Wirepoints reports Illinois Debt Trading at Junk Levels.

A new borrowing by Illinois shows lenders are already treating the state like it’s junk-rated.

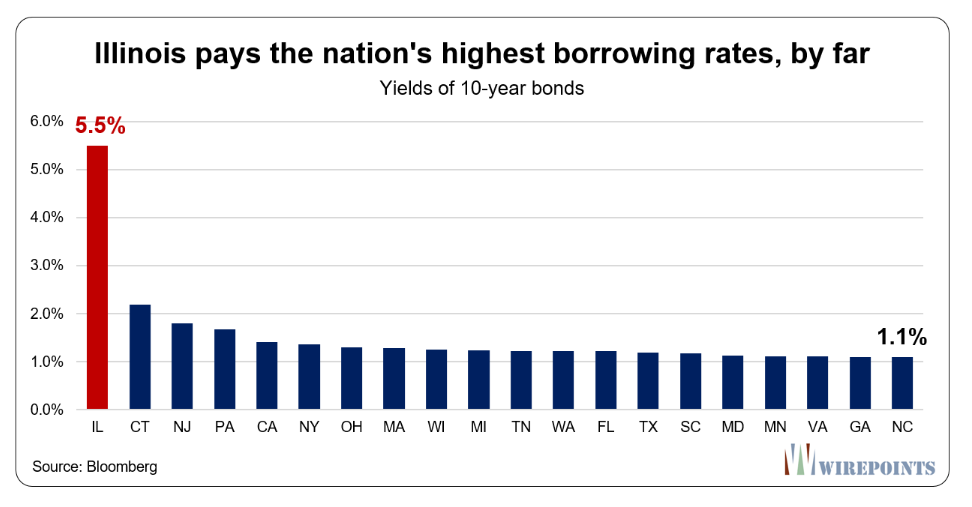

Last week, Illinois raised $800 million from the bond market with repayment dates through 2045. The borrowed money, meant for summer construction projects and a pension buyout program, costs Illinois as much as 5.85 percent yearly. No other state in the country pays such high interest rates.

Over the life of the $800 million bond issue, Illinois will end up paying $450 million more in interest costs than if it were a AAA-rated state.

Illinois Borrowing Penalty

Illinois’ True Retirement Cost is 58% of the Budget

On May 4, I noted Illinois’ True Retirement Cost is 58% of the Budget

Illinois has the worst funded pension plans in the nation. That was true before Covid-19 as well.

New Jersey, Hawaii, Connecticut, and Kentucky are next in line. But no other state comes close to having that much of their budgets swallowed by retirement costs.

On April 17, I commented Illinois is Insolvent: State Requests a Pension Bailout From Congress

No Bailout

Illinois does not deserve a bailout. Its pension woes are of it own making and have nothing to do with the coronavirus.

Illinois debt trades like junk, because it is junk.

Mish

The most important economic law, applicable here, is: What cannot be paid, will not be paid.

It’s just a matter of how much time until people reconcile with reality.

Why pick on Illinois,every state and DC is bankrupt and completely insolvent,the federal govt is quietly borrowing a trillion dollars “officially”probably double (triple)that every single MONTH! Most of that massive pile of freshly printed cash is goin to bail out the bankrupt states! After a dozen years of “the longest expansion in US history” (LMMFAO),record low unemplyment ….”rate”,12 years of positive GDP…”rate”…..virtually everything (literally) is insolvent/bankrupt/needs bailout or has collapsed/closed!

“No Bailout”

…

Camel’s nose

Looking forward to the day a line is drawn … somewhere … anywhere.

Its rather annoying that anyone will still loan them money

I don t think the FED will allow Illi to default ….I am inclined to buy some Illi debt….We DO live in lalaland after all, don t we ?

Is this an opportunity to front run the fed?

Good question.

I remember when Greece on the ropes and yields in the double digits … I was thinking NFW … and then along came Draghi …

How many folks own their own island now from “investing” in Greek debt?

At this point it’s all just Illi-noise.

Why California Is In Trouble – 340,000 Public Employees With $100,000+ Paychecks Cost Taxpayers $45 Billion

Rulings at the local level have suggested so far that pensions can be cut despite what the California Supreme Court ruled of public state-employee pensions being guaranteed. My guess it local pensions will be the first to go. Current state employees benefits will be cut over time. Then some locales will start declaring bankruptcy like Vallejo did. Like a mirage in the desert, the economic security of state retirees will disappear. Oddly this goes on in nearly every state at some level. In some states like Texas, public employees don’t contribute to social security and that money goes to a pension fund instead that guarantees more than social security to even community college employees. Unless the Fed starts buying state debt, there is no way out of this but deflation over a long time.

I’m in the right state but in the wrong job and I don’t know how to correct it. 🙁

The 340,000 employees includes county and municipal employees, etc. California has only about 236,000 full time state employees and most do not earn $100,000+. Most of the problem is at the local level. Since municipalities in California are permitted to file for BK, I think change will be coming at the local level first as suggested by Casual Observer. No state should get a bailout, but if one is passed by Congress it should be on a per capita basis and not based on the debt/deficit a state has racked up.

Spot on.

Bailout coming soon. There is just no other way.

At this point tomorrow is the only day that matters. Party on.

Of course there is. They made the mess. Let them clean it up. When I drive through Illinois, I won’t even buy gas or food there because I don’t want to contribute even a little to their tax revenue.

That sounds like a moral argument. Moral arguments do not seem to carry much weight in financial circles these days. Bailouts appear to be disbursed to those who have the greatest need and have good political connections. The State of Illinois is looking especially needy and their political connections are pretty good.

That’s lots and lots of economic pain.

I was hard headed enough to not learn after 2008 that economic pain is unexceptable.

2020 has taught me that they will collapse the system before they start letting people suffer.

I know what’s right and I know what’s going to happen. Those are two completely different things.

The reasoning will be: cheaper to bail them out then to watch the whole muni ediface crumble.