Every month I am amused by the comments from NAR chief economist Lawrence Yun regarding housing fundamentals, especially job growth.

Forget about strong jobs. Toss Yun’s views in the ashcan.

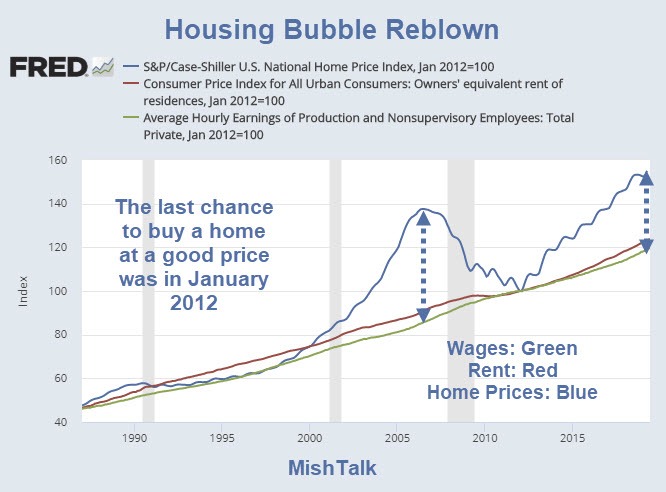

Compared to wage growth, homes are nearly as unaffordable now as they were at the peak of the housing bubble.

That’s without factoring in student debt and attitude changes regarding debt, assets, and mobility.

January 1987 to January 2000

In the 13-year period between 1987 and 2000, home prices, rent and wages all rose together. Homes were home, not speculative playthings, not a retirement vehicle.

That changed in 2000.

January 2000 to July 2006

In the 6.5 year period between January 2000 and July 2006, home prices soared 85% vs 22% for both rent and hourly earnings.

People thought homes would never stop rising. Supposedly there was a massive shortage of homes. People line up for block for the right to buy a Florida condo. In a few short weeks, after the pool of greater fools ran out, the housing crash began.

The housing crash lasted longer than the stock market bust and finally ended in late 2011. January 2012 was the last time rent, home prices, and wages were roughly in sync.

January 2012 to April 2019

Home prices are not quite as bad as they were in July of 2006, but pressure on would-be buyers is extreme.

Wages are up 19%, rent is up 23%, and housing prices are up 55%. Those are national averages. Some markets are better and some much worse.

Millennials are under sever pressure because the price of rent has outstripped wage growth. Waiting to buy has generally made matters worse.

Those who could not afford to buy a home in 2013 are much further behind today.

Worst Time to Buy Since 2012

Now is the worst time to buy since 2012. Markets vary of course, and so do strategies. Those who own a house, especially a big one in a hot area have a good chance to downsize.

But the new kid on the wanna-be block would be wise to think twice.

Deflationary Bust Coming

I am convinced another deflationary asset bubble burst is at hand.

For discussion, please see Deflation Coming: CPI Supposedly Headed Nowhere, But Let’s Dive Inside.

The bust could easily last six to eight years this time, not two. Indeed, that is my expectation.

The bubble represents asset inflation. Asset deflation will likely be accompanied with a small amount of price deflation as well.

No Crash?!

Unlike others, I am not calling for a crash. The liquidity conditions are way different. And the primary bubble this time is not housing, but junk bonds and equities coupled with very deflationary demographics.

I expect something more along the lines of -15%, +3%, -10%, +5%, -8%, -8%, +5%, -18%. The result of that is about -46% with nothing worse than -15 to -20% or so.

When I called for a deflationary bust in 2005 I was widely thought of as a fool. I was, for two years.

Maybe I am again, for even longer.

Mike “Mish” Shedlock

Can we get an update on this chart? We’re almost done with Q1 2021. Seems like real estate is higher than ever. Somebody stopped by my mom’s and offered her $315K cash for her house. She bought it 2 years ago for $220k.

Why is Canadian bubble is so different, any explanation, thoughts ? being largely dependent on US economy, why it has no impact even in recessions.

It’s the interest rate that is going to give, mortgage rates already fell while the fed rate is still the same, the banks know.

“In the 13-year period between 1987 and 2000, home prices, rent and wages all rose together. Homes were home, not speculative playthings, not a retirement vehicle.”

The Ownership Society scam. Alan Greenspan took lending standards to ZERO.

