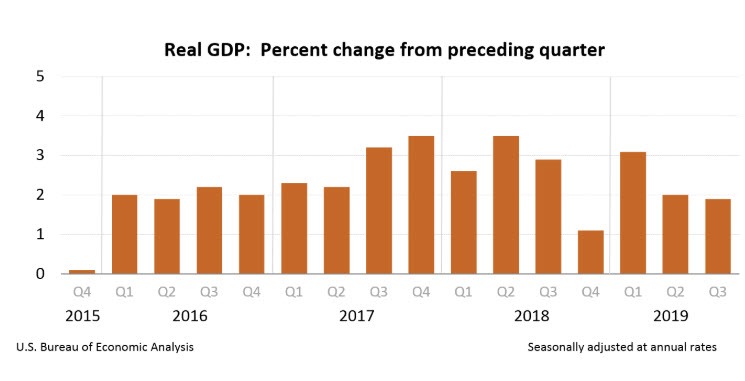

The BEA’s Third-Quarter 2019 (Advance Estimate) of GDP this morning came in at 1.9%.

The spin of Econonday vs Consumer Metrics is interesting.

Econoday Highlights

- The third quarter was solid but with one uneven edge, at an inflation adjusted 1.9 percent annual rate which is near the top end of Econoday’s consensus range and only 1 tenth below the second quarter’s 2.0 percent rate. The good news is that strength is squarely centered in the most important component, and that’s real consumer spending which rose at a 2.9 percent pace despite a very tough comparison with the second quarter’s unusually strong 4.6 percent showing. And within consumer spending, durable goods continue to post very sharp growth at a 7.6 percent rate versus 13.0 percent in the second quarter with both quarters showing especially strong results for recreational goods & vehicles. This speaks to discretionary strength at the consumer level.

- Residential investment is another important positive in the third quarter report, rising at a 5.1 percent rate and offering the first positive contribution to GDP since the fourth quarter of 2017. Government spending was also a plus for the third quarter, rising at a 2.0 percent rate which, however, is down from 4.8 percent in the second quarter. Federal nondefense spending led the quarter at a 5.2 percent rate with defense at 2.2 percent growth.

- The report’s big negative is a second straight quarter of contraction for nonresidential fixed investment, falling 3.0 percent after the prior quarter’s decline of 1.0 percent. Nonresidential structures showed special weakness with equipment also in contraction. The Federal Reserve, citing slowing global growth, has signaled special concern over the outlook for US manufacturing and specifically the outlook for related business investment. These results will add to the arguments for those on the FOMC who are pushing for a rate cut at today’s meeting.

- Net exports were a small negative in the quarter, pulling GDP down by 0.08 percentage points despite a turn higher for exports. Inventories pulled GDP down by 0.05 points for a second straight negative contribution.

- But it’s consumer spending and its contribution of 1.93 points that headlines third-quarter GDP, pointing to fundamental momentum for the economy and ultimately reflecting the strength of the US labor market.

Consumer Metrics Institute

The minor change in the headline masked a material weakening in the growth of consumer spending. The growth rate for aggregate consumer spending on goods and services was reported to be over 1% lower (-1.10 percentage point: pp ) than in the prior quarter. The growth of governmental spending (Federal, state and local) also weakened by about half of that amount. But largely offsetting those negative impacts on the headline number were soaring inventories and exports.

Annualized household disposable income was reported to be $253 higher than in the prior quarter, and the household savings rate was reported to be 8.1%, up 0.1 pp from the prior quarter.

Consumer Metrics Institute Highlights

- Consumer spending for goods was reported to be growing at a 1.14% rate, down -0.60pp from the prior quarter.

- The contribution to the headline from consumer spending on services was reported to be 0.79%, down -0.50pp from the prior quarter. The combined consumer contribution to the headline number was 1.93%, down -1.10pp from the prior quarter.

- The headline contribution for commercial/private fixed investments was reported to be -0.22%, up 0.03pp from the prior quarter.

