Headline Inflation Could Top 4%

Jeffrey Gundlach says Headline Inflation Could Top 4% by June.

Headline CPI inflation is almost certain to rise above 3% in June and July, according to Jeffrey Gundlach. It could even top 4%, he said, which would “really spook the bond market.”

Gundlach spoke to investors via a webcast, which he titled, “Looking Backward” The focus was on his flagship total-return fund (DBLTX).

There is no inflation in core CPI, Gundlach said, but headline inflation will increase significantly and will be greater than 3% in June and July. The Fed is aware of this and is telling the bond market it is unconcerned, according to Gundlach, and welcomes that level of inflation along with the accompanying negative interest rates. This allows the deficit to be financed with cheaper dollars, he said.

Headline CPI could even go above 4% over that time, he said, based on ISM data, which could trigger a bond selloff.

To get inflation, Gundlach said we need to give everyone a “Bellamy credit card,” which was portrayed in Looking Backward. It would essentially be a stimulus handout to Americans that must be spent over a fixed time or returned to the government.

“It’s shocking that households with $150,000 of income and three children will get $6,000 from the government,” he said, in reference to the $1.9 trillion stimulus. “This looks a lot like a monetizing experiment.”

Gundlach On Speculative Bubbles

“We are in a speculative bubble in government debt and equity valuations,” he said. If there is a collapse in stock prices, it will not be 10 or 15%, but a “large number. There will be a tremendous unwind of stock positions.”

He also stated the “VIX will hit its highest level in the next correlation and will go over 100.”

I agree with his opinion on speculative bubbles, but a VIX over 100 might be overdoing it.

And if stocks crash, so will consumer spending and US treasury yields. Inflation will be the last thing on the Fed’s mind, except how to get it.

3% to 4% CPI Inflation By June?!

Gundlach is referring to year-over-year impacts, not a sudden spike of 3% in one month.

Easy Comparisons

It’s not that inflation will be rampant.

Rather, it’s the impact of year-over-year comparisons, goosed by a huge Covid-related dip in energy prices in April and May of 2020.

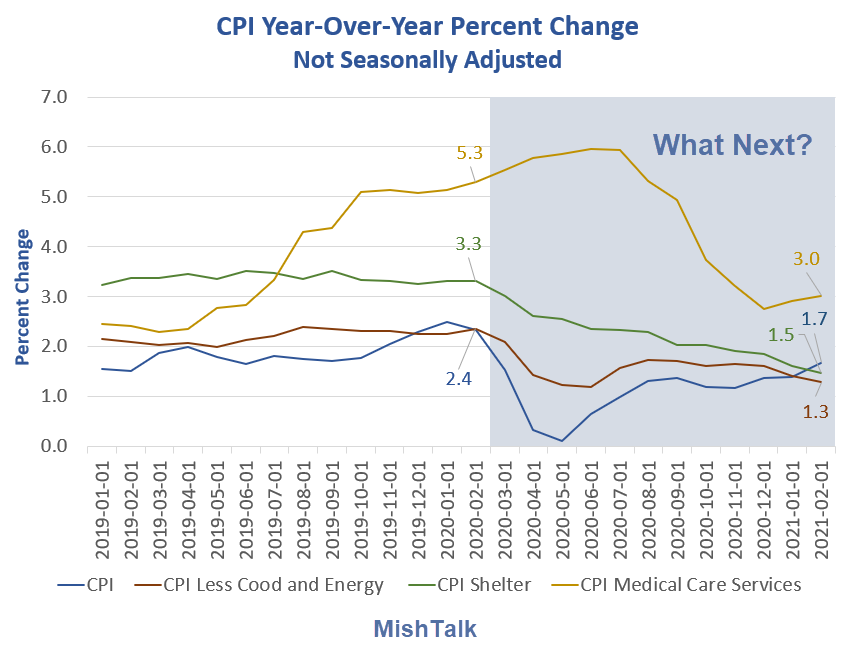

CPI Select Indexes Not Seasonally Adjusted

The huge dip in energy prices in April and May of last year only made a tiny dip in the CPI that month as shown on the chart.

