by Mish

Markit notes that a profit squeeze on businesses. Input prices are rising faster than final prices on goods and services.

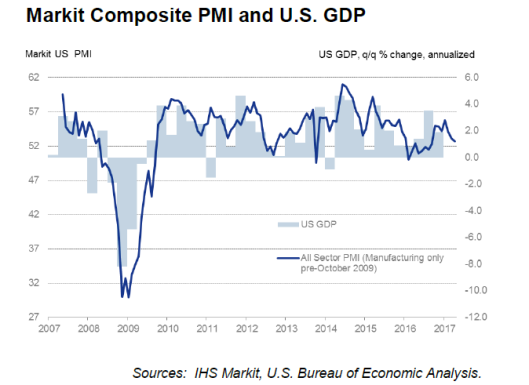

Markit’s chief economist keeps his 1st quarter GDP estimate at 1.7% but estimates the 2nd quarter will get off to a rocky start at 1.1%.

Key Findings

- Flash U.S. Composite Output Index at 52.7 (53.0 in March). 7-month low.

- Flash U.S. Services Business Activity Index at 52.5 (52.8 in March). 7-month low.

- Flash U.S. Manufacturing PMI at 52.8 (53.3 in March). 7-month low.

- Flash U.S. Manufacturing Output Index at 53.4 (54.3 in March), 7-month low.

At 52.7 in April, down from 53.0 in March, the seasonally adjusted Markit Flash U.S. Composite PMI Output Index signaled a further slowdown in private sector output growth. The latest reading pointed to the weakest rate of expansion since September 2016.

April data also revealed the weakest rise in private sector payroll numbers since February 2010, driven by a softer pace of staff hiring among service providers.

There were signs of a squeeze on operating margins in April, as input price inflation reached its strongest since June 2015. At the same time, prices charged by U.S. private sector firms increased only marginally and at the slowest pace since November 2016.

April data signaled a sharp and accelerated rise in average cost burdens across the manufacturing sector. The rate of input cost inflation was the fastest since December 2013, which survey respondents linked to rising commodity prices (particularly metals). Meanwhile, pressure on

margins from higher input costs contributed to the strongest increase in factory gate charges for almost two-and-a-half years.

Comments by Chris Williamson, Markit Chief Economist

- “The PMI data suggest the US economy lost further momentum at the start of the second quarter. The surveys are signaling a GDP growth rate of 1.1% after 1.7% in the first quarter.”

- “The vast services economy saw the weakest monthly expansion for seven months and the manufacturing sector showed signs of growth

slowing further from the two-year high seen at the start of the year, despite export orders lifting higher.” - “The labor market also continued to soften. The surveys signaled a marked step-down in the pace of hiring in March which has continued into April. The latest survey data are consistent with only around 100,000 non-farm payroll growth.”

- “The survey responses indicate that some froth has come off the economy since the post-election bounce seen at the end of last year. However, with inflows of new business picking up slightly in April and business optimism about the year ahead also brightening, there’s good reason to believe that growth could revive again in coming months.”

Business Optimism

My only quibble with Williamson’s comments is in regards to business optimism in point four above.

At best, business optimism is a spillover Trump effect but more likely it is a strong contrarian indicator as well.

Divergence with ISM Grows

The ISM did not forecast second quarter GDP yet but its first quarter estimate is a fairy tale 4.3%, well above any other forecast I have seen.

There should not be a huge difference between the ISM reports and the Markit reports because both companies survey the same industries, but there is.

For further discussion, please see my April 5 column, Another ISM/PMI Divergence: Non-Manufacturing.

Is there a reason to believe Markit over ISM? Yes. Markit is more in line with actual hard economic numbers whereas ISM matches sky-high sentiment numbers.

Mike “Mish” Shedlock