- Inventories subtracted -0.05% from the headline number, up 0.86pp from the prior quarter. It is important to remember that the BEA’s inventory numbers are exceptionally noisy (and susceptible to significant distortions/anomalies caused by commodity pricing or currency swings) while ultimately representing a zero reverting (and long term essentially zero sum) series.

- The contribution to the headline from governmental spending was reported to be 0.35%, down -0.47pp from the prior quarter.

- The contribution from exports was reported to be 0.09%, up 0.78pp from the prior quarter.

- Imports subtracted -0.17% annualized ‘growth’ from the headline number, down -0.18pp from the prior quarter. Foreign trade contributed a net -0.08pp to the headline number.

- The annualized growth in the ‘real final sales of domestic product’ was reported to be 1.98%, down -0.94pp from the prior quarter. This is the BEA’s ‘bottom line’ measurement of the economy (and it excludes the inventory data).

- The real per-capita annualized disposable income was reported to have increased by $253 quarter to quarter. The annualized household savings rate was 8.1% (up 0.1pp from the prior quarter). In the 45 quarters since 2Q-2008 the cumulative annualized growth rate for real per-capita disposable income has been 1.50%.

Mish Take

There is something for everyone to cheer or knock. Take your pick.

My main beef is the Econoday notion that spending drives the economy. It doesn’t. Consumers going in debt to buy things they cannot afford is not a sign of strength.

For discussion please see Debunking the Myth “Consumer Spending is 67% of GDP”

Also see Tale of Two Economies: Industrial Production vs Retail Spending

The debate over consumer spending aside, Trump’s trade war took a toll on manufacturing. The GM strike did not help.

The overall result with the trade war and strike factored in might have been better than expected.

Mike “Mish” Shedlock

Borrowing (printing)$300 billion a month to drive 1-2 GDP, yet the official deficit is “only” a tril and change? At a burn rate of 300 billion per month,the deficit (real number)is closer to 3-4 tril which means lots of shady bookkeeping goin on!

Why does everyone keep saying we have low inflation? What fantasy world do you live in?

It’s the fantasyland of gov statistics.

Even employees of Google making well into six figures cannot afford to live in the sh!t hole that is San Francisco… there were several TV shows including 60 minutes that looked into “Googlers” who live in RVs on the streets outside of Google HQ, and shower in the company gym. Its all they can afford, making a “paltry” $300K per year in SF.

Lots of other cities are the same, albeit with smaller numbers / less ridiculous costs of living — but still unaffordable to many with good jobs. So more and more people are living in RVs full time — but it is out of necessity, they are not vacationing.

Otherwise, it was another solid “muddle through” quarter. Too much debt drowning the system for any serious growth to happen

“Even employees of Google making well into six figures cannot afford to live in the sh!t hole that is San Francisco… there were several TV shows including 60 minutes that looked into “Googlers” who live in RVs on the streets outside of Google HQ, and shower in the company gym. “

Sure, that is the typical lifestyle in SF. You keep reading stories in your bubble about SF, it obviously makes you feel good. Tearing SF down to “worse than where I (Bob) lives” really says much more about you, and where ever you live, than SF.

I live near SF. I’ll bet I’d never switch places with where you live because this place suits me. And nobody is asking you to move to SF, so WTF?

I used to visit your sh!t hole (SF) every other year, but the conference was shifted to a different location because of all the homeless people, needles and feces.

You are not welcome where I live. Please stay in the shit hole you voted for

Google HQ is in Palo Alto. Some dorks would rather live in an RV next to Google HQ than have to bike/walk/Uber to Cal-train. Because the life of a software developer in SF is sooooooooooooooo rough.

Mish’s blog is global, and many people know where San Fran sh!t hole is… many outside of California don’t know Palo Alto.

SF vs Palo Alto an important distinction for those who live in / around the sh!t hole — but its really missing the forest from the trees for everyone else.