This happens because motor fuel only accounts for 2.88% of the index. The broader “Energy Index” is only 6.155% of the CPI.

It takes a huge swing in smaller components to impact the current CPI much, but the year-over-year impact is another story.

Year-Over-Year CPI and Projections

Shelter is stabilizing factor that comprises a whopping 33.316% of the CPI.

Owners’ Equivalent Rent (OER) is the largest component with a 2020 weight of 24.26%. Rent of primary residence is another 7.86% for a total weight of 32.12%.

Housing is not directly in the CPI and rents are pretty stable.

Incremental increases in most of the CPI components plus a big increase in energy will lead to something like 3.4% year-over-year inflation in May by my calculations.

And if energy prices decline from here, in May of 2022 we will have year-over-year comparisons that will look more benign than they are.

This is one of the problems with year-over-year comparisons when there is an unusual spike or dip.

Whether these year-over-year comparisons will “really spook the bond market” as Gundlach suggests remains to be seen.

If the market expects 4% or even 3.5% and the CPI comes in at 3.4% or lower, a huge bond rally could be in store.

Expect the Word Transitory

If these spike projections are accurate, expect Powell and other members of the Fed to be howling the word transitory for weeks on end.

ISM Angle

This statement by Gundlach caught my eye.

Headline CPI could even go above 4% based on ISM data, which could trigger a bond selloff.

That is an angle I had not ever considered so let’s put the thought to a test.

ISM vs CPI

I took the ISM portion of the chart from TradingEconomics and kept resizing the CPI chart from Fred via trial and error until the years on both charts aligned.

I highlighted negative correlations. There are about as many positive ones. . I see no relation between the ISM and CPI. The relationship appears to be totally random on average.

What about the Producer Price Index?

Healthcare is the Biggest PPI Component

Healthcare, not energy is the biggest component of Producer Prices. And Producer Prices are not part of the CPI.

For discussion, please see Healthcare is the Biggest PPI Component With Over 3 Times Energy’s Weight

Contrarian View

Now that the nearly everyone, but especially the average Joe, is looking for more inflation, the contrarian is looking the other way.

For discussion of the massive retail bet by small speculators on the inflation theme, please see my March 7 post Small Speculators Pile Into Treasury Shorts, Is a Short Squeeze Coming?

Also note my March 9 post Gold and Silver Pop as US Treasury Yields Drop

We are going to see a pop in year-over-year inflation, but then what?

Inflation Largely in the Rear View Mirror

The Fed has blown another huge set of bubbles. Those looking for future inflation should instead look to the past.

We “have” inflation, and plenty of it. We will have it as long as asset bubbles keep inflation, but don’t expect the CPI to follow except as pertains to easy year-over-year comparisons.

Factoring in housing prices, not just rent, inflation is already at 3.5% by my preferred measure, just not by the CPI.

For discussion, please see Fed Hubris: Housing Prices Show the Fed is Making the Same Inflation Mistake

With the real interest rate at -3.45% is it any wonder speculation in stocks, junk bonds, and housing are rampant?

This is the same mistake the Fed made between 2002 and 2007 when it ignored a blooming housing bubble with dire consequences culminating in the Great Recession.

CPI Mistake

It is a mistake to continually believe monetary inflation will show up in the CPI.

It hasn’t and likely won’t any time soon because housing prices are not in the CPI and medical care is ridiculously undercounted due to people on Medicare and business coverage plans.

Pause in the Storm?

Previously I commented: Inflation Fears Recede After Another Tame CPI Report, Pause in the Storm?

I think not. Nor do I think there is a much of a storm to begin with.

Before anyone of my readers scream, I am talking about inflation as measured not as really exists.

