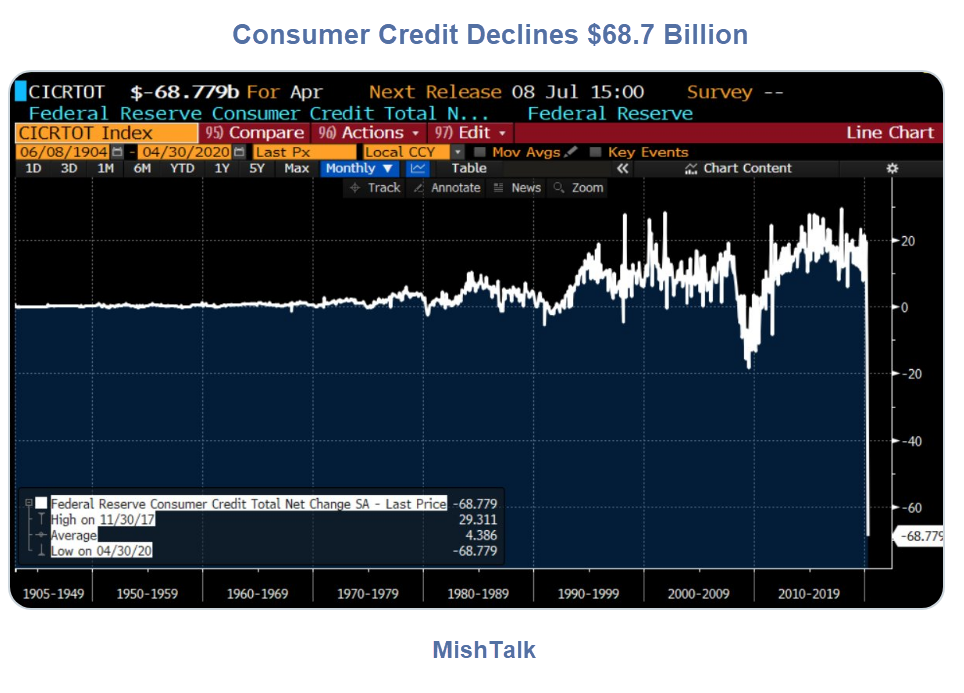

The number comes from the Fed’s Consumer Credit Report released today.

Consumer Credit April 2020

The above shot is from the credit report. I added the yellow highlights.

The lead chart is from this Tweet.

Here it is back to 1904. Appears the great American consumer would rather pay down their credit than go out and buy needless widgets. Mnuchin and Powell will need a new plan to force spending rather than debt paydowns. pic.twitter.com/3FPQKyT5Op

— Randy Woodward (@TheBondFreak) June 5, 2020

That is from Bloomberg, but I cannot match it in Fred. This is what Fred depicts.

Change in Total Consumer Credit Owned

Using numbers from the Fed Table: 4,202.0 – 4,133.7 = 68.7

Other than the obvious spikes, the charts are the same. I believe the spikes are related to reclassification of student debt and other changes in reporting of Student Loans.

Change in Total Consumer Revolving Credit

The change in revolving credit is -58.32 billion. That also matches the Fed report which has it at 1,078.1 – 1,019.8 = 58.3 Billion.

Total Revolving Credit

The above chart provides a needed perspective on the Fed report which shows revolving credit fell an annualized 64.9%.

Clearly, consumers have a lot more rebalancing to do. Equally clearly, the Fed wants to prevent just that.

$68.7 billion is an unprecedented decline, but what’s coming (or doesn’t) is more important.

Mish

3rd crisis in two decades.

My guess is consumer sentiment is shifting, pay down debt and save as much as possible.

Consumer credit was down 68.7b in April, following a drop or 11.5b in March. Ever since Covid hit, it’s been dropping like a rock. It would have been worse except for a big non-revolving credit jump in February and March.

Even more telling is what happened to revolving credit, i.e. credit cards. Revolving credit dropped 26.2b in March and 58.3b in March. In 2018 revolving credit rose 36.8b, in 2019 it rose 39.6b, and then in Jan/Feb it rose another 5.4b. So, from January 2018 until the end of February 2020 it rose a total of 81.8b, and then in March and April it dropped a combined 84.5b. Thus, revolving credit is now at a level last seen in 2017.