In 2001, 10,000 appraisers petitioned the government over appraisal fraud. Nothing was done about it. In September, 2004, the FBI warned congress of massive mortgage fraud. Nothing was done about it. In 2004, the Big Five investment banks were given leverage waivers by the SEC. They subsequently leveraged up as much as 30 to 1.

Paul Krugman noted that Greenspan needed a housing bubble to grow the economy out of the .com crash. Thus unchecked appraisal fraud, mortgage fraud and leverage waivers for investment banks.

No banker has gone to prison for participating in the scam.

The problem with no response to noted wrongs, may appear to justify people taking their own actions to protect assets from scrupulous ,illiterate , greedy. and self interest groups who wouldn’t even blink when their clients are on street for $1000 dollar refi they never even approved of.

Prices may look like a bubble, but the volume does not confirm one. In a classic bubble mania BOTH prices and volume increase. The housing market reflects the economic polarization of society. The argument that low housing inventory will inevitably cause price spikes fails to acknowledge ownership rates are STILL hear historic highs (saturated market), that many people do not put their house on the market because they feel they cannot get the price they want, and that there is no longer job security to back 30 years of mortgage payments.

I’m under contract on an $800k house in a NJ train town that still needs $80k of work. This could be a huge mistake but my wife and I are getting old and it’s now or never to start a family.

High skilled immigration plays a role in this too. Since the 80s we’ve been importing massive amounts of immigrants from India, China, Pakistan etc.. who far outearn the average American. I work in tech and probably more then half the people I work with weren’t born here.

Maybe I’m wrong but in places like NY, SF, Seattle it’s just supply and demand – so many more people then 20 years ago but the same single family housing stock. Developers have only been building of 1 and 2 bedroom apartments – great when you’re living the single lifestyle but it’s not going to meet growing demand for family housing

The only way I can see housing in these coastal markets decline is of people leave them for places like Oklahoma City. Maybe that’s going to happen and I’ll be ruined, but I’m hoping not.

Property taxes in Illinois are nuts

$15K a year on our $400K home

Crazier in western NY. $20-25k on $400k house

Y’all come on down to Huntsville, Alabama, the taxes on a 400k house is about $2500.

Oh man, I’m in Orange County CA and I am flabbergasted at these prices. I can’t find even a small townhouse in our price range (500k), and we make well above the median income. And even with the “slowdown” prices aren’t dropping even nearly enough for us to buy. Debating between a 1 or 2yr lease renewal and have no clue when to hope for an affordable place.

“Now is the worst time to buy since 2012. Markets vary of course, and so do strategies. Those who own a house, especially a big one in a hot area have a good chance to downsize.”

Well, I’d rather not wait any longer. I’m still using the address of my house in the Phoenix area which I gave to my ex-wife (at least my half) two years ago. I had an awful experience living in a (relatively) cheap apt in Mesa, AZ, waiting for the housing bust that still hasn’t come.

I’m now sitting in motel in the OKC area. Houses are cheaper here; you can buy a small brick or stone masonry house here for under 100k. I won’t get one that cheap because I’m looking in Norman, a college town, where real-estate is a little pricier, but still cheaper than other temperate, suburban places in the country. This town appears to quite liveable. Oklahoma is also a low cost-of-living state in other ways.

I may buy something this weekend. When the bust hits, I shall probably get a double-hit as the student loan bubble bursts with real-state. So be it. All I want is a place to live and surf the net. And a place to park my belongings that are now in storage.

I was going to ask if a storm cellar was a requirement for you, but unless things have changed there in the past 6 years, there apparently are NOT that many available:

“underground storm shelters are somewhat of a rarity in Oklahoma, the country’s third most active tornado belt state, with only 3.5 percent of homes in the greater Oklahoma City metropolitan area having basements and conventional storm cellars, according to Reuters.”

Selected quote from “Gimme shelter: Why storm cellars and basements are a rarity in Oklahoma” link to mnn.com

So…..I guess it was a dumb question.

Wish you well in your search for a place to call home.

Of course, tornadoes are a concern to me while looking for a house here. While few walls can withstand objects hurled at them at 250mph, you stand a better chance with brick or, better yet, stone masonry than wood. While few homes have storm shelters, most of them are brick and not few are stone masonry.

A mortgage agent, who prepared a loan pre-approval letter for me, told me her aging parents’ home in Moore was hit while they were out. Their belongings were destroyed although the family dog miraculously survived. She also said that new homes are built to better withstand tornadoes, including roofs that are ‘strapped down’, whatever that means. Maybe, I’ll consider a newer home

In any case, I travel a lot and plan to spend tornado season in other places.