It’s easy to have “low inflation” when you don’t count housing and undercount the cost of medical care.

If you are looking for inflation, the last place to look is where they tell you to look.

Looking ahead, I believe bubbles pop and the result will be anything but higher inflation.

Mish

Good on him. We need to get rid of these restrictions based on IGNORANCE.

This video explaining the Quantum Financial System: https://rumble.com/vbcrzf-the-quantum-financial-system-qfs.html

This will solve all “our” problems. Whoa, this is the best thing to come along since sliced bread. This is our bright future. Loving it already.

Governments would never agree to it – giving away too much power.

Banks would never agree to it, they’re all bust.

1 fixed currency for the World – would cause extreme surpluses and deficits.

Why is 100 billion coin the right number?

Eggs and baskets – too much risk in one supposedly secure, unbreakable and uncontrollable infrastructure.

I can’t see it ever happening. Not as a uniform financial system for all. It’s an interesting concept though, thanks for posting. I do think government created digital currencies are on the horizon, and I also think the swift payment system will be replaced.

If the FED uses the CPI to gauge inflation, it purposefully underestimates. They want inflation because that’s how they make their money, but they changed their target from annual to average over several years. This frees them up to goose inflation much higher in the near term by increasing M1. Inflation is already happening as everyone can see at the gas pumps, and most are woefully un-prepared for the destruction of their own personal spending power.

Jeez ! Your exceptional nation is throwing money around as if there s no tomorrow….This can never end well ! Btw, I just read in a belgian newspaper that George Floyd’s family will get paid 27 million to compensate their ‘grief’? LOL! Tell me again that crime doesn t pay off! Many a family in the US must be praying secretly for a similar ‘loss’ to happen to them … Your woke society literally comes at a price, doesn t it … CRAZY!

The Bernanke Fed paradigm is still in effect: to never ever let deflation happen here, bubbles shmubbles. But the Fed is always one step (at least) behind markets, and when something breaks they’ll have zero control over the effects. If there is a significant bout of deflation, I expect the rest of the cowards in DC will immediately turn to writing checks brrrrrr like their jobs depend on it. Maybe that’ll be Mish’s currency crisis. … One theory is that that is the dollar-devaluation that equities are already pricing in…. Anyway, the rest of this year may feel “strong”, as people and businesses get moving again. Psychology matters.

Bond yield curve steepening, 10-year/2-year spread widening. Gonna be a good year!

10 year jumped 10 basis points today alone.

“Inflation is Poised to Soar, 3% by June” is a non sequitur.

Be curious to see if no correlation existed between the CPI and the ISM prices paid index. Probably not but could be worth looking in to

I sold all my TIPS a month ago, as Mish convinced me that the CPI was fake, because if it wasn’t, then everyone would own TIPS.

OT but I think it’s interesting how every #metoo case starts small and then grows and grows as more accusers always crawl out of the woodwork. Makes me glad I never stood for office….Who would want to be a politician in this kind of toxic climate?

The worst thing about the Democratic Party is that they cannibalize their own. I think this is a direct consequence of all the promises they’ve made made to the identity politics crowd in support of their false narratives on race and gender. You reap what you sow.

There are now 30 women lined up to try to throw Cuomo under the bus. I wonder if he kissed anybody inappropriately at any high school parties.

So which is more meaningful core or headline inflation? I find it odd we shouldn’t be concerned about a transitory spike if there’s no downward spike after? Purchase power is still impacted

People cannot edit because that feature was bundled in Maven code that allows the these denial of service attacks and mass generated comments by bots.

Editing comments is turned on for me only. I correct obvious errors when I see them or they are pointed out.

This is ridiculous. Needs to be rethought and fast

gundlach has been wrong so many times that it’s hard to believe that anything he says will come to pass.

Yes – I almost got sucked into that and had a post explaining why he was wrong about the whole thing. Then I started looking at year-over-year analysis. He never explained his reason, just a huge pop coming so my first instinct was that he was wrong across the board.

