benefited from Americans buying cheap goods from Asia and spending the savings at restaurants. That’s going away.

I forgot one kind of restaurant: the old drive-ins. Sonic drive-in is just a fast-food restaurant that brings the food out to you – but it’s faster than the drive-thrus at other fast food restaurants (probably because you decide what you want to order before you push the button).

More family-oriented drive-ins might make a come back. I haven’t been to one since Gino’s bought Tops in 1967.

There’s a report on airline rationalisation over on Wolf Richters site – wolfstreet.com

It seems certain that a quite a few airlines will be nationalised or renationalised.

Airline travel will most likely pickup to a new “normal” around 2024.

“Restaurants that survive the virus will be those that own their property (not renting) and aren’t in debt.”

Not sure if that’s true. Who else is the landlord going to rent to? The old school restaurants that own their own property will probably survive, but if a back-door bailout is implemented, then the banks or their proxies will just wait it out until business picks up.

What’s suppose to happen is the bank’s loss of revenue means they would be forced to sell the property on the courtyard steps since they would be in violation of reserve requirements, etc. Then, a prudent “cash hoarder” would swoop in and buy the property.

“Upward mobility” via sacrifice, but that avenue has been severely narrowed, if not closed in this society for awhile.

“Who else is the landlord going to rent to?”

I suspect fewer people will be going out to a restaurant in the future, even after the virus passes. There will be a deep and long recession and less trade with countries that make cheap goods that Americans can save money on to spend at restaurants.

Businesses that do well will be those that bring stuff to your house.

Who cares? Pass massive spending bills. Skip the oversight. Someone else will pick up the tab.

“(CNN)The recently resigned acting Navy Secretary Thomas Modly’s Monday trip to Guam where he addressed the crew of the USS Theodore Roosevelt and slammed their former commander, cost the Defense Department an estimated $243,000, according to a Navy official.”

Now THAT is what you call STUPID.

Money well spent to get rid of the jerk. Small potatoes compared to Trump’s constant trips to Mar al Lardo.

No worries, Dow at 30,000 by year’s end 🙂

FT reports that Chase has temporarily stopped accepting applications for small business loans outside the government’s Paycheck Protection Program.

Yeah, small businesses are toast!!!

This is the final BINGE on the credit card they have no intention of ever making a single future payment on.

And they will continue to run it up until the rest of the world says “No more Reserve Currency status for you!”

Actually, the rest of the world may have already said that, and that is why we’re binging.

The government promised $10k in grant money in the EIDL in the original Care Act. Now that is being reduced to $1k per employee. In addition, no (or very little) money has actually been paid out. Many small businesses were depending on this money to keep them afloat until May (when things might reopen). Now the rug is being pulled out from them between this and the fact that the actual PPP loan amounts tend to be a lot smaller than what any of these companies actually require.

Expect MASSIVE bankruptcies among small businesses over the next three month. Small business represents 57% of the labor force. Half to 3/4 of those folks will lose their jobs over the next 3 months as well. This is on top of all the layoffs the big boys will be doing over the next 6 months.

At best the 3rd quarter recovery everyone is talking about will be a 60-70% improvement off the bottom. (IE…30% lower than pre-Covid-19…still depression level numbers.)

Government aid will be too little and too late to do any good for many.

It’s not only people living check to check. Apparently many large corps are as well. Many can not pay their rent.

Who’d a guessed CO2 would actually threaten the food supply chain?https://finance.yahoo.com/news/side-effects-fuel-demand-crash-151750732.html

the front page of CNN Money is full of disastrous news yet the stock market is going up nearly every day Why? Is it QE or what? Please explain.

The Fed’s been buying stock. What’s so unclear about that. Ok, so their charter does not allow it, but who’s going to arrest them?

It is?

It’s not?

Will they tell us if they are?

Counter trend rally post initial fall, wont last. Will see sell in May and go away kick-in too.

“stock market is going up nearly every day”

For the last ten trading days, the S&P 500 has gone up four.

That question was also asked by God, and even He couldn’t get an answer.

She. Asked by She.

