Stories have been circulating about Vermont testing blockchain for recording real estate transactions.

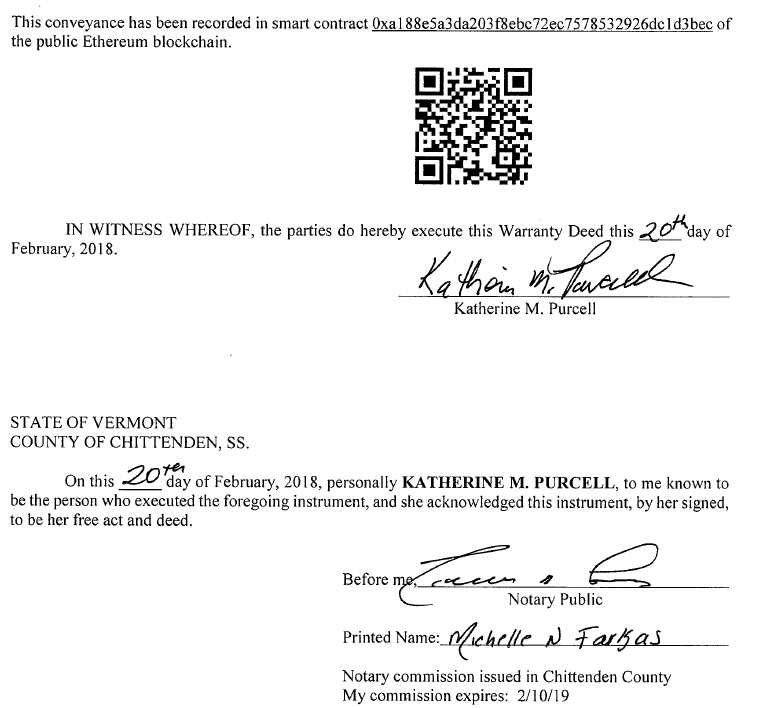

A contact at Propy informs me that the city of South Burlington, Vermont, just became a global blockchain leader by locking in the first US real estate deed completely on blockchain.

In October of 2017, Business Insider reported Propy Announces World’s First Real Estate Purchase on Ethereum Blockchain.

Natalia Karayaneva, CEO of Propy said, “This is only the beginning. With this transaction, we’ve broken first ground in putting the $217 trillion real estate market on the blockchain. We’re starting with Ukraine, but over the coming year we plan to facilitate real estate transactions with the use of PRO tokens in California, Vermont, and Dubai.”

Business Insider posted this disclaimer “Propy is the source of this content.”

I make the same disclaimer.

My contact says “This first deal makes it much easier for the rest of the 49 states to iterate the process. In fact, Arizona and Colorado are next.”

I have some questions and will post an addendum when I have answers.

Implications

First, this is not unexpected. I have many times commented that blockchain is perfect for real estate transactions. Real estate is low-volume, high-value. Buying candy bars on blockchain is not practical. Blockchain does not scale.

Second. This does not change my attitude towards cryptos. At some point everything will be crypto, but it will be government-sponsored and it will not be Bitcoin nor Ethereum.

Finally, and most importantly, entire chains of business will vanish.

Think of the business of title insurance. Poof!

Mike “Mish” Shedlock

To use automobile ownership by analogy, blockchain should do for home ownership what carfax does for automobile history. History is the key word in a title search. And for mortgages which are repackaged (who owns them) there should be a good answer for that as well, simply because the computer program will not take NO for an answer.

Come to think of it, you might have to treat your exes a little better going forwards into the future as well. Especially the ones that are notably proficient in using the internet.

Let us assume that only 1% of the population is vindictive enough to have a dodgy local developer murdered for misselling them property, would that second-order of justice not be enough to render title-deed insurance redundant?

Let me tell you, I wouldn’t screw over a client with a bad title plan if I knew I could be massacred in a drive by shooting whilst walking home from Costa Coffee the following week. If I heard that this sort of thing was going on to people like me, I’d play the game very straight indeed, from then on. Just saying.

For every pious Stephen out there who accidentally hired a clumsy assassin on the internet, we might presume a plethora of Stephens who got away with soliciting murder scot-free.

link to washingtonpost.com

link to deepdotweb.com

The internet is bringing us back to the medieval period where if you want to purchase enforcement you have the choice of suing either through the king’s courts via the local magistrate and the sheriffs OR you can sue through the lord of the manor and the (virtual) courts of local aristocratic powers (i.e. murderous drug dealers).