So when is the Infrastructure bill being passed?

Mish – thanks for this tremendous analysis. Spot on pointing out what is and is NOT impacting inflation. Truth matters. I admire your ability to not accept the prevailing narrative and actually investigate what is happening underneath the surface.

Thanks – Much appreciated

Inflation Isn’t Happening, and It Likely Won’t. Here Are 7 Charts Showing This.

Inflation is not only in goods and services, it is in assets. Further, the inflation in assets greatly overwhelms that for GDP, both absolutely and relatively.

Look to M2, the broadly defined money supply. Divide this by GDP – the good stuff. We find that the amount of money required to produce GDP is increasing by leaps and bounds.

In Q418, the M2/GDP ratio was 0.683; in Q419, 0,700; and in Q420, 0.885.

What is the main culprit contributing to the M2 rise? It’s the Fed – as a result of the Fed’s printing money to buy government/GSE securities to keep interest rates in line. The Fed’s asset sheet has increased 82% since beginning-last March or $3.4T. (M2 went up a similar or $3.4T amount.)

The CBO’s 2021 US Gov’t deficit was forecasted this February to be $2.3T. This did not include the just-passed $1.9T stimulus. This brings the total deficit this year (up over $4T.)

This means that means that the $4.2T sum will, due to the Fed’s accommodation, likely be added to M2, bringing the Q421 total to $23.2T. (Do you think that the current Fed’s action of $120B/mo security purchases, in effect since last spring, won’t increase appreciably?)

On the flip side – sure, GDP will go up. “GDP Now’s” 3/8/21 forecast is 8.4% (real, SAAR) for Q121. Multiply this by a liberal GDP inflation factor of 2.2% results an increase of 10.8%. Let’s again be very liberal, and say that this will continue over the FY Q420-Q421 period. This assumption is several hundred basis points higher than the consensus forecast including the CBO and OECD.

Increasing the Q420 GDP of $21.48T by the 10.8% results in $23.8T. Dividing this into the $23.4T of projected M2 resulting in a Q421 monetary inflation ratio of 0.983. This is 11 percent above the Q420 ratio of 0.885.

Will we see this inflation in goods and services? We’ll see some but remember, the great bulk of the Government’s largesse increasingly goes into assets (75-80 percent), rather than the intended GDP. Further, this goods and services inflation will only last until the Government beneficence runs out – then it’s back to the Government feed-trough again.

Regarding interest rates, the Fed is continuing to hold down the yield curve’s short-term tail. Longer term interest rates are rising – until the Fed decides to take action. The 10-Yr treasury has increased about 100 basis points, or from 0.6% last summer to just over 1.6% currently. However, this one percent gain compensates but for a small fraction of the coming monetary inflation increase.

Let’s make the 0.983 and 0.885 whole numbers for easier calculation – or 983 and 885 respectively. Take the mid-point of 934 for interest rate determination. The one percent interest rate gain accounts for 9.34. However the overall monetary inflation increase amounts to 983 minus 885, or 98.

If anything, the CPI vs ISM chart@MishTalk posted might be negatively correlated. Maybe Gundlach is expecting ISM to fall??? I’m not sure how a falling ISM would lead to more inflation, but seems to be negatively correlated, however correlation does not imply causation

If you look at the chart I highlighted negative correlations. There are about as many positive ones. Thus, it appears to be totally random on average. Will add this note.

Yup. I noticed. I would think falling ISM would be correlated with deflation, if anything, ie, less people buying widgets

I believe Mises said that the fallout from crackup booms can be either inflation or deflation and that which it will be depends on the particular circumstances at the time.

Even if apples go to $20/dozen will the Fed dare to raise interest rates? Not only would it have adverse effects on asset prices but government debt would explode and the dollar would go through the roof. Government looks after itself first and the ultra rich second. I don’t see the US raising their borrowing costs and tanking stock and bond valauations or exports to help Main Street. Despite extremely low interest rates, interest payments are the #2 budget item for th Japanese government.

