The BLS released its report on Job Openings and Labor Turnover (JOLTs) for September on November 5. The release is for the nonfarm sector.

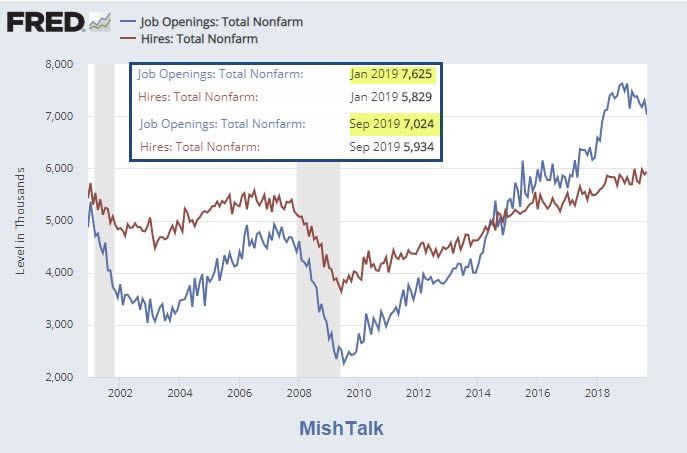

The above chart shows hires vs openings.

Three Key Points

- Since January, openings are down from 7.625 million to 7.024 million, a net of -601,000 total.

- Since January, openings are down 7.88%

- Since January, hires are up from 5.829 million to 5.934 million per month.

- Over the 12 months ending in September, hires totaled 69.9 million and separations totaled 67.4 million, yielding a net employment gain of 2.5 million.

Point number 4 is from the JOLTs report.

All Nonfarm Employees

Employment Level

BLS Benchmark Revisions

Wait a second. What about Benchmark Revisions?

“Preliminary benchmark revisions are calculated only for the month of March 2019 for the major industry sectors in table 1. The existing employment series are not updated with the release of the preliminary benchmark estimate. The data for all CES series will be updated when the final benchmark revision is issued.”

The final benchmark revision is not yet posted so 501,000 jobs are not reflected in the previous charts.

Nonetheless, this is clearly close enough for government work.

What Does This Mean?

The base numbers are off by 501,000 assuming the benchmark revision is accurate. The discrepancy between JOLTs and jobs is another 258,000.

Expect still more revisions, especially towards the top of economic cycles.

With more revisions coming, the question “What does this mean?” is best answered by this reply:

We cannot possibly know, because we don’t even know what the numbers really are.

I especially am wary of alleged job openings, confident that they are boosted by tactical methods to secure more h1b visas.

However, due to Soaring Unit Labor Costs and Declining Productivity, it makes sense for the number of opening to decline, even if we don’t know from what level.

Also note that the Decline in Profit Margins and Investment Suggests Recession Due Now.

This too supports a decline in openings.

If you have additional ideas, please comment.

Mike “Mish” Shedlock

And last night on ’60 Minutes’ Jamie Dimon was very bullish. It is all about the consumer – represents 70% of GDP and they are spending and that is good for the country. Interesting to look at consumer debt. Is it rising with all this spending?

The Inflation Gap: A new analysis indicates that rising prices have been quietly taxing low-income families more heavily than rich ones. link to theatlantic.com

A study was not needed to find this out. It is a result of the Cantillon effect – which, as the name implies, is known since the times of Cantillon (18th century). The topic has been discussed here and elsewhere for years, and the Atlantic only heard about it now?

The actual number of opening is probably lower since 2 to 4 recruiters post ads for the same position.

By the way the other reason openings are falling dramatically is nonrenewal if H1B visas by the government. Employers are giving up on.hiring H1Bs and more of them are getting deported every month. The government is making the visa holder prove they have special skills compared to the US citizen or green card holder and in many cases finding that a US citizen or greencsrd holder can do the job just as well if not better at the same pay. Corporations are no longer even attempting to hire h1b Visa holders as they get denied their h1 renewal and have 90 days to find a job or leave the country. I’ve seen two cases of this personally of interviewees where I work. Increasingly companies have approached citizens and green card holders and this is also driving up wages for the tech industry while productivity I’d essentially the same. The next crop of engineering grads who are US citizens will have no trouble finding jobs come 2020.

Agree with CO, two of my kids (finished their PhD two years ago) saw the writing on the wall…and left the US to return to Canada. Very happy to have them back, as there is a major labor shortage here. Funny enough they still consult for their old employer (on a part-time basis), but are slowly cutting down their hours as the demands from the Canadian labor market for their skills make them very busy — to the despair of their old employer that has, in one case, been unable to replace my daughter’s skills sets, she says that they’ve had to shut down one or two divisions because they could no longer provide the customer services.

As they say, c’est la vie!

Canada has been a big beneficiary as some US employers are allowing their h1 employees to transfer to Canadian offices.

There are never as many openings as advertised. A lot of double counting goes on. There is also no shortage of skilled labor. There are plenty of underemployed citizens with engineering and science degrees. In fact most of them are older and still underemployed and cant get hired because of their age. They told their children not to go into these fields cause jobs were being offshored and outsourced to cheaper workers with h1b and other visas who are less qualified but just cheaper. The labor market never recovered from the financial crisis as that was a fake bubble that employed a lot of engineering talent as quants. Traditionally these people would have worked in more productive fields but the risk reward ratio is much better on wall street. The talent shortage issue has always been a false narrative created by the very companies lobbying for h1b and other Visa programs for CHEAPER labor.