Just continuing from the previous reply to you in another post on building a mini-pleat filter. I don’t have own comment window. N100 fabric I taped flat over both canisters of a dual canister half mask, the resistance is just about acceptable, total surface area around 55 cmsq. Much less area and it is not practical. So the minipleat idea I posted was to tidy that up and improve airflow more . So I finally have first rough model assembled following the idea I posted. I prefer metals to resin so it was a bit of messing around and improvising because I used resin for the model. Anyway, it works well, the teeth are 0.5 cm and they double the surface area (measured, I was trying for tripling but losing a mm here and there between moulds ended up with double) , they could be made longer etc. and give larger area. So on this one where the opening is 4 x 5.5 cm I have 44 cmsq. I just taped it all up for speed. It seals well and keeps the pleats. The teeth need to be a tad longer to fit perfectly with the cloth ( geometry when closing on material), I knew this but purposefully left that out , taping the edge instead. Caulking on one side could also work.

So just one this size is adequate for a mask. When I have everything to assemble it set up clearly I will post that, but I just followed what I posted in the previous comment.

The so-called “stock market” is a Federal Reserve-controlled video game. A complete fraud. Shares will never be completely worthless, but will eventually buy you an egg or two – if you’re lucky.

It’s common for transfer payments to welfare recipients, to increase during downturns.

Infrastructure spending reviving the economy?

As someone involved in the construction world, I have been busy these last few weeks (building luxury apartments is essential, doncha know?).

For some reason I fail to see how a gigantic infrastructure package would benefit those other than who already have been working through the shutdown–namely construction workers and construction companies.

It’s the service economy that is being hit the worst (70% of he economy!) Because they aren’t working, there is less money that they can spend.

But until people are assured that participating in a service economy won’t result in a serious chance of a death-tempting illness, it won’t be revived.

Will Biden be the Herbert Hoover of the 20th century? More than anyone in the country he represents the conservative banking community and the FIRE economy. He certainly isn’t an FDR.

If Trump loses (I don’t think that’s a guarantee), Biden will be responsible for building a new way of life. Few people today understand that FDR did just that. The old factories would never work they way they did in the ’20’s. So he basically created the infrastructure to create suburbia. FNMA, infrastructure projects, federal financing of local infrastructure were all designed to build suburbia on a mass scale which would employ millions in home-building, auto manufacturing, road construction, etc…

I see a global depression. Biden being in way over his head as the unemployed begin to rise up, and a Sanders type following. Though Bernie himself will be too old.

FDR died before the end of WW2. He put Social Security in place, but hardly was responsible for “building a new way of life.”

A come to Jesus moment for anyone who was barely employable 3 months ago in the most overrated “strong economy” in history, and for anyone over 60 who was looking at barely-workable retirement cash flow projections 3 months ago.

Some will wish they had died.

Well – stock market is back to normal.. almost 50% of the drop is regained and optimism is flying in the air… Never fight the FED

Normally I would agree. But liquidity was everywhere before the crisis. More liquidity to do what. Buybacks?

It’s a bear market now. A few spastic days up is very different from the slow bull grind up of the past 10 years. Anyone with any brains buying the momentum up has tight stops — which will cause fast reversals.

If you have time to waste, Dr. Bernanke, the arsonist turned firefighter, offers his wisdom.

The news is always positive at tops, and often even more so at the end of dead cat bounces like this one. Couple that with the widespread belief the Fed is all-powerful (see Wizard of Oz) adds up to another, even bigger leg down, and soon.

A fall in cases doesn’t mean the restaurants, stores and resorts will be open next week.

We have more time to go.

The market is looking to the next 6 months when the Fed will own the stock market.

What’s there to understand other than that?

The BOJ owns 50% of Japanese ETFs

does that help or hurt?

The Nikkei has doubled since the GFC, so it has definitely helped.

Well that’s the problem. They only own 50% 🙂

Once they own everything, they can set the price to whatever they want. Mark to Market Magic is something the whole gang at the Fed is expert at?

Of course, when they try to offload the whole lot later on, it will be a different story. But hei, that’s a problem for 10 years down the road.

