Nixon Shock

A reader asks “What Forced Nixon to Close the Gold Window in 1971?”

The answer is called “Nixon Shock“.

Nixon wanted to fight the war in Vietnam, not raise taxes, and not hike interest rates to finance it.

Arthur Burns, not Volcker was at the Fed.

American economist Barry Eichengreen summarized: “It costs only a few cents for the Bureau of Engraving and Printing to produce a $100 bill, but other countries had to pony up $100 of actual goods in order to obtain one”.

Vietnam War and the Dollar Exodus Beginning

The dollar exodus had its beginnings way back in February 1965 when President Charles de Gaulle announced his intention to exchange its U.S. dollar reserves for gold at the official exchange rate of $35 per ounce.

Lyndon Baines Johnson was president. The War in Vietnam and Johnson’s “War on Poverty” accelerated the US deficit and inflation.

On a campaign that promised to restore law and order to the nation’s cities and provide new leadership in the Vietnam War, Richard Nixon won the election in 1968.

Arthur Burns was Fed chair.

In 1971 President Nixon appointed the then Democrat John Connally as Treasury Secretary. That’s when things started rolling.

Our Currency But Your Problem

Shortly after taking the Treasury post, Connally famously told a group of European finance ministers worried about the export of American inflation that the dollar “is our currency, but your problem.”

By 1971, US money supply had increased by 10%. In May 1971, West Germany left the Bretton Woods system, unwilling to revalue the Deutsche Mark. Switzerland also started redeeming dollars for gold.

On August 5, 1971, the United States Congress released a report recommending devaluation of the dollar to protect the dollar against “foreign price-gougers“.

On August 9, 1971, as the dollar dropped in value against European currencies, Switzerland left the Bretton Woods system.

On August 15, 1971 Nixon directed Connally to suspend, with certain exceptions, the convertibility of the dollar into gold or other reserve assets, ordering the gold window to be closed such that foreign governments could no longer exchange their dollars for gold. He also issued Executive Order 11615, imposing a 90-day freeze on wages and prices in order to counter inflation. This was the first time the U.S. government had enacted wage and price controls since World War II.

The American public believed the government was rescuing them from price gougers and from a foreign-caused exchange crisis. Politically, Nixon’s actions were a great success. The Dow rose 33 points the next day, its biggest daily gain ever at that point, and the New York Times editorial read, “We unhesitatingly applaud the boldness with which the President has moved.”

So Much for Temporary

The move was not temporary. There have not been any restraints on deficit spending since.

Wars became easy to finance. Deficits? No problem.

In 2011, Paul Volcker, who replaced William Miller as Fed Chair in 1979, expressed regret over the abandonment of Bretton Woods.

“Nobody’s in charge,” said Paul Volcker.

“The Europeans couldn’t live with the uncertainty and made their own currency and now that’s in trouble.”

Powerful “Advantages” of Debasement

In contrast, Paul Krugman said a country “can print as much or as little money as it deems appropriate. There are powerful advantages to such an unconstrained system.“

This is not 1960 – Trump’s Trade War Not Winnable

This is not 1940, 1950, or even 1970.

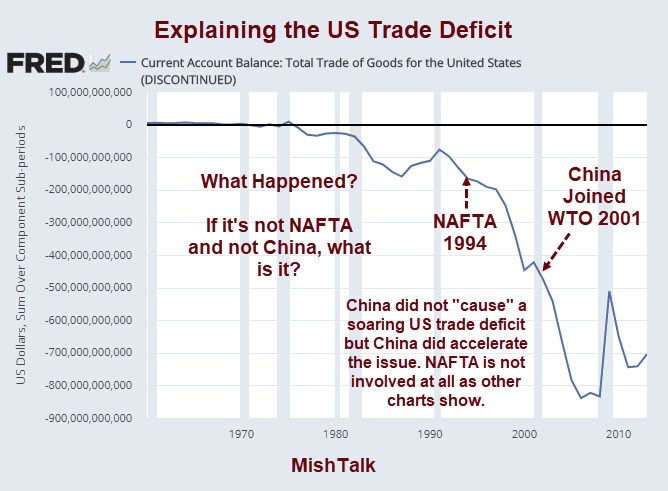

Contrary to Trump’s touting, his trade war battle isn’t about NAFTA or the WTO.