I think it’s a combination of two things. First, people are unsure of their future, making them reluctant to spend, and eager to stop paying 7-18% interest. Second, they were locked down, and had no easy way to spend, so they applied all that to pay off credit cards. I expect another drop, but smaller, in May. After that, who knows. In 2008 they continued to pay off debt until 2011, and it was about 2014 before they really let spending get out of hand again.

My guess would be that after a few months of living off credit cards, waiting for UI many lower income people have bumped up against their credit limits and now are unable to purchase. Many banks have also been reducing credit limits for customers they feel are at higher risk to default.

Exactly. You just nailed the bullseye. And don’t forget credit requirements to get a home mortgage have tightened considerably over the past few months. Lot’s of folks can no longer qualify for a new mortgage for obvious reasons. This may not be reflected in the official government charts but give it a month or two and it will be.

As long as the decrease in credit comes from sub-prime borrowers having their cards taken away by the banks, then declining credit is a good thing for the economy in general. Credit distorts the true demand as I define as people who want something now and have the cash to pay for it.

There was an article earlier this year (pre covid) on issuers raising card limits (without recipients asking / approval) … as issuers found that borrowers typically used 70% of limit … whatever the limit. I guess that has ended + some limits lowered.

An observation.

I have very good credit. And it has been months (last year?) since I received a credit card offer. Not as many offers as I got prior to GFC, but until current drought an offer (or two) a month.

Good point. There have been none in my mailbox, and usually I get a couple a month.

Mish, I always said that I do not trust Chinese financial data on any level, they are not using the same accounting procedures (certainly not FASB and even that venerable institution of truth and trust is as corrupt as any other now since mark to make believe has been allowed ever since the GFC) so I take this and any other economic/financial reports and graphs with a grain of salt. Our reporting system is extremely dependent upon periodicity and we are just too close to the sudden cardiac arrest in the economy called Covid to make any useful judgements yet. But, beside that I just no longer trust our reporting any more than the Chinese because of their treatment of inflation and prices. As a retiree on a fixed income I know damned good and well what prices are, I track them closely, yet year in and decade out they under report prices to the point where the emperor has not a stitch on.

I also want to know why my own credit score has dropped 25 points in three months, and most of that since I closed on my house in early April. I just made payment number one, 359 to go, with no forbearance and no late fees, no massive precarious new debt, home ownership used to bump your score up into the realm of serious adult who minds his credit, but that appears to have changed without explanation. I am not laid off, and cannot be in future, my income can’t drop in nominal terms.

I think the supercomputer AI’s have decided that house prices are going to seriously drop over the next couple years and that is being reflected in credit scoring to limit lender exposure to debt the consumer can’t service once things really go organically south after the Covid trigger was pulled, the way sub prime triggered but was not the cause of the GFC. Call it a preemptive downgrade of all credit scores reflecting the wisdom of AI that we all will be less worthy to borrow soon. The one good thing is that it will not impair my ability to do an IRRRL to lower the interest rate on my mortgage come December.

Here by the way is a chart of incomes and how Covid has affected government share of that income, courtesy of the Daily Shot Editor:

Please note that wages (earned income) now make up well under half of all income. Also note that earlier in the week we were treated to a Fed report (or was it BLS?) that claimed a more than 10% jump in incomes. So which is it? There is conflicting data everywhere now so no reason to trust any of it.