What is this “offload” event you speak of? Based on recent history, once a central bank starts buying assets wholesale to support prices, they own them forever. Also, once they own a lot of assets, they have a strong vested interest in continuing to support the prices of those assets.

It’s obvious you don’t understand how banana republics work, Government uses public money to buy assets from certain “interests” at inflated prices. Afterwards, they offload those assets at bottom prices.

That may be how banana republics work, but the Federal Reserve in the US is a privately owned banker’s bank that issues credit out of thin air and ostensibly aims to get more back in nominal terms than it lends out. How can they cheaply sell assets they paid dear prices for without absorbing losses? Admittedly, they could just make a corresponding bookkeeping entry and label it “goodwill,” but they truly would be printing electronic money at that stage and not just “lending” money. Would the US Treasury and lawmakers let them do that without taking them over?

And yet they are now buying junk bonds, thereby making sure they’ll “lose money”.

You seem to be under some sort of delusion that we are on the way of becoming a banana republic. No. We are already a banana republic.

After today I can see the writing on the wall. The Fed will provide a place to roll over any and all economically significant debts that cannot be serviced due to economic disruption from the virus. If a corporation has bonds that were recently downgraded from BBB- with a yield of 4% and it cannot pay the coupon due to lack of income, then the Fed will let them roll it over at 3% and increase the borrowed amount to cover the coupon payments for the near-term. Just like homeowners used borrowing to turn their houses into ATMs before the 2008 crash, businesses have been using borrowing to turn their businesses into ATMs for the last 10 years and unlike in 2008, the Fed is not going to allow that to stall before doing something about it. If pension funds become forced sellers of bonds that were recently downgraded below investment grade, then the Fed will give those pension funds a place to sell to without taking a capital loss. The Fed has all that covered and they are providing facilities much earlier this time around so nobody big will suffer massive write-downs.

The only way the Fed loses money on this deal (in nominal terms) is if COVID-19 persists much longer than most expect and if the income streams servicing these debts do not come back within a year or two, causing businesses to go bankrupt and default on those bonds outright despite being able to roll the debt at lower cost short-term.

Meanwhile, businesses that do not go bankrupt will sell less product and many people will have less work that pays well. The average person will eventually suffer from a “lack of purchasing power.” Said another way, there will be a “poor distribution of income and purchasing power.” Hmm…where have I seen that before? Someone should hold Bernanke’s feet to the fire about this situation.

As I said on a previous post. By rolling everything into their balance sheet, the Fed can apply all sorts of Mark to Market Magic. They’ll be the new 3M!!!

Mish should trademark the term “Par Value Forever!!!”

Next big investment: Societal Collapse Bond. That too frequently happens in a banana republic.

Illogical. If they own everything, there will be no participant on the other side of the trade to keep prices up. No buyers, prices crash.

The classic economic definition of Communism is that “the state owns the means of production”.

If a central bank owns 51% or more of a corporation, then they have a controlling interest and are, in effect, the owners of that corporation. If a central bank such as the Swiss National Bank, the BOJ, or the Fed is considered to be a part of the government (rather than a quango), then the government would effectively own that corporation.

The SNB and BOJ haven’t used their ownership to vote directly in corporate elections and seize control, but they could do so. The BOJ would need to switch from owning ETFs to owning actual stocks, but owning 51% of every company’s stock is not a huge leap from owning 50% of ETFs. It’s just more of the same thing, and the BOJ is currently running out of ETFs and bonds that it can buy.

If current trends continue and central banks keep increasing their ownership of stocks and ETFs, will we soon see a new form of Communism, where central banks rule over us, instead of a Central Committee?

We aren’t there yet, but the trend is most definitely for central banks to own more and more of the economy as time flows forward. The once-unthinkable is becoming reality before our eyes, exactly how far will they go?

Trapped

(Spain last night, what happens when they contain everything)

well if we go back to “normal” they will finish buying up their own stock at our expense.

Dead cat bounce, or in Elliottwave terms, a 3 wave corrective retracement is likely.

We will not go back to normal that easily. I am 56 and have been trading and investing for decades. These retracements happen in both up and down markets. If you bet on a bull return, take it slow and get price confirmation that you are correct. I wish you luck!