by Mish

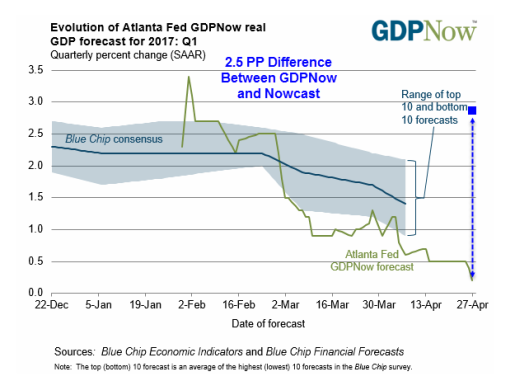

FRBNY Nowcast: 2.7 Percent — April 21, 2017

Model Flaws

- Nowcast uses no hard auto data: This is a serious error. Autos account for 20% of retail sales and fleet sales are also very important.

- Nowcast has an incorrect reliance on unemployment rate: People dropping out of the labor force and actual employment rising can both move the number in the same direction. Both things cannot mean the same thing.

- ISM vs PMI: Both reports measure the same thing, yet those reports signal very different things. At least one of them is wrong. GDPNow and Nowcast both rely on ISM even though the PMI reports have been more accurate, at least recently.

- The GDPNow and Nowcast models both suffer from an inability to think. The weather provides a nice example. In December, the weather was unusually cold, causing Industrial Production numbers to soar (heat and electric production), for the entire upcoming quarter. I estimated in advance, January would take away those numbers. My assertion played out, at least for GDPNow. I still cannot account for Nowcast.

ISM vs PMI

I discussed the difference between ISM and Markit’s PMI estimates recently, for both manufacturing and non-manufacturing (services).

- April 3: Markit PMI vs. ISM Fantasyland GDP Projection: Stagflation Lite?

- April 5: Another ISM/PMI Divergence: Non-Manufacturing

- April 21: ISM-PMI Divergence Widens: Markit Estimates 2nd Quarter GDP at 1.1%, Says Profit Squeeze Underway.

On April 3, the ISM made this statement: “The past relationship between the PMI® and the overall economy indicates that the average PMI® for January through March (57 percent) corresponds to a 4.3 percent increase in real gross domestic product on an annualized basis.”

On March 24, Chris Williamson, Markit Chief Business Economist, stated ”The survey readings are consistent with annualized GDP growth of 1.7% in the first quarter, down from 1.9% in the final quarter of last year.”

On April 5, Williamson reiterated “The surveys of manufacturing and services are running at levels consistent with GDP expanding by 1.7% in the first quarter.”

On April 21, Williamson stated “The PMI data suggest the US economy lost further momentum at the start of the second quarter. The surveys are signaling a GDP growth rate of 1.1% after 1.7% in the first quarter.”

For discussion, please see ISM-PMI Divergence Widens: Markit Estimates 2nd Quarter GDP at 1.1%, Says Profit Squeeze Underway.

ZeroHedge Estimate History

- On April 5, ZeroHedge replied to my email ““Call it 1.3%“.

- On April 25, ZeroHedge replied to my request for a number with “Ok sure, put me down for 0.8%.“

- On April 27, ZeroHedge updated his estimate to 0.4%

Mish Estimate History

- On April 3, on Coast-to-Coast, live syndicated talk radio, I told George Noory I expected GDP would be 0.6%.

- On April 14, I lowered my forecast to 0.4% following retail sales reports as noted in GDP Forecasts Dip Again

- On April 25, following the existing and new home sales reports I up my forecast to 0.7%.

- On April 27, following inventory and durable goods reports I lowered my forecast back down to 0.4%

GDPNow Partial History vs Mish

Final GDP Predictions

- GDPNow April 27: 0.2%

- Mish April 27: 0.4%

- ZeroHedge April 27: 0.4%

- Markit April 21: 1.7%

- FRBNY Nowcast April 21: 2.7%

- ISM April 3: 4.3%

What About Rate Hikes?

Whether this is yet another “transitory” period remains to be seen, but one of these downturns will stick.

Three hikes may not sound like much, but there is over a trillion dollars worth of debt that needs to roll over soon, at increasing rates, at a time when consumers are gasping and minimum wages hikes are in play.

The market expects another hike in June and still more hikes later in the year. I sure don’t.

If the Fed can convince the market it will hike, the Fed will hike in June. That may be a tough act if first-quarter GDP is under 1%.

Weather Impact on Estimates

For a look at how the weather impacted factory utilization and thus GDP estimates, please consider Formulas Don’t Think: Investigating Weather-Related GDP.

In that article, I commented on cold weather in December followed by warmer than usual weather in January.

For reasons I do not understand, GDPNow followed my model of unwinding the weather-related effects, but Nowcast didn’t.

Meanwhile, Don’t Worry Weakness is Transitory: Fed Expects a Second Quarter Rebound, Higher Equity Prices.

Final Comments

My range in April was 0.4% to 0.7%.

I did not have an initial number at the start of the quarter other than “I’ll take the under, way under” in response to initial estimates from GDPNow.

I expect I will be saying the same thing again.

The only things holding up the economy are housing and aircraft orders. I believe the latter has skewed many of the soft data regional Fed reports.

Hard data is starting to look ugly. Autos have rolled over, bank lending has rolled over, retail sales have been weak, and credit card defaults are up sharply.

The strong clue came on April 3, when most were going gaga over ISM numbers. April 14 was confirmation.

Addendum Note From Patrick Higgins

Hi Mish,

I can’t say too much until next Friday because of the FOMC blackout on communications. Nondefense aircraft and parts shipments from the Census manufacturing report are used to estimate nonresidential investment in aircraft in GDPNow. However, these data don’t get folded into GDPNow until after the full international trade report when exports and imports of civilian aircraft and parts are released. The indicator used by GDPNow is shipments less exports plus imports of nondefense aircraft and parts. Since the March international trade report data isn’t released until after the first GDP estimate, the aircraft shipments data from today’s durable manufacturing report doesn’t weigh into the GDPNow model forecast.

Best regards,

Pat

Patrick Higgins is the creator of GDPNow.

Mike “Mish” Shedlock