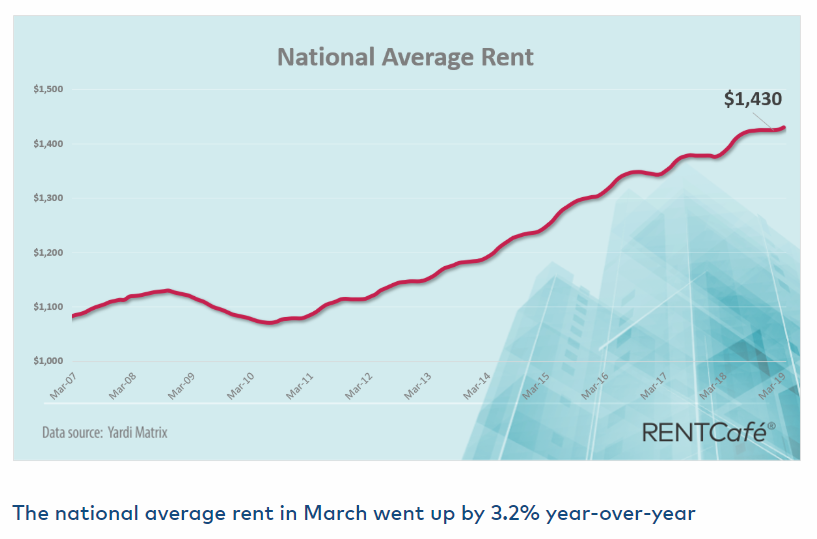

The RentCafe reports the Average National Apartment Rent Kicks Off the Spring Rental Season at $1,430.

Key Findings

The national average rent was $1,430 in March 2019, 3.2% ($44) higher than this time last year, according to data from Yardi Matrix.

- 92% of the country’s largest 253 cities have seen rents grow in March year-over-year, 6% of rents remained unchanged, while 2% of cities experienced rent drops compared to 2018.

- The fastest and the slowest y-o-y rent changes occurred in small Texas cities — Midland (14.6%) and Odessa (13.3%) are the only cities with increases of over 10%, while Pearland is the only one where rent decreased by more than 2%.

- The early beginning of the rental season saw rent prices increase by 3.2% over the year — the lowest annual growth we’ve seen in more than 6 months.

- Compared to last year’s figure, the March average national rent of $1,430/month is $44 higher. Month-over-month, however, we witnessed a 0.3% rise, or $4 more added to average rent prices. This is consistent to last spring’s growth levels, signaling the end of the sluggish winter season.

Largest Cities

Phoenix and Las Vegas Top the List

Aggressive increases in the Southwest have kept Phoenix and Las Vegas at the top of the list when it comes to rent growth in the past year, 7.8%, which translates into $75 and $76 more per month, respectively. Apartments in Jacksonville, FL come in third with a 6.3% ($64) increase accounting for a monthly average rent of $1,074. LA, where the average rent price is $2,469 following a 5.6% increase that means $130 more per month. Apartments in Memphis, TN now go for $39 more than in March 2018: $790/month after a 5.2% increase. It’s important to note that, compared to this time last year, San Francisco, CA had the highest net increase among large cities – the average rent of $3,619 means new renters would have to pay $153 more than what they would’ve 12 months ago.

The weakest increases happened in Houston, TX(0.9%), followed by Manhattan and Portland, OR, both witnessing a 1.6% y-o-y increase. Rents in Queens reached $2,268 after a 1.8% y-o-y increase, and Boston, MA saw a 2% increase compared to last year, which brought the average rent price here to $3,343.

Year-Over-Year Wage Growth

Let’s review the wage growth numbers as noted in my most recent Jobs report: Wild Job Fluctuations Again – Payrolls Rose by 196K but Employment Fell by 200K.

- All Private Nonfarm from $26.84 to $27.70, a gain of 3.2%

- All production and supervisory from $22.49 to $23.24, a gain of 3.3%.

The Fed

The Fed, Keynesian clowns, and the Bloomberg Econoday writers want more inflation. They are all nuts.

Ask any renter if they want prices to keep going up.

Mike “Mish” Shedlock

Over the last few decades, a great amount of wealth flowing into paper promises rather than tangible assets has masked true inflation but it is everywhere. This means that while many economy watchers tout the line any economic crisis will result in massive defaults and deflation hidden forces may prove them very wrong.