Volcker had the cojones to push rates way up, but the price we paid was recession. As Mises said there’s no graceful way out of the consequences of too much easy money.but

I think we’ll see inflation followed by deflation, if only because the Fed won’t have another Volcker on standby; more likely Stephanie Kelton. I think they’ll try MMT first. Only after everything is FUBAR will they pull on the reins.

The longer you kick the can the worse the outcome. In a rational world this should have happened years ago before Draghi’s “Whatever it takes” stick save.

So if the bubbles pop then there will be massive defaults and deflation. I think that the Fed will try all that it can to prevent it. If it does happen I think that it will be short like the last one (a month or two) while the Fed bombs everything (businesses and individuals) with dollars. It certainly is difficult trying to figure out how to invest. Equities, hard assets (gold, real estate, etc.), cash? Definitely not bonds.

If definitely not bonds, who is buying? And what is the consequences of it? Only the government itself is buying. Then one day the money will be like paper.

If the S&P tanks, the big money world-wide will line up to buy UST’s no matter how crappy the yields might be.

What I fail to understand is how the market will DROP with the endless money printing. That was not happening in the late 90’s or mid 2000’s.

Inflation Isn’t Happening, and It Likely Won’t. Here Are 7 Charts Showing This. Inflation may be on many investors’ minds, but it has yet to show up in the numbers. Moreover, a close reading of the data suggests that inflation won’t be a problem for some time, if ever. https://www.barrons.com/articles/inflation-isnt-happening-and-it-likely-wont-here-are-7-charts-showing-this-51615468745

Inflation is running at about 10%. Meanwhile, the Fed says housing prices are rising 2% a year.

Meanwhile in Texas, our often indicted but never convicted AG is suing the city of Austin for keeping the mask mandate in place. Abbott and Paxton both are liable to work themselves out of a job, the way they’re headed, if you ask me.

No one is asking you. However, masks do work if worn properly (e.g., not down below your nose!) and everyone should use them. If everyone did there would be no pandemic, IMHO.

“No one is asking you.”

My, aren’t we passive-aggressive this morning.

I’m fully supportive of the local mask mandate, btw, and will wear my mask until the evidence suggests I no longer need one, other than for work, where I’ve been wearing one routinely for more than 30 years.

If you voted for Abbott and Paxton, you’re getting what you deserved, good and hard.

Pop? Bubbles can pop you say?

I think today and Monday is when we see if gold really has turned up. The dollar is looking pretty strong this morning, and the ten year bond is still trending higher, although it is easing a little at this hour.

I think gold will test support again at 1690, but maybe I’m wrong. I am waiting to reload the fun trade until we get some kind of resolution on which way metals are headed.

Looks like 1700 holds today. Bullish.

I don’t usually follow Bold futures but unless I’m misreading something there’s a backwardation on Gold, or very close to it.

I don’t follow futures at all, but I used to read Keith Weiner when I was really trying to trade gold, and he uses the action in futures to develop his strategy.

I know that backwardation in gold is rare and usually doesn’t last long….but some people think when the dollar dies gold will go into permanent backwardation as people rush to get out of fiat. I doubt we’re there yet.

But it certainly can be construed as bullish for gold price. I’m generally bullish on gold over the longer term, but just trying to convince myself the bottom is in here. If Monday is another up day and we don’t drop below 1700 again, I’l be onboard.

I agree, I don’t think the dollar is about to die yet. I do think it is an indication that people prefer to hold the Gold metal to dollars at the moment. I wonder if the Gold price stops tracking treasuries soon, it did today if I’m not mistaken. There’s no reason for it to track them under current conditions IMO. Treasuries/dollars just different forms of Government debt and the current backwardation or tight basis indicates people prefer to hold gold bullion to the debt.

I don’t think I’d want to be short Gold futures.