Unwinnable Trade War

Nobody Wins, But Germany and EU Hurt Most in Global Trade War

As I explained in Nobody Wins, But Germany and EU Hurt Most in Global Trade War Trump is fighting a battle that cannot be won.

The roots of this crisis stem from Nixon closing the gold window in 1971.

China’s inclusion into the WTO exacerbated the trade problems but did not cause them.

Even if the US had a higher pain tolerance, the US cannot possibly win a trade war.

For further discussion, please see Trump’s Unwinnable Trade War: Gold Explains Why

Here’s the short answer, once again as to why Nixon closed the gold window: Nixon wanted to fight the war in Vietnam, not raise taxes, and not hike interest rates to finance the war.

Failure of the London Gold Pool

Inquiring minds may wish to read about the Failure of the 1960s London Gold Pool for more interesting details.

Flash forward to today.

Sound Familiar?

Sound familiar with the current trillions of dollars blown in Afghanistan?

With Japan’s building bridges to nowhere to fight deflation?

With China’s SOEs?

With negative interest rates in Europe and Japan?

With Trump howling about the strong dollar?

Beggar-Thy-Neighbor Currency Wars

Every country wants to devalue its currency to raise exports and have a current account surplus.

It’s mathematically impossible but math never stops politicians.

Forget the Yuan

Many expect China to overtake the US and for the yuan to replace the dollar as the world’s reserve currency.

Such talk is nonsense. The reserve currency holder needs to meet several requirements of which China meets none.

In Forget the Yuan, King Dollar is Here to Stay, I note 6 reasons why the Yuan will not replace the dollar.

Who Really Want’s Reserve Currency Status?

Despite moaning about the dollar, China does not want to have the world’s reserve currency because it implies running trade deficits in which other nations accumulate yuan reserves.

Japan and the EU (led by Germany), don’t want to have the reserve currency “advantage” either, for the same reason:

An export-based, current account surplus economy is incompatible with reserve currency status.

Please read the above lines over and over until it sinks in.

Reserve Currency Curse

The reserve currency irony is that despite protestations of US advantage, no country wants the alleged advantages the US purportedly receives.

Trump would be very pleased if the Yen, yuan, and Euro rose vs the dollar, and US exports rose.

Does Japan want a strong currency? China? The EU?

Since no one really wants it, having the reserve currency is best viewed as a “curse” not an “exorbitant privilege“.

Trade Wars and Currency Wars

If you peel off the layers hidden over the years, Trump’s trade wars are really an effort by Trump to shed the “reserve currency curse“.

Global Consumers of Last Resort

The US is stuck with the reserve currency because we have the largest, most open capital markets in the world, the world’s largest bond market, and a far better business climate than the EU, China, or Japan.

To ensure the US remains the curse holder, the EU and Japan have negative rates, China does not float the Yuan but props up corrupt SOEs, and Germany punishes the rest of the EU.

Everyone wants to export to the US, and they do.

The result is a currency war with everyone hoping to devalue their currencies against the dollar.

As a direct result, and aided further by better US demographics, US consumers have become the global consumers of last resort.

It’s part of the curse.

Curse Important Observation

That is correct!

I was discussing from the point of view of what every country wants, however, illogical. https://t.co/oWPZf8SKzf

— Mike “Mish” Shedlock (@MishGEA) October 1, 2019

Ironically, the curse is imaginary as the above Tweet discusses. It’s the strive to remove the curse that’s damaging.

Currency Crisis Coming

Since the dollar is still rising (thanks to European, Japanese, and Chinese tactics), It may take even bigger US deficits before something major breaks.

On that score, both political parties in the US are poised to deliver increasing deficits as far as the eye can see.