One place it is most obvious is apparent in the replacement cost of buildings and infrastructure destroyed or damaged by natures fury. The article below looks at several trends which point to the reality we should expect rents and housing cost to edge higher in the future.

I think both the volatility and the over-regulation of real estate has landed us in a situation where its risky to build and safer to buy up existing rental stock. Follows the trend of “financialization” of our economy with “rentiers” stripping capital from everybody. Also from demographic viewpoint a lot of boomer households have become empty nests so to speak, a married late middle age couple living in a three or four bedroom house. I see a lot of this in my circle.

I guess if any “political topic” deserves to be seen in terms of medians versus averages, this is it. One $100,000 a month rent will skew all these averages.

It’s called supply and demand. Rents are set at what the market can bear. Maybe the section 8 crowd should learn marketable skills, stop having litters of kids and get an education. We have certain types of people who play professional victim and constantly blame others for their poor life choices

“It’s called supply and demand. Rents are set at what the market can bear.”

Nic9075, I’m not sure we have a “fair market”. Seems odd that there appears to be plenty of new apartments in the large cities, charging top rent rates, but are only partially filled. In a normally functioning market with competition, apartments keep lowering their rents to fill all vacancies, as an unfilled room is a money-losing venture – at least from what I’m told from private landlords. My sense is that the new, large, swanky apartments are owned by the super rich (or corporations) to whom power has been consolidated during the last ten years. I had a lot of “hope” that Obama was going to change this power structure back in ’08, but instead he was taking email dictation from the VP of CitiGroup, an insolvent bank by any rational standard.

Note that I say “appears”, as I don’t have any hard data supporting my view on vacancies. Please convince me my impressions are wrong and that we indeed have a free market where prices are set at the margins!

It’s no longer called “supply and demand” when supplying what is demanded, is banned. “Supply and demand” is no more what determines prices for housing in Pacific Heights, nor darned near anywhere else, than it is for civilian machine guns. In both cases, a few well connecteds can charge whatever the heck they want for “grandfathered” old junk. Safe in the knowledge that our totalitarian government stands ready to ban any potential competitor from adding higher quality, lower priced supply, despite them being able to do so easily.

Strip away the totalitarian state, and suppliers could profitably cover an additional 1000 square feet in San Francisco for a few percent of what buying it currently costs. Ditto New York, and most every other larger city. Ergo, what determines prices, is involvement of the totalitarian state. Not mindless babble about “supply and demand.”

most people in section 8 housing don’t have the ability to learn higher end marketable skills. We sent all their middle class lifestyles over to asia with “free trade” . But I’m sure you and Mish are celebrating their loss of lifestyle as you are able to buy goods for10% less while denigrating those who are affected.

Its

Property taxes are higher, utility costs are higher, rents are higher. Shocking! (not)

Isn’t stated, but I assume this rent is for a 2b/2b?

Renters, indirectly, pay for the obama’s QE insane houses prices and exponentially increasing property taxes.

Landlords pass on these expenses.

Until the renters can no longer pay.

We are at that point now. Many cities have renters paying 50% or more of take home pay for the rent.

There is no money left to save, buy a car, take a vacation or have children, etc.

Renters don’t see it. If they did they would be screaming for:

Interest rates at 6%+

Public unions disbanded

QE unwind accelerated

Bankers in jail

Mark to market. Foreclosures completed within 60 days.

End of insane state and local zoning and regulations

Really that is news to me.

Seems like everyone has the latest iPhone, chooses to have multiple vehicles especially when there is ample public transportation in NYC, spend lots of money on lottery tickets, tattoos and vaping products.

“The latest IPhone” costs a few days worth of roach shack rent in San Francisco. Ditto some used car.

If government banned building new IPhones the way they do housing, “Everybody” would no longer be able to afford IPhones anymore, either. Then the few privileged leeches who happened to own one, could get away with charging insane usury rent for those, too.

Such is the difference between free markets, and totalitarian kleptostates ran exclusively for the benefit of the ruling junta and it’s useless, leeching hangers-on.

That’s how totalitarian, feudal societies have always worked: The productive needs to work harder and harder, in order to transfer an ever greater share of what they create, to idle, deadweight leeches living off of government mandated wealth transfers.