@Carl_R @MntGoat @Mish

In all honesty, who would you trust more to follow through on their outward promises, your insurance provider or your local murderous drug dealer? I’d side with the latter.

The day is fast approaching where anonymous purchases of ANY service online will be absolutely unstoppable by the authorities. It will be a combination of anonymizing technologies currently being pioneered: OpenBazaar, I2P and Monero.

I agree – business may not vanish totally as I said, but costs will be cheaper – This is not going to happen overnight

FWIW, Bitcoin is crashing again. After hitting about 19,000, it fell to under 7,000, then rallied back to about 11,500, but in the last few days it has fallen again to 8600, a drop of about 27% this week.

Of course health care is the same. As were know consumers get absolutely gouged as the status quo is protected from change by $$$$ lobbyists.

Title insurance is one of those industries that is mostly a scam. Protected by lobbyists in DC. Consumers get gouged over-paying for title insurance that has a very, very low claims rate. Cash cow business. You do need title insurance in case there is a title issue, but it should cost far less. Real estate agents also are a rip off only protected by their power lobby in DC. Home buyers still get completely raped on fees at the closing table by lenders, Realtors and title companies. And it is all protected by powerful very well funded lobbyists. Real estate purchasing should have been totally disrupted by the Internet by now…..like travel agents were and retail stores were.

BTW ZH does not talk up Bitcoin. He posts articles form others who do. Big difference.

We need someone in each county to record and verify and do searches etc. You answered your own question.

Your comment is like talking up CNN and other fake news cites because the Internet is useful. What is Zerohedge’s motive for pumping Bitcoin? What is the motive for businesses that will be displaced by cryptos to bash it?

Google “public companies blockchain”. Google is one of the biggest investors.

How does using a non-distributed block chain in any way improve upon using a standard relational database to record property sales? In Florida, each county has a clerk of the courts who is responsible for safely maintaining property ownership records and the corresponding sale and contract information. How does using a block chain database improve on that process?

the title/mortgage/lien, is still in dollars, I assume. Since all contracts, bonds etc are in dollars, that is what props up our currency. The real news, is when contracts are negotiated in gold or cryptos/alternative currency…that is when the SHTF

There are moments in history when technology changes the face of land ownership, such as Britain in the middle ages, when the courts started recognizing land documents, and most small land owners had inherited the land or it was passed them word of mouth or a handshake. The Church understood writing, and documents and quietly went about taking land from the illiterate and poor. The courts were complicit of course just as they were after 2008, when title could not be proven, foreclosures were still done. The only advantage to the home owner in rare instances, is that they were absolved of their obligation, or to wit, stripped of ownership.

I disagree, the thing about any communication technology is the adage, “garbage in, garbage out”. Since none of properties being transferred were ever certified by blockchain, that process will take time and effort. I had some issues I had to resolve with the assessor, and the map agent told me half the titles in my country are wrong. They go on INTENT. And there are fundamental issues between planning departments and home owners which are ignored for the sake of expediency. The blockchain system is going to reject most RE transactions unless of course the sloppy nature of title transfer is programmed into the blockchain, and that ain’t going to happen.

Zerohedge keeps talking up Bitcoin like a car salesman. It’s like talking up the Edsel because gasoline is useful.

Are there any public companies that capitalize on providing the technology or capitalize on using blockchain

One topic I’ve never seen discussed is how a blockchain ages, in particular with smart contracts. Real Estate lasts forever. As the smart contracts evolve, for instance when specific plat information is added to avoid duplicate titles, how does the encrypted, unmutable transaction the person in the story entered into get modified with the new information? How do you fix a mistake in a smart contract? The docs for our current house had the correct property location but gave a mailing address that transposed the house number. That got propagated to the property tax department who mailed reminders to that location until we became responsible for paying the taxes and I got the mailing address corrected. For a time there will continue to be a paper trail of RE docs and the processes for recording documents on paper will continue, like other IT projects(think accounts receivable, accounts payable,) eventually that will be abandoned or at least forgotten by those involved in RE transaction (eventually maybe nobody but the two parties.) I hope the system is well engineered with geographic dispersion. Even if the primary system is destroyed in a hurricane or nuclear exchange, property ownership records need to be maintained for hundreds if not thousands of years.

