Buyer Fatigue

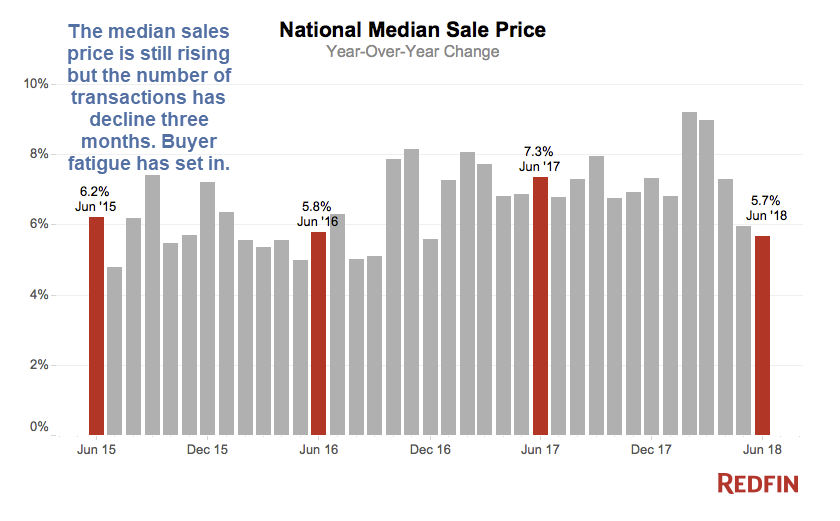

Redfin notes June Home Prices Rose 5.7% Year Over Year; Smallest Increase Since December 2016. The key point is buyer fatigue.

“The affordability crisis may have reached a breaking point in Portland, San Jose and Seattle,” said Redfin CEO Glenn Kelman. “After 75 straight months of price increases in these markets that far outpaced wage growth, homebuyers are now becoming selective about which homes to buy, and at what price. The homes that did sell in June still sold quickly, but buyers were significantly more likely to reject homes that were less desirable or aggressively priced by the seller: the percentage of listings in these markets that sold within two weeks declined in June from 61 percent to 52 percent, and the fraction of listings that dropped their price increased from 31 percent to 33 percent.”

“We’ve seen similar signs of buyer fatigue in the past, especially at this point in the season,” Kelman continued. “But in this case the lull has lasted a bit longer and affected more markets than in the recent past. It’ll be interesting to see whether buyers adjust to the latest price increase and come back in force this fall, or if instead we see these markets shift more in favor of buyers.”

Related Articles

- Apartment Construction in 2018 Expected to Decline 11% After Strong 6-Year Run

- Existing Home Sales Decline Third Month Despite Rising Inventory

- Real Hourly Earnings Decline YoY for Production Workers, Flat for All Employees

- Housing Starts Unexpectedly Plunge 12.3% in June, Permits Down 2.2%

Once again, signs are adding up that housing has peaked this cycle.

Mike “Mish” Shedlock

Colorado Springs housing market is still on fire; homes are selling within hours and days. C-Springs was ranked #2 best city this year by US News & World Report, so perhaps it is an outlier for housing?

The median price increased because the volume decline in lower priced homes was greater than the volume decline in higher priced homes. Demand has declined across the board, but the mix shift caused the median price to increase. Decline was greater in California because the effective cost of financing a home purchase increased more with the new tax code. I live about a mile from the Netflix building in Los Angeles and I can’t wait for Wal-Mart to launch streaming in 4Q:18 as I hope to be able to get a deal on a larger house.

Zillow’s price “Zestimate” for Portland has gone down the last 2 months, for the first time since 2011.

Excellent comment dfw

A bigger boom will lead to a bigger bust and take down the broader economy with it. Rates are rising and the crack hit that has been interest rates will go away.

Dallas definitely hitting the wall of affordability. After barely rising at all in May, sales in June turned slightly negative. It will be interesting to see where July numbers land, but I would expect more stagnation with a lack of affordable homes. Additional jobs are great, but home price inflation has far exceeded local wage gains…

The housing and stock markets will have a race to the bottom like last time. Stocks should bottom first since their transactions take a fraction of a second. Housing can take months.

Rising interest rates + DJT new tax laws + QE unwind = the tipping point

Want housing prices to go back to “normal?” Get government out of the business of guaranteeing mortgages. Enforce GAAP. Throw bankers in jail for fraud.