by Mish

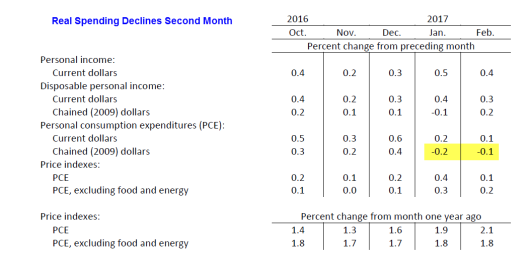

The weak rise in spending is fresh on the heels of a weak 0.2% rise in January.

Personal income increased $57.7 billion (0.4 percent) in February according to estimates released

today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $44.6 billion

(0.3 percent) and personal consumption expenditures (PCE) increased $7.4 billion (0.1 percent).

Real DPI increased 0.2 percent in February and Real PCE decreased 0.1 percent. The PCE price index

increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The increase in personal income in February primarily reflected increases in wages and salaries and

rental income of persons.

The decrease in real PCE in February primarily reflected a decrease in spending for services that was

partially offset by an increase in spending for nondurable goods.

Personal outlays increased $7.5 billion in February. Personal saving was $808.0 billion in

February and the personal saving rate, personal saving as a percentage of disposable personal income,

was 5.6 percent.

Real Spending Down Again

If the Fed expected consumers to spend more because consumers are confident or inflation is up, they were totally off base. For the second month consumer spending was negative.

This report is likely to take a bite out of first quarter GDP estimates.

Yesterday, I noted the Third Estimate of 4th Quarter GDP Increased Slightly to 2.1% thanks to increased consumer spending. It didn’t last.

Mike “Mish” Shedlock