The Philadelphia Fed Manufacturing Outlook Report shows business conditions are at 27.9, well above the Econoday consensus estimate of 20.2. The Econoday analysis caught my attention, emphasis mine.

The Philly Fed report continues to post very unusual levels of strength. October’s headline of 27.9 is nearly 8 points above Econoday’s consensus and more than 2 points above the high estimate. Employment, at 30.6, is a record in 48 years of this report’s data. The unusual strength of demand together perhaps with lingering hurricane effects on the supply chain are making for the longest delivery delays on record, at 21.6.

Other October readings are also unusually strong but less so than September: new orders 19.6 vs September’s 29.5, unfilled orders at 10.9 vs 17.0, shipments 24.4 vs 37.8, the 6-month outlook 46.4 vs 55.2. Philly’s sample is building up inventories while price data show a 7-month high for inputs costs, at 38.1, but a dip back in selling prices to a still very solid 14.2.

This report together with Empire State’s report on Monday are extensions of what have been unusually strong indications from regional reports, results that contrast sharply with much less strength in factory orders and outright contraction in manufacturing production. It’s important to remember that regional reports are based on small sizes where responses are always voluntary. Still the strength of the regional reports, if nothing else, is pointing squarely at improvement ahead, at least to some degree, for the nation’s factory sector.

Square Points

Given none of the recent regional manufacturing reports match actual manufacturing production numbers as compiled by the Fed itself, the report points squarely at nonsense.

Manufacturing Employment

Diffusion indexes measure the number of companies reporting an increase in employment vs the number reporting nor change or firings, so the above chart does not represent a valid representation of diffusion index problems. The next chart does a better job.

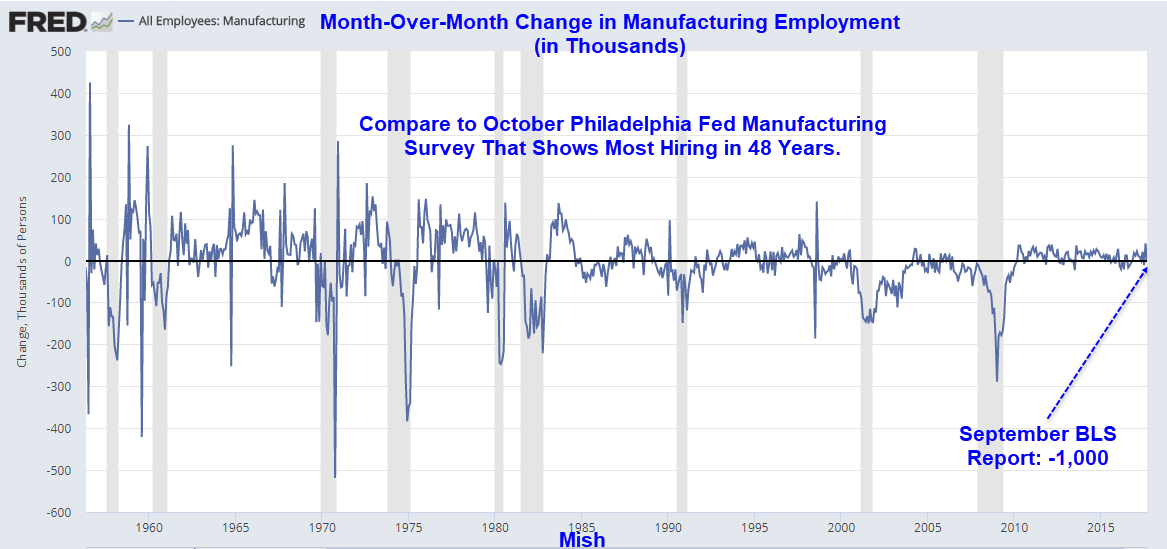

Change in Manufacturing Employment

The BLS reported a decline of 1,000 manufacturing jobs in September. We do not have the October numbers yet, but it is safe to say manufacturing will not show the strongest gain in 48 years.

What’s going on?

With diffusion indexes, a company hiring one employee counts as much as another firing 300 or even 3,000. Factor in a small sample size and the ability of companies to not waste time responding to surveys and the reports might look like (and do look like) complete nonsense.

This is an inherent weakness of diffusion indexes.

Economy So Strong

The economy is so “strong” that only a net 14.2 percent report being able to charge more for their products although a net 38.1% report having to pay more for their inputs.

Reality Check

Every month the Fed produces its own report on manufacturing output. The final reality check is a comparison to the regional surveys vs what the Fed reports as actual production. The numbers are galaxies apart.

For discussion, please see Manufacturing Production Unexpectedly Fizzles: No Hurricane Bounce

Trump Effect in Play?

Finally, I wonder if a Trump effect is in play.

Here’s my angle: Companies do not have to respond to these Fed manufacturing surveys. Companies outsourcing workers to China or Mexico may not want to respond and face the wrath of Trump Tweets!

Related Articles

- Housing Starts and Permits Dive Again, Mainstream Media Blames Hurricanes: What’s the Real Story?

- China’s Yield Curve Inverts: Will the US Follow?

Mike “Mish” Shedlock

Long time reader, you needed to change the format of this new website. The homepage just gives me a headache now.