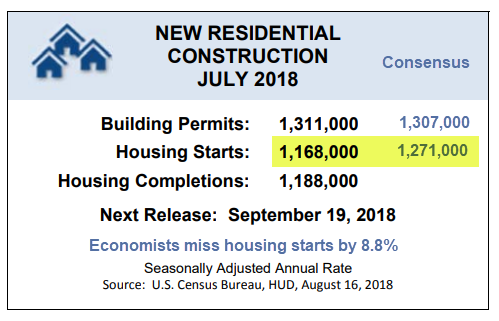

The New Residential Construction report shows continued weakness in housing.

July starts rose 0.9% to 1.168,000 million units seasonally-adjusted annualized (SAAR). The only reason there is a reported increase is the census department revised a miserable June even lower, from 1.173 M to 1.158 M.

Economists Miss the Mark

The Econoday consensus for housing starts was 1.271 million, about 8.8 percent too high. The lowest guess was 1.20 million, 2.7 percent too high.

Lumber? Labor?

Econoday blames a labor shortage and lumber tariffs.

Capacity constraints in construction may very well be slowing down the sector as housing starts have turned lower. They did rise 0.9 percent in July to a 1.168 million annualized rate but follow a sharply downward revised 1.158 million in June. July’s result is far below the low end of Econoday’s consensus range at 1.200 million. Year-on-year, starts are down 1.4 percent with completions, at a 1.188 million rate, down 0.8 percent and homes not started, at 175,000, up 23.2 percent. Lack of available construction labor and high costs for lumber, which are tied in part to tariffs, are negative factors.

By region, the Midwest is leading the way with mid-to-high single digit yearly gains for both starts and permits. The South is close behind with the West and Northeast lagging.

Starts by Region

- US: +0.9%

- Northeast: -4.0%

- Midwest: +11.6%

- South: +10.4%

- West: -19.6%

Hmm. It appears we have capacity restraints and lumber issues in the West and Northeast but not the Midwest or the South. Fancy that.

Mike “Mish” Shedlock

US stock markets are up huge today. The economic miracle continues with no end in sight. The law of gravity has been repealed and there is only one direction: UP UP AND UP! Will it ever end? Maybe not in our lifetimes – DOW 100,000 baby!

I always worry about these over simplified explanations where there are obviously thousands of variables influencing the final number. Just two variables for being wildly off the mark? Will the next prediction be more accurate because economists won’t make that mistake again? 🙂

Lawrence Yun….” ’tis transitory”