Comment of the day. This is exactly what is happening and the data itself can be found for each state. In MA, we have over 50K H-1B Visa Workers, and they’re not all tech workers. Those that are, due to the lottery system, are not all “skilled” either, they’re cheap. There’s a hell of a lot more to this to go into here, but you are spot on.

I’ve been hearing this for over 20 years and right now I can’t find any good programmers. All the resumes I see are from people who switch jobs every 6-12 months. Looking for more pay.

I used to manage a group in Bangalore for a fortune 500 company.. It was supposed to save money. It didn’t. Instead of our US developers writing code, they spent all their time fixing code written in Bangalore. The outsourcing movement was abandoned after a few years.

I agree with this. Interestingly, I think the US is doing a lousy job of educating good CS majors. Everything is getting watered down by web design and javascript. Why are they teaching java in college? Teach C with a little C++. Everything makes sense after that.

There is a severe shortage of skilled workers (both “college skills” like math and engineering, as well as technical skills like welding or machine work). If you have these skills, you can get several job offers anytime you want.

There is an abundance of unskilled labor (English majors, political science, gender studies, journalism, etc etc) — and the country already has as many Starbucks as it can handle.

Higher minimum wages mean these unskilled workers will get marginalized — forced to be part time in the short term, and replaced by automation (financed cheap thanks to the Fed!) in the medium term.

Since the BLS numbers just count the total, and pretend a barista pays the same as an experienced lathe worker, the BLS statistics are going to be very very misleading.

Thanks for mentioning ‘technical skills’ since sometimes I feel like im in lower social class than the unemployed liberal arts majors. If you g

as I was trying to say, if you get dirty at work, regardless of your pay and skills, you can even be looked down upon by a starbucks employee. No respect whatsoever. I try to nevermind but sometimes I really get agitated with the idiots im surrounded by.

Just cash your paycheck, build your savings, buy an apartment building and tell the “clean” humanities majors they had better get their rent in to you on time. You get the last laugh

You are drinking the kool-aid. Every Western aligned advanced country has a shortage of breadwinner jobs and a big chunk of the workers are stuck in gig economy. Yeah there is a small shortage of the highly skilled but it reflects in their pay being higher. I ask you, where is the wage inflation this skilled worker shortage should be causing?

The pipe fitters and welders that work at my company generally work about six months of the year (during down time) – but in those 6mo they make more than the national annual average.

The chief guy spends the other six months of the year at his second house in Florida; both his houses are paid in full. He does have mortgages on two apartment buildings that he also owns, and rents out. His wife is a bookkeeper (makes sure the rent gets collected), and he regularly picks the brains of people in banking and law to set up LLCs for his apartment investments. He drives an old truck which he maintains himself.

The junior guys work more like 8-9 months of the year, and work on their own properties or go hunting the other months. They are starting to ask questions about how to invest their savings too.

Any monkey can point a torch at some metal and ‘weld’ the pieces; even a gender studies major could probably do it. Doing it well is another matter. Making a strong weld that can withstand extreme stress takes skill and lots of experience. I imagine a humanities major could figure it out given enough time, but I haven’t seen it happen.

Math isn’t all that complicated, and theoretically every high school grad in the USA is supposed to have basic math skills…. in theory. But in practice they do not. And for whatever reason, adults don’t develop these skills. Maybe they can, but they don’t.

Ergo, people with technical skills or math skills are tough to find. There is a shortage, and its not like the college humanities can make the switch easily (or maybe not at all).

The english majors, and the absolutely pointless nonsense majors …. they all drive fancy new cars and fancy trucks and have car loans to prove it. They work 12 months a year and still struggle to pay the bills. And since colleges spew out thousands more of them every year, they have absolultely no pricing power.

Too many college grads have no employable skills. There is no shortage of “breadwinner” jobs, there is a shortage of college grads with breadwinner skills.

So shipping is down, PMI is down, hiring is down. It’s here, people. The expansion has ended and we’re headed to Slogville.

I just finished reading a ZH article about the use of non-GAAP metrics in accounting, which seems to be the new norm. Oh my, this is going to be an interesting year ahead of us, in a LOT of ways.

Chinese curse: May you live in interesting times.

(note sarcasm) The dirty, smelly, uneducated shale oil drillers (/sarc) are buying houses with cash. The super-educated UC Berkley graduates are financing $60K cars with negative equity for seven years…. You can’t make a valid observation about the US economy without noting this distinction.

The shale oil companies (as opposed to the workers) are in deep debt and will likely default in large part. Industries (including shale) that have lots of debt and struggle to pay interest only (no amortization of the principal) are in deep trouble.

Other industries are using debt because the Fed is giving away money cheap. Any analysis that doesn’t make this distinction is missing the big picture.

Non-GAAP accounting is very prevalent, especially in the IPO market (aka Silicon Valley). WeDontWork was not an anomaly.

Older industries tend to be extra leveraged — because artificial Fed rates make debt cheaper than equity. But they follow GAAP a lot more closely, and they tend to have the cashflow to service their debts. These industries are also using debt to automate a lot of jobs, because equipment financing is cheap and labor is expensive.

Big banks have relied on “cost savings” (aka mass layoffs) instead of new products and services. Local banks and credit unions have been capturing market share and deposits from slacker money center banks.

Its a very bifurcated system, and journalism majors don’t get it. They voted for Hilary, and tend to report what they wish happened more than what is happening.