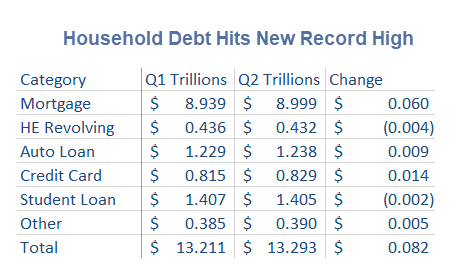

Inquiring minds are digging into the New York Fed Quarterly Report on Household Debt and Credit.

Total Debt

Mortgage Originations

Auto Loans by Credit Score

Credit Score Ratings:Equifax

“Lenders generally see those with credit scores 670 and up as acceptable or low-risk borrowers. Those with credit scores from 580 to 669 are seen as “subprime borrowers,” meaning they may find it more difficult to qualify for better loan terms. Those with lower scores – under 580 – fall into the “poor” credit range and may have difficulty getting credit or qualifying for better loan terms.”

At least 1/3 of the auto loan originations are subprime.

Loan Delinquency Status

Percent of Balance 90+ Days Late

Debt Slaves

The number of debt slaves rises every month.

Party on dudes. Your house, your education, and your stocks will bail you out. Right?

Mike “Mish” Shedlock

best guess,1/2 (at least) written off /down,bank bailout 2.0 will be massive with a capital M

As a contrarian data point: the compounding rate from 2003 Q2 thru 2018 Q2 is 3.92% Given that many people think that inflation figures reported by the government are understated, the growth in the overall debt over the past 15 years simply seems to be following inflation with some shift out of credit cards and mortgages and into student loans. In fact, going back to 1999 data gives a compounded growth rate of 5.55% so the overal rate of growth has slipped from the 99-03 time frame.

Real consumer debt has grown at more or less at the same overall real growth rate of the economy for a while now.

The bubbles this time around are in corporate and government debt.

There are quite a few people around here who think that the reported inflation rate is overstated, especially if you factor in technological advancements. The cost of telecommunications has fallen about 90% since 2000 and continues to plummet. Oh sure if you’re still paying for cable or satellite TV you’re paying more than ever, but why, when you can get one or two over the top (OTT) video services and probably an off-air antenna for a fraction of that price. Unless there’s a very specific group of channels you watch, I doubt you’ll miss the regular cable programming package.

Of course the big exception is the highly regulated products and services like autos and healthcare. But everything else seems to be getting cheaper all the time. Maybe the tariffs will change that, but doubtful they will be around for very long.

Although the Fed’s Z1 Flow of Funds report issued on June7, 2018 shows that total household debt outstanding (mortgage and consumer credit) at the end of the 1st quarter totaled $15.255 trillion, $2 trillion higher!

Can anyone explain the difference?

In the Z1, I understand that includes hedge funds. That as well as margin balances on brokerage accounts make up a bit of the difference.

Question – when the party stops, will those left holding the bag be better able to cope with the losses than last time?

An important question, is the credit system more resilient now than 07-09?

It’s not the same landscape as in 07-09. Consumers in general are in much better shape than back in those days. The bubble this time is in government and corporate debt where the amounts borrowed have been massive, loan covenants getting “lighter” and “lighter” and investors not being properly compensated for the risk they’re taking. When European junk bonds yield less than treasurys you know something a’int right.

This is correct – consumers were so thoroughly destroyed by the housing bubble, they had no chance to amass massive additional debt this time around. Instead governments and corporations did, at a pace that actually dwarfs the growth in consumer debt during the housing bubble. The only comparable development in recent history is the corporate debt-fueled binge of 1980s Japan.

That’s the question posed for twenty years, who will be holding the grenade when it inevitably detonates?

Taking the latest guess at total USD-denominated debt ($247 trillion), each and ever buck of it is someone’s ASSET. And those assets decline in value for each uptick in interest rates, which unless one believes the End of History has arrived are certain to rise (more than they already have.)

The Mt. Krakatoa of Debt represents the largest credit inflation in recorded history. That inflation (which is a state of mass minded psychology) buoyed asset prices into orbit and fueled decades of double-digit compound growth of industries like Medical Services (i.e., the Hospital-Insurance Cartel), the Pentagram’s M-I-C and Welfare Administration (which has exploded these past 25 years, employing armies of people to hand out the loot and prospect for more “need.”)

To me, this long period of economic and monetary insanity is the largest game of chicken imaginable, everyone desperately hoping that the inevitable, catastrophic collision is still a long way off. Maybe it is. Maybe it’s coming soon. Heck if I know.

All I know is that (1) we HAD our inflation, meaning that until the value ($247 T!!) of all that debt is burned down to embers, inflation as a “solution” is literally impossible. All roads lead to a mass-minded reframing of the past, resulting in a stampede for the exits…but to where? (2) If debt and asset prices collapse, exiting to a bank balance will be like switching staterooms on the Titanic.

Things have never been better. The economy is doing fantastic because Trump says so. Stocks are going through the roof! The law of gravity has been repealed and it’s just up, up, up from here on out! Party on, Wayne!

A quarterly increase of 6/10ths of 1% doesn’t seem particularly alarming.

Maybe it should be. What happens if it contracts?

It’s alarming because it’s not enough of an increase? I guess, contraction may be a sign of slower near term growth or recession. Annual growth in debt of 2.5% seems like a goldilocks type number.