by Mish

Let’s check out the winners and losers as noted by the Brooking Institute in its report Metro area unemployment trends buck the national narrative: A story of convergence, not divergence.

In May 2017, the U.S. unemployment rate dipped to 4.3 percent. That rate varied considerably across the nation’s 388 metropolitan areas, from a low of 1.7 percent in Ames, Iowa to a high of 19.2 percent in El Centro, Calif. (those figures are for April 2017, the latest data available).

[Mish comment: May metro data is now available (June Nationally) and the Smoothed Unemployment rate for El Centro is 21.6% down from 30% in November 2010]

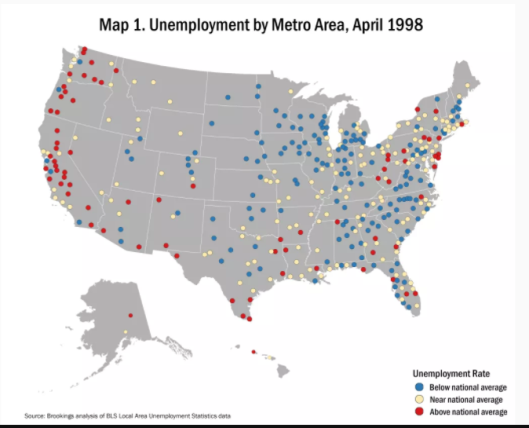

The last two times the national unemployment rate was that low were in the late 1990s, and just before the Great Recession in 2007. Compared to those two business cycles, metro areas today are actually more similar in their unemployment rates.

In April 2017, when the U.S. unemployment rate was 4.4 percent, 226 of 388 metro areas had unemployment rates within one percentage point of that benchmark. 100 metro areas had rates below 3.4 percent, and 62 had rates exceeding 5.4 percent.

In April 2007, when the U.S. unemployment rate was 4.5 percent, slightly fewer (217) metro areas had rates around the national average.

But in April 1998, when the U.S. unemployment rate was 4.3 percent, only 153 metro areas had rates within one percentage point of that figure. Many more (159) had rates well below the national average, and several more (76) had rates well above the national average.

Most strikingly, metro areas across the industrial Midwest—in Ohio, Indiana, Michigan, and Wisconsin—have unemployment rates today at least one percentage point lower than in April 2007. In the Milwaukee metro area, the unemployment rate stands at 3.2 percent today, versus 5.3 percent in April 2007. In the Battle Creek, Mich. metro area, it is 3.6 percent, down from 6.8 percent a decade ago. And in the Fort Wayne, Ind., metro area, the unemployment rate has fallen to 2.5 percent, well below its 4.5 percent level in April 2007.

Metro Areas 2007

Metro Areas 2017

Spotlight Illinois

- Illinois has 12 metro areas, none of which have unemployment rates below the national average.

- Illinois worsened between 1998 and 2007 and then again from 2007 to 2017.

- Neighboring states are all now better than Illinois

Illinois vs Neighboring States

With each passing decade, the unemployment situation in Illinois has gotten worse. Indiana and Michigan recovered from the rust belt blowout but Illinois didn’t.

This is not surprising. The state passed its first budget in three fiscal years, complete with massive tax hikes. The budget is required by Constitution to be balanced, but it isn’t.

An exodus of businesses and private citizens is underway. Reforms are desperately needed but none came with the passage of the budget.

Rauner 0-44

Governor Rauner is 0 for 44 in reforms he set out to accomplish. In fact, the corporate and personal tax hikes put the true score at -2 out of 44.

Cash-strapped cities suffer under prevailing wage laws and untenable pension promises.

Corporations suffer under the worst workers’ compensation laws in the nation.

Citizens suffer from the highest property taxes in the nation.

It is too late to save Illinois from insolvency. Rather than fix the problem, the new tax hikes will make matters worse.

Five Desperately Needed Reforms

- Municipal bankruptcy legislation

- Pension reform

- Right-to-Work legislation

- End of prevailing wage laws

- Workers’ compensation reform

Number one on my list of Illinois reforms is bankruptcy legislation. It is the only way out for numerous Illinois cities whose hands are tied by union-sponsored prevailing wage laws and pension plans.

Moody’s held off for now downgrading Illinois to junk status, but junk is baked into the cake sooner or later. The budget fixes nothing.

Mike “Mish” Shedlock