Grantham’s 13-page synopsis Bracing Yourself for a Possible Near-Term Melt-Up suggests the bubble will burst and the consequences devastating, just not yet.

His key reasons center around an expected 3.5 year window that is typical of other bubbles coupled with advance decline ratios and acceleration that have not yet turned.

Acceleration

Classic Bubble

Advance-Decline

S&P 1997-2001

Summary Grantham Guesses (“Absolutely Personal Views”)

- A melt-up or end-phase of a bubble within the next 6 months to 2 years is likely, i.e., over 50%.

- If there is a melt-up, then the odds of a subsequent bubble break or melt-down are very, very high, i.e., over 90%.

- If there is a market decline following a melt-up, it is quite likely to be a decline of some 50%.

- If such a decline takes place, I believe the market is very likely (over 2:1) to bounce back up way over the pre 1998 level of 15x, but likely a bit below the average trend of the last 20 years, as the trend slowly works its way back toward the old normal on my “Not with a Bang but a Whimper” flight path.

“*If if the bubble ends in the way I expect it will, then the structural stress may well help the decline become, in technical terms, a real humdinger.*”

According to Grantham “The advance-decline line is clearly not delivering a threatening message yet.”

Advance-decline refers to the number of shares increasing in price minus the number of shares declining in price.

Hussman’s Take

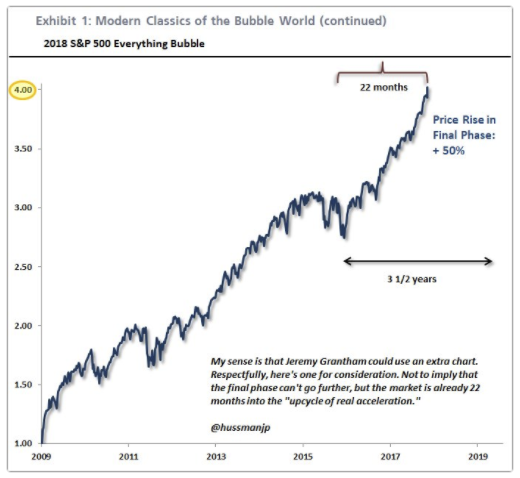

Note that we are “only” into month 22 whereas Grantham expects 36-42.

Hussman is correct that acceleration is readily apparent.

Replies to Hussman

Blow-Off Top

Have we met the sufficient conditions or is another year of investor euphoria coming?

People are still making excuses “the market is cheap”.

But it has to be that way for bubbles to form.

Mike “Mish” Shedlock

Jeremy Grantham, who is credited with calling the 2000 and 2008 downturns has only added to market enthusiasm by informing us last Wednesday to be prepared for the possibility of a near-term “melt-up” but that is only part of the story. The negative part contained in Grantham’s note that many seemed to discount were his feeling that this is one of the highest-priced markets in U.S. history and “this would likely set the stage for a burst bubble and a stock-market meltdown in the future.” more below.

http://brucewilds.blogspot.com/2018/01/much-talk-about-market-sweet-spot-but.html

“Mish, I currently am in gold/silver and miners. I’ve stayed out of stocks (much to my dismay), would this be time to buy index funds with trailing stops (10%?), or stay away?” Hi John H:

My track record is such that even I would not ask me. But no, I am not buying indices here and I would advise against it. Like Hussman, I have not timed this remotely accurately.

You can make a lot of money off a bubble if you can time it right. Sell at the top, then buy at the bottom when there’s blood in the streets.

Mish, I currently am in gold/silver and miners. I’ve stayed out of stocks (much to my dismay), would this be time to buy index funds with trailing stops (10%?), or stay away?

Repeat after me, there is no speculative bubble, this market action is almost entirely rationally determined by the excessive global monetary bubble. When capital flows switch then something will happen. The US is a third world hot money destination, soon to be a third world energy exporting nation. If you are speculating in this market you are in bad company you won’t recognize the turn. Forget sentiment, a river of money is running over the banks, and it recedes the same way.

Using gold isn’t necessarily a really good basis for S&P 500 valuation either, as the “spike” peaking in 2000 was definitely large, and historically expensive, but much of that on the S&P/gold chart was due to that being a bottom in gold prices as well — Brown’s Bottom. As well, much of the lack of bounce in the S&P/Gold chart was due to a gold buying panic, not anything having to do with the dollar or the S&P.

This information is useful, but must be taken into consideration along with everything else. Using margin adjusted P/E tells a different story, as do several other reliable indicators of subsequent return.