And at the current rate any day now the government transfer will equal wages as a source of income. Yet even at that people are struggling at best and massively failing at worst. This puts us on a precipice that we all knew was coming, how it resolves is not really a question anymore since we know TPTB are simply not going to change the current Fed and Federal transfers to Wall Street and the 1%. Yes, they may transfer more to the lower 90%, but our SHARE of transfers will still drop in relation to the wealthy and income inequality will continue to get worse. So much so that the rioting will one day stop being about racial inequality and start being about income inequality, and if you ask me that is already what is at the heart of the troubles, because race is a huge indicator of earning power. In fact the poorer you are the more the police are going to try to contain your anger, and that is why race “APPEARS” to be at the heart of police brutality. Soon enough it will be recognized that it is not really about race but about economic disadvantage and we will 90% of us be in that same foundering desperate boat. Yet they still will not change anything fundmentally, the wealthy own the government and are going to act to protect their portfolio even if it means a world war where we are all just cannon fodder. That has been the go to solution in the past, though who knows, it was just demonstrated that biowarfare (Covid) is like the neutron bomb, kills population while leaving the assets in tact. Now they just need a far more deadly pandemic.

Very well said, Herkie.

Hi Herkie, Thanks for a very thoughtful post. I know the Fed is, once again, buying up toxic securities, but are they directly transferring money into the 1%’s bank accounts? I look at building a healthy 401k and owning assets including RE as the only way one can gain a decent retirement. Yellen herself urged people to get into assets before she acted to support their prices. Do you know that there are people in the upper 10% wealth segment that got there through hard work, sacrifice, frugality and yes, good luck. Why is it a bad thing to restore the wealth of all asset holders to where it was before the Chinese virus pandemic?

Buying the toxic assets means corporation (corporate shareholders) do not have to write those losses off. Since the top 10% of the population own 84% plus of all assets who does this socialization of losses and privatization of the profits help? It is not your friendly neighborhood disabled vet struggling to get by on a $36k per year veteran disability that is for damned sure. And just since the begining of February the balance sheet of the Fed has risen by trillions on top of much MUCH more that is off balance sheet, who did they give that liquidity to? Hint, the direct stimulus payments to the people cost about $300 billion, out of a federal stimulus that was over three trillion, and that is just one stimulus bill by the government that has nothing to do with the trillions the Fed has disbursed. Once again Main Street is being sterilized from the newly minted wealth, even though they are going to be the ones that pay for all of it via taxes and stealth taxes called inflation.

How is a 401k invested in NEGATIVE REAL RATE instruments going to build your wealth? When real estate goes down is that going to make you better off? How are “people” supposed to get into assets when 61% of the population cannot come up with $500 in an emergency?

The number of people in the top 10% does have some few who got there through social mobility, hard work, brains and LUCK! Like my brother who got an accounting degree and lucked out to land a job as assistant comptroller/auditor of a California county where the job of auditor controller is an elected position and the guy he worked for wanted to retire and groomed him to be successor; the job paid $137.500 plus generous benefits that brought total compensation to about $165k. Believe it or not that put him in the top 10%, but, the top 10% now owns more than 84% of all assets. People cannot buy into assets to take advantage of the Fed’s largess if 297 million of us only own less than 16% of all assets, and nearly all the assets we do “own” are extremely illiquid and (as demonstrated in the GFC) vulnerable equity tied up in our homes.

MOST of the wealth of the top 10% is owned by the top 1%, meaning at least half of all assets are owned by just 3.3 million Americans. And the top 5 richest people on Earth own more assets than the entire bottom half of the world’s population. You are never going to work the numbers to a state where it is credible that any one of us can leave poverty/low income and join the rich or even merely affluent. The odds are only very slightly better than winning the lottery. And at least the lotto has a far better risk return ratio if you do pick the right 6 numbers.

My brother by the way worked in his position for 7 years and resigned under a cloud as his office had some back biting person (s) though thought a white male should not be in charge of anything no less the county’s money. No matter, he earned enough in 7 years to retire in comfort for the remainder of his life.

My equity holdings have just about recovered to where they were before the Wuhan virus pandemic. I am not in possession of data on the number of folks in the top 10% who got there through hard work, perseverance, frugality and luck. I can only offer anecdotes.

