President Trump now advocates intervening in the markets if he does not like the direction of the stock market. This is seriously crazy, but please consider Top Trump official calls bankers, will convene ‘Plunge Protection Team’

U.S. President Donald Trump’s Treasury secretary called top U.S. bankers on Sunday amid an ongoing rout on Wall Street and made plans to convene a group of officials known as the “Plunge Protection Team.”

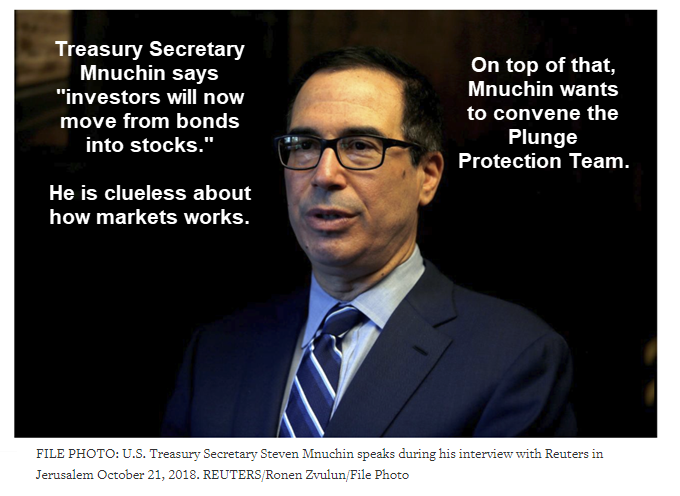

“Today I convened individual calls with the CEOs of the nation’s six largest banks,” Treasury Secretary Steven Mnuchin said on Twitter shortly before financial markets were due to open in Asia.

The Treasury said in a statement that Mnuchin talked with the chief executives of Bank of America (BAC.N), Citi (C.N), Goldman Sachs (GS.N), JP Morgan Chase (JPM.N), Morgan Stanley (MS.N) and Wells Fargo (WFC.N).

“The CEOs confirmed that they have ample liquidity available for lending,” the Treasury said.

The Treasury said Mnuchin will convene a call on Monday with the president’s Working Group on Financial Markets, which includes Washington’s main stewards of the U.S. financial system and is sometimes referred to as the “Plunge Protection Team.”

The group, which was also convened in 2009 during the latter stage of the financial crisis, includes officials from the Federal Reserve as well as the Securities and Exchange Commission.

Seriously Crazy

This administration is seriously crazy.

Might I point out there are already breakers if the market falls too far, too fast. Also note that Yapping No Longer Works.

Here’s the Bear Market Reality: Expect Much Worse.

The PPT isn’t going to stop the decline unless it buys the entire market.

Dear Secretary Mnuchin, I have a question, if the stock market is undervalued and investors will rotate from bonds to stocks as you stated, why do we need a PPT?

Of course, Treasury Secretary Mnuchin is Totally Clueless About How Markets Function. It is mathematically impossible for investors to rotate into stocks.

Wow. Such stupidity.

Mike “Mish” Shedlock

Better than a phone call would be if they met in a dark high-rise lounge with a low ceiling à la Atlas.

DC gettin desperate,Treasury will start buyin stocks directly if the PPT/other central banks doesn’t step up share purchases.Could we see the treasury as the largest shareholders in the FANGS in 2019????

“President Trump now advocates intervening in the markets if he does not like the direction of the stock market. This is seriously crazy…”

Let me know when “they” stop intervening in the markets. The so called PPT goes back to 1987.

Greenspan held rates artificially low to create a housing bubble (intervention) and Bernanke held them at ZIRP for years after it burst. Congress told FASB to allow banks to lie about the value of their assets, which jump started the 2009 bull market.

Then there is the Bullard manipulation of 2014, when during a stock market dump he said QE shouldn’t end, goosing it to a new all time high. Later he said he remarks were misunderstood- after Japan announced it was taking over QE.

Yellen was asked when she was going to raise rates, as QE ended and she responded soon. This upset the market, so the comment was walked back. Intervention of another kind, as is the wording of the FED announcement the market waits breathlessly for, after every FED meeting.

Do they realize that this amounts to a stock market fraud?

Heaven forbid that we should actually have something resembling true Price Discovery in these so-called “financial markets”.

I think this is spot on. It seems that Trump will do anything to get a short term win, no matter how small and at what long term expense.

Trump is no more crazy now than he was when he was running for office. I don’t understand why anyone would be surprised at anything he has done in office. Polished politicians sometimes paint one face while they campaign, and have a different one in office. Not so with Trump. It baffles me why anyone would have voted for him, but since they did, they have no standing to complain.

“Polished politicians sometimes paint one face while they campaign, and have a different one in office.”

Hillary tried to influence the election by hiding her speech to Goldman Sachs, in which she talked about having a public policy and a private policy, which Golman Sachs would have privy to.

“President Trump now advocates intervening in the markets if he does not like the direction of the stock market. This is seriously crazy…”

Let me know when “they” stop intervening in the markets. The so called PPT goes back to 1987.

Greenspan held rates artificially low to create a housing bubble (intervention) and Bernanke held them at ZIRP for years after it burst. Congress told FASB to allow banks to lie about the value of their assets, which jump started the 2009 bull market.

