Currently, the Fed plays tiptoe with rate hikes and the ECB has virtually guaranteed everything with its QE bond program.

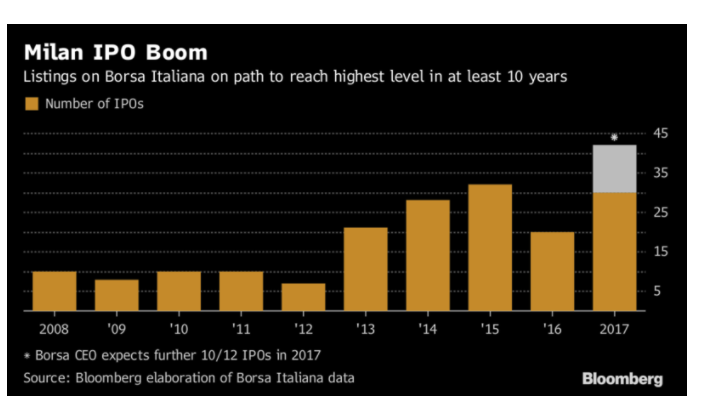

Initial public offerings are booming in Milan as investor demand for Italian assets is driving company listings to the highest level in at least a decade.

It’s hardly surprising that Investors Can’t Get Enough of Italian Assets, or any asset for that matter, except the one that provides a true hedge against central bank shenanigans.

Initial public offerings are booming in Milan as investor demand for Italian assets is driving company listings to the highest level in at least a decade.“2017 will be one of the best years ever for IPOs in Italy, in terms of number of companies that started trading,” Barbara Lunghi, head of primary markets at Borsa Italiana, said in an interview. “Companies seeking to list shares in Milan are increasing in a structural way and it looks like we’re at a turning point, with 2018 set to be another strong year.”

Tax Break Sugar

Ah yes, who can possibly resist double-dip super-sweetened ECB bond buying coupled with tax breaks for Italy?

I happen to have a cartoon tribute.

Sugar Bear vs Granny Goodwitch

Sugar Bear vs Granny Goodwitch II

https://www.youtube.com/watch?v=lx6vSOHJIm8

Sugar Bear vs Granny Goodwitch III

https://www.youtube.com/watch?v=RMK2Na05oOA

Sugar Crisp 1950-1977

What Have Central Banks Wrought?

The answer is bubbles, reckless corporate actions, and a hugely deflationary environment, the very thing the central banks think they are preventing.

Bond Bubble?

On August 4, I commented on the Bubblicious Debate: Greenspan Says “Bond Bubble About to Break”, No Stock Market Bubble

There’s a bond bubble for sure, but it’s in corporate bonds, not US treasuries.

There’s also a bubble in Eurozone sovereign bonds, priced as if Italy, Spain, Portugal, and Greece will never leave the Eurozone.

“No Irrational Exuberance in Stocks”

Alan Greenspan says “There is no irrational exuberance that I can see. In fact, it is just the opposite at this stage.”

Greenspan the Contrarian Indicator

Major comments by Alan Greenspan, widely portrayed by the media are most likely perfect contrarian indicators.

He has been calling the bond market a bubble for years but only recently did he say there was no stock market bubble.

With Greenspan, one needs to be careful. He is frequently correct about some things. However, the things about which he is correct are either never widely published, or they are widely disputed.

“You can’t get growth going so long as entitlement expansion is anywhere near where it’s been recently. It’s eating up the sources of investment and the sources of growth and you can’t have it both ways. You cannot fund all of the entitlements that everybody wants and expect that you are going to get GDP growth out of that at three percent or more.”

Truer words were never spoken. But that particular comment was not widely disseminated, nor does the biased social media agree.

Bubblicious Debate

Is there a bond market bubble? Absolutely!

Say what? Yes, Virginia, there is a bubble. However, it’s not the bond bubble that Greenspan and nearly everyone else sees.

The bond market bubble is in corporate bonds. Junk bonds yields are near record lows. Issuance of covenant-lite bonds with no protections and can pay yields, not in cash, but with more bonds, is at or near all-time highs.

Yields are prices as if defaults will never rise again. That’s the real bond bubble.

Challenge Unanswered

My Challenge to Keynesians “Prove Rising Prices Provide an Overall Economic Benefit” has gone unanswered.

BIS Deflation Study

The BIS did a historical study and found routine deflation was not any problem at all.

**“**Deflation may actually boost output. Lower prices increase real incomes and wealth. And they may also make export goods more competitive,” according to the BIS report.

It’s asset bubble deflation that is damaging. When asset bubbles burst, debt deflation results.

Central banks’ seriously misguided attempts to defeat routine consumer price deflation is what fuels the destructive asset bubbles that eventually collapse.

For a discussion of the BIS study, please see Historical Perspective on CPI Deflations: How Damaging are They?

Meanwhile, economically illiterate writers bemoan deflation, as do most economists and central banks. The final irony in this ridiculous mix is central bank policies stimulate massive wealth inequality fueled by soaring stock prices.

Related Articles

- Deflation Bonanza! (And the Fool’s Mission to Stop It)

- Debunking MMT, Keynesianism, Monetarism: Reader asks “What theories do you believe?”

- “Idiosyncratic and Transitory Factors” Holding Down Inflation: New Definition of Transitory

I’ll skip the Italian IPO, all the FANG stocks (Facebook, Amazon, Apple, Netflix, and Google), and the broader market in general.

I prefer gold to Sugar Crisp

Note: I have moved my website to The maven. For details, please see Welcome to the New MishTalk .

Mike “Mish” Shedlock

Arbitrarily classifying something an “asset,” doesn’t magically make it dropping in price any less of a good thing than if you equally arbitrarily classified it as a “consumer good.” Neither does the fact you pay something for it today, on the expectation that you will get something later. If the later was true, price inflation in refrigerators would be a supposed “good thing”, as long as people bought them on layaway…… For any given future income stream, which is what an “asset” is in it’s idealized form; the less you have to pay for it today, the better off you are. No different that the situation is for any other good. Whether classified as “consumer good,” “asset,” or whatever else.