Haha. Actually, in my case, the title insurance worked. I was able to buy the land a second time, and all my costs were covered, so I was made whole. On the other hand, I don’t know of anyone else who ever collected anything off of a title insurance policy, so the cost of them is remarkably high. Rather than saying Title Insurance will vanish as a result of this, I would rather guess it will remain, but the price will drop substantially.

Has Mish written anything about this? – link to congress.gov

I don’t see anything on this site about it.

I would have thought New Hampshire would be ahead of Vermont in the move to leverage the efficiencies of cryptos. Although, the move by socialist safe-state’s like IL toward bitcoin for tax payments shows financial desperation is also a driver for crypto adoption.

link to coindesk.com

The leading states in the race to become “crypto valley” are WY and AZ, but the obvious benefits of security and efficiencies will force not only states, but businesses into the crypto world. Below are just a few more examples of how the blockchain will be utilized:

link to cointelegraph.com

link to coindesk.com

link to coindesk.com

Mish, it’s encouraging to see you’ve softened your position on cryptos. In the past you would have argued that these states, and companies like Porsche, GE, FedEx, and many others are wasting their time and money on blockchain-based technologies. However, your belief that they must be “govt sponsored” demonstrates you still don’t understand the decentralization driver behind cryptos. Although, I’m not sure what is implied by “govt sponsored”. If it’s a rubber stamp registration fee to make sure govt gets its cut without adding value, then I can see the crypto world tossing them some lobbying bread crumbs to maintain their facade of importance. However, if you think cryptos need govt to move forward, then you don’t understand the declining trend of govt trust and confidence, which is a giant snowball that has not yet reached the cliff. Govt, by its very nature, is always light years behind the learning curve, and when confidence hits the rocks below, they will come begging to be included, or risk a revolution.

Your CYA disclaimer about “it” (crypto) not being Bitcoin or Ethereum is meaningless. No one has been saying that Bitcoin or Ethereum would be the only cryptos. Your statement is like saying credit cards will not advance because the Diners Club Card won’t be “the card”. Bitcoin and Ethereum – along with Litecoin, Monero, and the other initial coins are driving the competition for improved solutions.

Title insurance should be one of the first victims of blockchain technology. I would say good riddance! Here in Texas I refer to it as promulgated price gouging. It’s one of the biggest scams going, and one of the most expensive costs for home sellers after agent commissions. Texas has one of the highest costs for title insurance in the country, and not surprisingly homeowners get virtually nothing of value for the cost. Just ask yourself when was the last time you filed a claim on your title insurance? This is one of the reasons why title companies market their services to Realtors rather than end user homeowners. A huge portion of the premiums paid for title insurance here in Texas (rate for premiums set by the state) goes to administrative overhead, not claims. The cost of the premiums in many cases has NOTHING to due with the risk of the policy, and you get screwed even more when you refinance because you get to pay even more premiums/cost for essentially no added risk. It’s enough to make your head spin, but the insurance industry and lobbyists have kept it alive because it’s profitable. Iowa figured out the scam and went to a much cheaper system years ago. link to iowafinanceauthority.gov

@Carl_R “How does blockchain protect against this?” You can anonymously pay your neighbourhood city gangster over the internet to have the developers swiftly killed in a drive by shooting.

…not sure if that fixes the situation in this case per se but it sets a precedent that changes something or other doesn’t it?

I’m surprised this has only just happened in the US. I was aware of this happening in the UK last year.

link to homesgofast.com

I agree mish the Government backed blockchains will outperform decentralised blockchains over the medium term. However we both know that over the next coming decade people’s faith in governments will be severely diminished. The question I ask myself is which governments?

Going forwards far into the future I expect more and more fragmenting of nation states. Blockchain is another technology that will aid the divorce of Texas and California from the States, Scotland from the UK, Catalonia from Spain, and God only knows how this will undermine nations with weaker governments.

I came by these views by reading “The End of Power” by Moises Naím.

I am one of the few people who actually collected on title insurance. I bought a partial lot, and the developer forgot to re-plat, and a couple years later, I came home to find someone had marked off an area where he planned to dig his foundation … in my side yard…and had a title allowing him to do so. I had to buy the land a second time (the original developer had gone bankrupt). How does blockchain protect against this? I suspect title insurance still has a role.