Good luck

We too are renting in the Phoenix area. The housing bust analysts have been looking for has yet to materialize here. Sellers are easing off their asking prices a bit but are stubborn. Meanwhile rents are out of control. This will continue until it ends. Which could be many years.

People are always buying, its what makes the market go! Timing your purchase in housing can be absolutely brutal due to the length of the wait, but in the higher priced markets it could make or break your wallet for decades.

I sufferred. . . and suffered in so cal through all the nonsense, I had a down payment ready from 2004, but closed finally. . . after marriage, and a kid, and a wife who was emotionally battering me to buy a house. . . in April of 2012. I suffered through all the parties where people called me an idiot for not buying, etc, etc.

I payed that house off two months ago. For good or bad. The money sunk into it generates a post tax (via OER) of about 8.5% a year after all costs of ownership are pulled out. A penny saved as they say. It is one of the best investment I’ve made without including any consideration of the price increases, only the reduction of my rent costs. If I factor in appreciation, I’ve easily outdone the market post tax during that time.

It was worth the wait, If I had bought the same house in 2006, I’d be paying on it for another 7 years probably more.

My point? Decisions like buying a house might be one of the most important purchases of your life. It’s worth as much time and consideration, and suffering as you can bear.

“No it does not. Let’s not confuse owning a mortgage with owning a house. Yes the cost of the mortgage went down. The price of the house did not.”

Bingo

The price of the house did not go down. But subsidized mortgages does mean third parties are effectively forced to help pay other people’s mortgages.

Such that while the total cost of the house remains unaffected, the effective cost to the mortgage holder himself, is lowered. With the difference being paid by those whose resources are forcefully commanded by the confiscatory state, in order to continue subsidizing housing racket participants.

Oh please. Even ignoring that 99% of owner occupied houses are purchased with a mortgage and therefore the lower the rate the lower the total cost. For that person who buys a $400,000 house with cash the opportunity cost is way less when 30 year treasuries are 5% versus when they are 3%. Over 30 years that opportunity cost drops from $1.4M at 5% to $470k at 3%.

The problem with your thinking is that you assume that a person who buys a home worth $400K at %5 will also buy the same home at %3. That is as we know from the last crisis not the case. That family will assume that they can assume a better home and buy a mortgage for lets say $600K. Do your math on that… Like I said you do not own a house you own a mortgage. In my opinion home should always be consider cheap or expensive against salaries not interest. The only people who define affordability based on interest rates are bankers and RE companies.

I think this time around, because pension funds are levered heavily in their search for yield plus their private sector bond purchases being a huge source for corp stock buybacks, the US government will be forced to tax and monetize like there is no tomorrow. May be a lot longer.

You never take into account interest rates when talking about housing affordability. In this recent run up mortgage rates have dropped 25-30%, meaning a house that’s 20% higher now has the same monthly payment. That knocks a big chunk out of that 55% price increase.

That knocks a big chunk out of that 55% price increase.

No it does not. Lets not confuse owning a mortgage with owning a house. Yes the cost of the mortgage went down. The rice of the house did not. BTW what happens if housing tanks again?

At the same time you lose your job and you are now driving for Uber?

If that were true we wouldn’t be seeing home sales sliding with mortgage rates at 3.75% on rising inventory. The flaw in that argument is that trickle-down does not translate for working Americans. Those lower rates are often not accessible, and even for those who qualify for the best rates, the price inflation on the home has far exceeded the average family’s income growth. Average families are falling behind trying to keep up. Of course the banks are happy to loosen restrictions and keep the credit spigot flowing, but it doesn’t solve the problem. We have plenty of people who own mortgages, but not nearly enough who actually own their homes free and clear. By loosening credit restrictions and trying to get more people into homes at inflated (artificially inflated) prices, we are just going to create more collateral damage and underwater borrowers during the next recession. Boom, bubble, bust. Wash, rinse, repeat.

The market clears inventory at given price levels. Unless the average mortgage duration has become longer historically, there is a similar end to the loan, irrespective of what percent of your monthly income is consumed. So if folks in the 1960’s took out a 30 year mortgage that consumed x% of their income, and folks today take out a 30 year mortgage that consumes 5x% of their income, after 30 years in either scenario, the home is paid off.

Interest and price certainly has an inverse relationship… along with a lot of other factors that continuously change and shift.