Then there is the Bullard manipulation of 2014, when during a stock market dump he said QE shouldn’t end, goosing it to a new all time high. Later he said he remarks were misunderstood- after Japan announced it was taking over QE.

Yellen was asked when she was going to raise rates, as QE ended and she responded soon. This upset the market, so the comment was walked back. Intervention of another kind, as is the wording of the FED announcement the market waits breathlessly for, after every FED meeting.

We need the Plunge Protection Team to keep the market from finding its true value after 24 months of irrational exuberance?

Also when you ain’t seen anything yet! We are not even in a bear market yet and these guys are making their pants wet! I cannot imagine their state if it gets going…

Well, leverage “was” their friend, wasn’t it? But somehow, this problem will get passed on to the sheep.

24 months of irrational exuberance????

You cant have it both ways with Trump. He is an abject failure on all fronts and may be a traitor. This is from a Trump voter who once hoped he would be the middle America needed to govern.

At this point dont be shocked if America functions more like the countries Trump once joked about when he said he wished America would try having leaders for life.

I think President Trump is calling the top US bank CEO’s / PPT before any of the first level market circuit breakers are activated in order to soothe the market with words instead of shots of liquidity. Trump has to know Wall Street will listen to itself more than the President. Since CEO’s all claim they have strong balance sheets and sufficient liquidity, Trump can say the CEO’s lied about their strength when the liquidity crisis DOES hit. The FED can then be dismantled for “just cause”, its members misleading the president about their financial health.

The question is how does the liquidity crisis transpire, inside or outside the US? A hard Brexit is a good candidate. Italy is having problems. China has manufacturing and real estate gluts, along with the debt to create them.

Ridiculous, truly ridiculous. Let’s start with the fact that Trump doesn’t seem to be able to hold even one idea in his brain at a time. You think he has any strategic capability whatsoever? Ridiculous. It’s amazing he dresses himself.

You contribute nothing but insults.

You can hate him (there’s a lot to dislike), but Trump beat every Republican challenger and then the Democrats who spent $1.2B. Perhaps underestimating his strategic capability is why his opponents consistently lose. Who’s dressing Hillary these days?

Will this be a liquidity crisis or a solvency crisis?

Can you imagine one or two top bankers’ saying anything other than what they did? For example would they say “Well…we’re not in tip top shape, you know, a a few bad investments, but we might be able to handle a moderate decline…”

The crisis starts as a liquidity issue and quickly morphs into a solvency issue.

I gave some more thought to Trump’s motive for assembling the PPT and publicly announcing so. The FED and Trump may want each other removed from office. Being able to place the blame on your enemy is politically convenient. By assembling the PPT, Trump can claim he did something to prevent a market crash, so any crash must have been due to the FED’s bad policies. I’m pretty sure banks that make up the FED would never admit a problem, so a material lie in public by those bank CEO’s gives Trump “cause” for dissolving the FED.

If Trump wants to ensure a crash, this is way to do it. Time somebody lit a fire to the tinder of overvalued stocks.

Besides taking and jawboning…

What can they really seriously do?

Mish, can you explain why is it mathematically impossible? If I’m not mistaken Martin Armstrong is calling for that same scenario with the sovereign debt crisis. Thanks.

Mathematically impossible because someone has to hold the bond and stock at any point in time.

Say A has a $100 bond, B has $100 stock and C has $100 cash. Let us say that is all the securities we have and there are only 3 players for ease of explanation.

Since we are discussing rotating from stocks to bond, we assume B sells $100 stock. Someone has to buy it. Let us say C buys it. Now assume B from buys $100 bond from A. So now we have A=$100 cash, B=$100 bond, C=$100 stock.

So while B has rotated from stock to bond, simultaneously C has rotated from cash to the stock and A has rotated from bond to cash. The sum of stock+cash+bond has remained unchanged. Only the players holding it have changed.

I think that is what Mish means..

What if A holds $100 (Tesla) bond, B holds $100 (Apple) stock, and C holds $100 cash. In a down market, A sells $100 bond to C for $30, B sells $100 stock for $70. You now have a ‘rotation’ from bond to stock because stock is a ‘better’ investment than bond.

A, B, and C can change their shares of the asset mix, but someone is holding each asset (and any resulting gains and losses from changes in value) at every point in time. A and B simply took the loss from the decline in value. After the decline, the value of the bond, stock, and cash is $200. Since someone held each asset at every point in time, someone took the loss as a result of the decline in value.

The important thing to understand is that individuals can rotate between assets, but in aggregate, someone is holding every asset at every point in time. That’s why the “market” can’t rotate from bonds to stocks.

I agree that this is probably what@Mish means. And @pi314 provides the alternative.

I feel for this jargon confusion. Personally, I find the financial jargon of “risk” (to mean volatility) to be deliberate fast-talk. And that’s even when I realize that, to a fund manager, volatility means “my customers leave me”. So. Yep. Volatility is risk.

BTW, Trump doesn’t speak “Standard American Politician” and a huge group of people just can’t deal with his different jargon. He just doesn’t say things how they want him to say things and, bang, it’s flame-on time.

Right.. put another way, for every buyer there is a seller.. net net, zero sum game

I understand that. In the case of Europe, the ECB is the ultimate buyer and they cant stop buying or else…