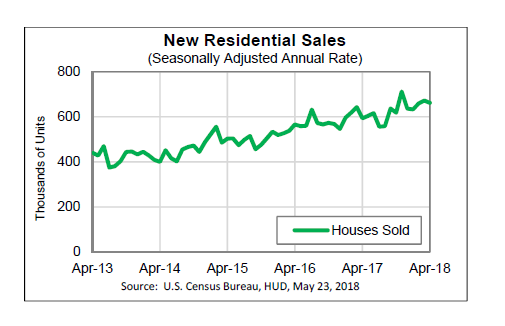

The Econoday consensus estimate for April new home sales was 677,000 at a seasonally adjusted annualized rate (SAAR).

The Census Department report on New Residential Construction shows a 1.5% pullback to 662,000. But March was revised from 694,000 all the way to 672,000.

The decline from March as originally reported was 4.6%. The perceived housing momentum flattened.

Mortgage News Daily trumped this up as New Home Sales Continue to Improve on Annual Basis. The statement is true but the comparison was also easy.

Easy Year-Over-Year Comparison

The March sales as originally reported were up 5.3% from February. As revised today, March sales were up 1.9% over February. April took 1.5 percentage points from March.

The perceived housing momentum just vanished.

Mike “Mish” Shedlock

link to npr.org

Show me the data that proves rising rates reduce housing prices, I don’t see it.

link to bankrate.com

It happens with a lag, but it generally does happen (keeping in mind that the effect may not appear in every region or in every region to the same extent).

Do you have data that confirms your statement? While it appears to be intuitive that when rates go up prices would decline, I don’t believe the data backs it up.

Probably because of higher interest rates. Which will lead to lower prices in a few months. It takes a while for sellers to realize they have to lower their asking price.