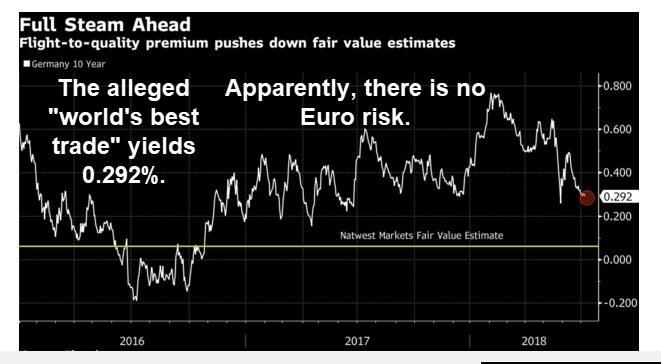

The World’s Best Risk/Reward Trade Is Long 10-Year Bund says NatWest.

It’s time to double down and add to long positions in 10-year German bunds, which offer the best risk-reward trade in the world, according to NatWest Markets Plc.

Fair value for 10-year German bond yields has halved to an estimated 0.06 percent, more than 20 basis points below current levels, according to strategists Andrew Roberts and Giles Gale. The reasons to buy remain plentiful, they wrote in a July 6 report.

Firstly, positioning: no-one is long and everyone is short. Secondly, the European Central Bank continues to support markets, offering long-term guidance as to the next policy steps. Thirdly, the amount of free float available in German securities will continue to shrink as the ECB’s asset-purchase program continues.

Dear NatWest

Let’s assume as you must, there is absolutely no currency risk.

Let’s also assume as you must, there is absolutely no chance the ECB does anything that surprises you.

Finally, let’s assume that “no one is long” and that nothing can possibly be wrong with that thesis.

Assuming all of that, your gain to fair value is a bit “more than 20 basis points”.

Heck. I will be generous and call it 25 basis points.

Is a quarter of a percent really the best you can do in terms of risk-reward?

By any chance did you up the ante with leverage?

If you are counting on capital gains to boost the return, then let me ask what happens if your currency risk assumption misses the mark?

The mad search for yield turns up strange proposals. This was another one.

Mike “Mish” Shedlock

I was kidding about the sure thing

If the assumptions are correct. I’ll stick with options for profit and Treasuries for my bonds. Maybe it pays off but I am wary of anything financially related to the EU at this time.

I’m more than happy if the cheap money starts flowing into German bonds. At least it’s not being used to bid housing prices even further into the ionosphere.

I think if you are holding a ten year at .29% and the yield drop to .06% your percentage gain on the sale is much more than a quarter point. I don’t know how to calculate the profit on this exactly. Also those guys probably want to lever up. Sounds like a sure thing non the less.

lol: my bank.

My Vanguard Federal Money Market account yields 1.84%, risk free. So that’s six times the yield with no risk. Why would I buy a German bund at 29 basis points that is wholly dependent on the ECB providing support at that level?

I think this highlights just how warped investment logic has been become after almost 10 years of highly abnormal central bank intervention.