Import and Export Prices Rebound Sharply

The BLS Import and Export Price Report shows import and prices continue to rebound sharply.

Import Price Synopsis

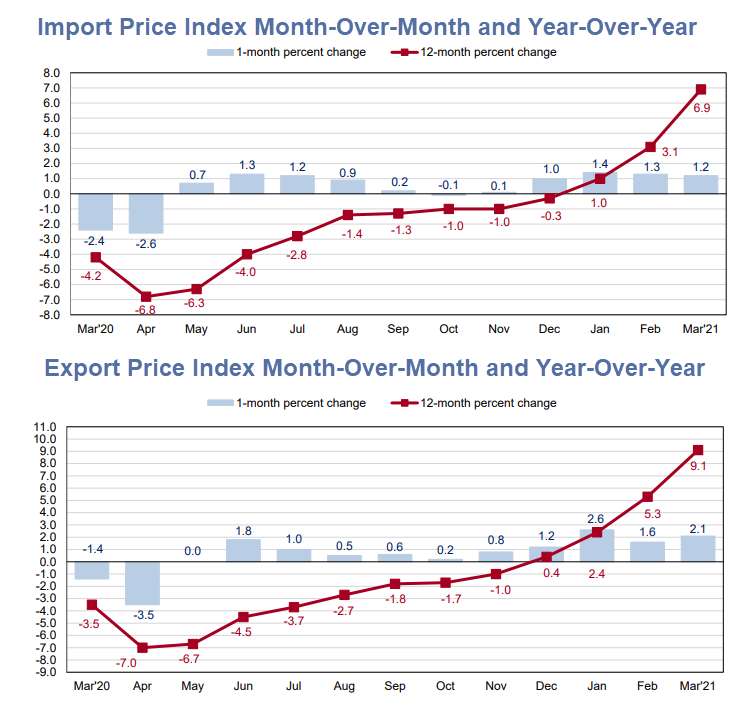

- U.S. import prices advanced 1.2 percent in March, 1.3 percent in February, and 1.4 percent in January.

- The 4.1-percent increase from December to March was the largest 3-month rise for import prices since the index advanced 5.8 percent in May 2011.

- The price index for U.S. imports increased 6.9 percent from March 2020 to March 2021, the largest over-the-year advance in the index since a 6.9-percent rise for the year ended January 2012.

Import Price Details

- Fuel Imports: Import fuel prices rose 6.3 percent in March, after increases of 11.7 percent in February, 8.4 percent in January, and 7.3 percent in December.

- The increases over the past 4 months were mostly driven by higher petroleum prices. Prices for import petroleum advanced 6.7 percent in March following a 32.3-percent rise from November to February.

- The price index for natural gas also increased in March, advancing 3.6 percent following an 18.0-percent increase the previous month. Import fuel prices rose 54.3 percent for the year ended in March, the largest 12-month advance for the index since a 68.9-percent increase in February 2017.

- The price indexes for petroleum and natural gas also rose on a 12-month basis in March, increasing 53.9 percent and 91.0 percent, respectively.

- All Imports Excluding Fuel: Prices for nonfuel imports rose 0.8 percent in March following increases of 0.5 percent in February and 0.9 percent in January.

- The March advance was driven by higher prices for nonfuel industrial supplies and materials; foods, feeds, and beverages; capital goods; and consumer goods.

- Nonfuel import prices rose 3.8 percent from March 2020 to March 2021, the largest 12-month increase since the index advanced 4.8 percent in October 2011.

Export Price Synopsis

- Prices for U.S. exports increased 2.1 percent in March, after rising 1.6 percent in February and 2.6 percent in January.

- The 6.5-percent advance from December to March was the largest 3-month increase since the index was first published in September 1983.

- In March, higher prices for agricultural and nonagricultural exports both contributed to the advance in export prices.

- The price index for U.S. exports rose 9.1 percent from March 2020 to March 2021, the largest over-the-year increase since a 9.4-percent advance in September 2011.

Export Price Details

- Agricultural Exports: Agricultural export prices rose 2.4 percent in March following increases of 2.8 percent in February and 6.0 percent in January.

- The March advance was driven by higher prices for meat, soybeans, fruit, and cotton.

- Prices for agricultural exports advanced 20.5 percent over the past 12 months, the largest over-the-year rise since the index increased 22.7 percent in September 2011.

- The 12-month increase was primarily driven by rising prices for soybeans, corn, meat, and fruit.

- All Exports Excluding Agriculture: The price index for nonagricultural exports advanced 2.0 percent in March, after rising 5.1 percent from November to February.

- The March increase was led by higher prices for nonagricultural industrial supplies and materials; consumer goods; capital goods; and nonagricultural foods.

- Nonagricultural export prices increased 7.9 percent over the past 12 months, the largest over-the-year advance for the index since a 7.9-percent rise in September 2011.

Inflation Chatter Will Pick Up

Inflation chatter is sure to pick up following this report.

Year-over-year CPI numbers are sure to surge in the next few months as well. I will post some estimates later today.

That said, I side with Lacy Hunt at Hoisington Management that inflation is mostly in the rear view mirror.

For details and an excellent set of reasons by Hunt, please see Expect Inflation to Accelerate? Here’s 8 Reasons to Expect Decelerating Inflation

Mish

This will likely pass in 6 or so months. Maybe sooner if states follow the lead of Texas and open back up. Seems to have had no ill effects on them.

What’s closed? You can go theme parks, ballgames at all levels, church, schools, gyms, and restaurants just about anywhere in the country. The only thing I can think of that’s still shutdown are cruises. Meanwhile, cases are surging again from an average of 55k a day to 72k in the last month.

seems like significant portions of the economy are coming back strong

Housing is absolutely on fire. It’s common for a property to get bid up 20% over asking, in days. The realtor I worked with said people were paying for inspections before the offer so they could offer cash with no contingencies.

No way this could end in blood and tears…. It’s Different This Time.

Shorts have some risk. Longs? Nah. Even after 2008, which is very different from today, it only took 3 years to recover.

Sure, as long as there is 1-2 trillion in stimulus every quarter.