The big fallacy is thinking of gold as a proxy for dollar weakness, when it’s nothing of the sort. The dollar and gold are related, to be sure, but their movement is not necessarily correlated. Put the dollar index chart next to a chart of gold prices and you’ll see little correlation. Gold doesn’t measure dollar weakness, it measures fear, and the two are very different things. We had a weakened dollar 1987-1990 and the gold price went down, as I wouldn’t describe those years as being exactly “fearful”. Likewise, gold spiked during the second half of the “rising dollar”, which was one of the largest spikes in the dollar’s index value.

Gold is gold and dollars are dollars, and gold has many uses today (as collateral, as an investment, etc) that aren’t related to money, and those drive the price of gold, as well as the dwindling physical supply and the exploding paper gold market, in addition to basic fear psychology. Those are complex factors and thus the priced-in-gold chart, while pretty, isn’t close to the whole story.

I actually have a question i specifically want to ask to you, if you wish to assist.

Realist. Fuzzy logic. Not knowing the future means no choices are any better than the other, therefore mathematically rebalancing would make no difference. Reason for rebalancing is risk related. I still say rebalancing is for puss***.

Thanks for the gold to s&P chart, AWC. I hadn’t looked at that for a few years. Certainly it’s good to be reminded that peaks and valleys tend to be only about once in a generation, about 35 years apart, and also that, since stocks actually produce income, unlike gold, which just sits there, the price of the S&P in gold rises over time. Thus, it would seem that there is a lot of room for either a further rise in the S&P, or a fall in gold, before the cycle reverses.

Granthman threaten the shoeshine boys that the market is melting up, in 1929. Oct 1929 meltdown, is the result of 1/2 a year trading range, starting in Dec 1928.

I remember when, after the 2002 bottom, Bob Brinker was making fun of the bad news bears, as he called them. He said the market was resilient. The December 2007 to March 2009 bear market wiped the smirk off his face, as his resilient market fell lower than it was in October 2002.

“Look at the website zerohedge. Been reading that since the 09 financial crisis, first for news, but after awhile I found it is excellent for contrarian point of view. That site has been short and bearish, as well as 99% of the people who post there, since the first day I read it.” Zero Hedge saying BTFD, is not short or bearish.

Zero Hedge headline: “The Dow Is Above 25,000: There Is Just One Problem…” “…retail investors refuse to get onboard for the voyage.” Martin Armstrong had previously said that 23,000 was the trigger point for when retail would join in on the most hated rally in history. At 25,000 Zero Hedge says that just isn’t the case- yet. Twice now, the market has been run up on the basis of financial fraud. The market has crashed when the truth came out. What truth will be revealed this time? What will the financial and economic carnage be this time?

“The market hasn’t hit it’s vertical phase yet. Plenty more upside.” The chart i saw the other day, showed the DOW to be already well into a parabolic move.

scenario. Any correction of significant size will trigger an immediate PANIC response from the Fed. He says they will “panic, BIGTIME” and that will be the trigger for an inflationary event that could get totally out of control.

@Sechel-That is the Bob Rodriguez

Realist, f*** rebalancing.

The DotCom bubble helped a lot of non-internet companies’ stock prices rise. Then the housing bubble helped boost prices of stocks non-housing companies. This bubble is a little different in that stock prices have been rising since 2009, but the bubble phase of cryptocurrency became obvious in 2017. So each market bubble has had some sort of theme, and when investors lose interest in the theme, markets sell off hard. Cryptocurrencies are very likely in their last stage as new coins are making new highs.

Simple, and only correct answer. “I don’t know.” Anything else shouldn’t be taken seriously.

The market hasn’t hit it’s vertical phase yet. Plenty more upside.

As a former portfolio manager investing institutional money there was a cardinal rule that you never, ever telegraphed bearishness or a market downturn to your investors. Why? Your assets under management (AUM) would take a big hit. You could be right, but you would rather have the market take away your AUM rather than a client. At your bearish worst, you would simply say that “over the “long term” we expect stocks to generate an 8% to 10% annual return”.

I note that in several 2016 articles Grantham was managing $120 billion and expected the market to make a major decline after the 2016 election. In recent articles it states that Grantham is now managing $77 billion. That’s a pretty large drawdown of AUM in a year where stocks rallied sharply.

My cynical view is that Mr. Grantham’s “melt up” narrative is more about stemming the slide in AUM. But in this market, he could be entirely right.

A man of Grantham’s gravitas, I am surprised to see, would commit oneself to the the ultimately futile act of future prediction. If its a bubble, then so be it. If not, so be it.

Notice how quickly the South Sea Stock Bubble corrected itself without the benefit of algos and the Plunge Protection Team.