My best friend from childhood was from a pretty poor but hard working family. His father did not have a high school education, and worked at the same factory job his entire life. My friend did attend college, and achieved top grades, graduating summa cum laude, and being elected to phi beta kappa. As he puts it, he had nothing to fall back on, and worked hard, motivated by fear and an idealistic belief that hard work would pay off. And yet he was denied admission to medical schools that less qualified peers were admitted to because of affirmative action. This caused him to become very discouraged, and he ceased his educational quest, and became a Grateful Dead head, began doing drugs, which caused concern amongst his friends, and worked low level jobs for a significant many years post college. He was also saddled with student loan debt, and unable to save money. Based upon his academic achievement, he was admitted to a decent MBA program eight years after he graduated from college, in an effort to change his life. It was either that or the military, as he put it. He is now in the upper 3% wealth percentile in the USA.

So here is a fellow who was from a disadvantaged background, with relatively uneducated parents, whose upward mobility was thwarted by his own government, who is now doing quite well. He continues to live frugally, drives a very old car, and continues to work hard. He believes that good health is your biggest asset, and then family and friends. He owns a very nice home flat out, and has zero debt. It is likely his heirs will be the beneficiaries of his wealth.

So there you go. Nothing is guaranteed. Play the victim and be a victim.

It is not about being a victim, you cite one success story out of a third of a billion people, and for every one of him there are 25 that never get to that top 10%. I have an IQ of 144, a hard work ethic, had a real job and car in high school, did 4 years in the Air Force to get GI Bill, went to college in the evenings (16 semester hours per semester) while working 40 hours per week for YEARS! Got my finance degree and a registered rep license from the SEC back when they were still the issuers. The most I have ever made in any given year is $45k. On the other hand a guy I went to school with did pretty much the same thing but worked fewer hours, made it into the top 10% but then again he married his boss’s granddaughter. Made partner real fast. While my best accounts in my book were taken away and handed to the top performers even though I recruited the “investors” so I never made it to the 1 and 1/2 percent commission level. I walked away from that job and became a financial analyst. Followed by years of frustration at not getting promoted, only to have my boss tell me he HAD TO HIRE ME because I was a disabled vet but he never had to promote me. And found out from a couple people at work that he hated gay men and was angry and felt tricked when he figured out I was gay. So don’t fucking sit at your keyboard and tell me our economic prospects are all down to our merit. That is just bullshit!

Herkie, I hope you are finally feeling better, and kicked that illness that had you down. If not, you might research myalgic encephalomyelitis/chronic fatigue syndrome (ME/CFS) as it relates to Covid19, which is something that can cause linger long after a viral infection is gone, and you might find some others of whom you can ask questions who have gone through the same thing.

68.7B seems low. I would have expected it to be hundreds of billions.

Read several articles on people scared of using cash (virus potentially on money) and prefer touchless (or close as possible) form of payment.

Positive economic news, no matter how false, combined with mass protests equals no more federal payouts to individuals.

“Why the Shockingly Good Jobs Report Might Be Bad News” link to nymag.com

Credit lines tightened, loans are being paid off, credit (M2) is being destroyed.

I mean capital is being destroyed..

Consumers are being super smart. The government sends them money and they use it to pay down their debts. They know this Covid thing will be an ongoing thing.

It does mean that future stimulus will have to be something that will force consumers to use it, perhaps a prepaid debit card with an expiry date.

Maybe rent got paid.

When facing an uncertain future, It’s not “super smart” to spend your money on anything. Including handing it to banksters to “pay down debt.”

Bury cash, or buy Gold and bury that. You may face years of no, or very little, income. Every dollar stashed away is golden, under such circumstances. While your credit lines will be reduced or withdrawn, regardless of whether you were a good lapdog and made one last Hail Mary payment with the last free cash you could get your hands on, or not.

Ask anyone who lived through the Argentinian Corralito (which is where the US is headed.) Times of uncertainty and distress, is when the dictum that “possession is 90% of the law” is at its most relevant.

And for those not familiar with the Argentinian Corralito, here’s a good read to bone up on what Stuki, I, and others believe will occur in the U.S.:

They’ll use the expiring money to pay for necessities and save their cash for something else.

i would use my expiring debit card to buy platinum eagles at the local gold and silver store

sideways or down?

m/s= from a macro perspective… It Appears the global tea party has come out to play in earnest and that sleeping giant is piseed off as all hell

That “V” recovery “seed money” appears to have gone sideways….