Its not like either place is affordable. When software developers are making well into six figures but can’t afford to buy a house in SF or Palo Alto or San Jose or any part of silicone valley (boobs not chips!) , that is a big problem

Of course the developers have different problems than the homeless and the sick and so forth. that is the point — it doesn’t work for most people (for different reasons). Its all one giant 3rd world sh!t hole

“Trump’s trade war took a toll on manufacturing.” What? Which of the numbers reflected this?

“The contribution from exports was reported to be 0.09%, up 0.78pp from the prior quarter”.”Foreign trade contributed a net -0.08pp to the headline number.”

The Mish editorial comment is just stating something he believes without a basis.

I’m surprised that the report didn’t confirm the beginning of the Mish recession. It’s coming —- someday!

Federal Reserve monthly Industrial Production.

Manufacturing segment

July .. -0.4%

August … +0.6%

September … -0.5%

Wow! down then up then down and maybe Oct up. Certainly a tragic result. Do the Mish chicken little dance and cry recession.

Most Mfg. companies can’t find employees and this is limiting them.

Don’t put words in my mouth.

Rebutting your specific point on manufacturing.

If you wish to counter, please do … with facts.

Else don’t bother.

If everything is so good why the need to prop up Wall Street?

As long as the Central Banks continue to prop things will continue to plod along…

Correct me if wrong, but there is no mention of the often grossly understated “GDP deflator” anywhere. Pray tell, what fictitious number did they use this time to come up with 1.9% in real GDP growth?

“The good news is that strength is squarely centered in the most important component, and that’s real consumer spending which rose at a 2.9 percent pace despite a very tough comparison with the second quarter’s unusually strong 4.6 percent showing. And within consumer spending, durable goods continue to post very sharp growth at a 7.6 percent rate versus 13.0 percent in the second quarter with both quarters showing especially strong results for recreational goods & vehicles. This speaks to discretionary strength at the consumer level.”

…

or, more likely, speaks to the long end of the curve tanking in August (60 bps … which is huge). Did consumers pounce on refinancing and lower rates on durable goods? The long end has since given back much of the drop … will consumer strength prove sustainable? NYFRB in November will release its Q3 report on Household debt. Expect a sizable jump in debt.

Mortgage rates bottomed well before August. I believe late June. I know I refinanced because the rate was ridiculous. It was gone the next week and generally stayed 50 bps or more above my rate.

Nope.

I’d have to believe Boeing’s inability to ship a backlog of completed Max jets hurts too. I believe they are still making but cannot invoice just over 40 per month.

Grounded B 737 MAX collect some sort of insurance payment, so they are great for the economy. And in the current quarter, Californian wild fires to the rescue of economic growth.

I suspect insurance revenue is not considered production. I would also suspect suppliers are feeling the reduced production rate too.

Insurance payments are not production, but do add to the GDP, and suppliers come from all over the world, so not included in US data.

I was just reading a breakdown of the Personal Consumption in Q3-2019 and something doesn’t seem right. How on earth is spending on RV’s now topping the list for the 2nd. consecutive quarter of 2019? Well in my opinion, these numbers are fake, because it just defies all logic.

It certainly defies the numbers reported by the RV industry as far as I’m aware.

The ski is falling! Doom! Gloom! Lions and tigers….

Most of these growth metrics are faulty. Productivity growth has been 2% or under for 2 decades. That is likely the true growth rate.

Personally I would prefer some kind of economic/social system based on sustaining vs. this never ending growth bs and continuous destruction of the planet. No, im not an AOC fan but this is all just ridiculous.

Aside from debt, incompetence and arbitrary totalitarianism, there hasn’t been much, if any, real growth in the US for decades. Neither population, resource utilization nor anything of real economic significance, has grown much since the moon landing.

The growth has mainly all come from non western societies. Not that “the planet” cares, but as far as the US is concerned, your personal preference for stagnation, has been duly heeded.