Meanwhile, negative interest rates are destroying the European banks. For discussion of this important issue, please see In Search of the Effective Lower Bound.

A currency crisis awaits as the current path is not sustainable.

Timing and conditions of the crisis are not knowable. It can start anywhere but I suspect the EU, Japan, or China as opposed to the US.

Meanwhile, I suggest holding at least some gold.

Mike “Mish” Shedlock

Why are deficits a problem? As you know deficits in Government are savings/assets in the non government sector. Accounting identity.

Deficit spending is the source of the currency.

Bigger deficits=more currency, more production, improved wages, lower unemployment, maybe even some spending on infrastructure[Fancy that!] All this value added will keep a lid on inflation

You have to use up all your resources before any inflationary pressure can be applied. That is a long way away.

Income inequality (and Secular Strangulation) is simply not putting savings back to work into real investment outlets. This occurs because every single economist on the planet doesn’t know a debit from a credit. Yes, we are doomed.

All bank-held savings are un-used and un-spent, lost to both consumption and investment, indeed to any type of payment or expenditure. Why? Because banks, from the standpoint of the entire economy and the banking system, pay for their earning assets with new money – not existing deposits.

The only way to activate savings, completing the circuit income and transactions’ velocity of funds is for their owners to spend/invest either directly or indirectly outside of the payment’s System. There are c. $11 trillion of savings frozen/idled in the commercial banking system.

I.e., savings flowing through the nonbank public never leaves the payment’s System. There is just an exchange in the ownership of pre-existing deposit liabilities in the payment’s System – a velocity factor. Why do you think Vt has fallen since 1981?

The surge in inflation relative to the real output of goods and services which began in 1965 was due to the Federal Reserve, under Chairman William McChesney Martin Jr., re-established stair-step case functioning (and cascading), interest rate pegs (like during WWII), thereby using a price mechanism (like President Gerald Ford’s: “Whip Inflation Now”), and abandoning the FOMC’s net free, or net borrowed, reserve targeting position approach (quasi-monetarism), in favor of the Federal Funds “bracket racket” in 1965 (presumably acting in accordance with the last directive of the FOMC, which set a range of rates as guides for open market policy actions).

Using interest rates as the monetary transmission mechanism is non sequitur. Interest is the price of loanable funds, the free market’s clearing price of credit. The price of money (the Fed’s bailiwick) is the reciprocal of the price-level, as represented by varied and specialized price indices.

Re: “The roots of this crisis stem from Nixon closing the gold window in 1971”

Complete tripe. The Gold Standard, the last legal link to gold (prior to the “gold cover” bill of March 19, 1968), was fictional, the economic tie tenuous, and its protection was a myth.

President Roosevelt and his Treasury Secretary, Morgenthau, exercising the crisis powers delegated to the executive branch by Congress, took the U.S. off the gold standard in April, 1933 by making the dollar inconvertible into gold at a fixed price. And to make matters worse they periodically kept raising the price of gold from $20.67 per ounce to a final price in Dec. 1933 of $35.

This had the effect of depreciating the exchange value of the dollar. All of this was done by a creditor nation operating with a chronic surplus in its balance of payments.

The reason why the U.S. went off the gold standard was because of the Pentagon’s communist containment deficit. This supposedly necessitated the Korean and Viet Nam Wars, etc.

The U.S. had a net liquidity deficit in every year since 1950 (with the exception of 1957), –up to 1976, when the private sector contributed its first trade deficit. These deficits were entirely the consequence of excessive U.S. government unilateral transfers to foreigners (re: foreign policy – solely our far flung military bases and personnel). During all this time the private sector was running a surplus in all accounts: merchandise, services and financial.

The Vietnam Ten-year War administered the coup d’etat to our gold bullion standard. By 1968, in an effort to keep the dollar at the $35 par, we had exhausted nearly two thirds of our monetary gold stocks, or approximately 700 million ounces to about 260 million ounces.

Alan Greenspan had an excellent article “Can the U.S. Return to the Gold Standard” in the WSJ on 9/1/1981.

I’ve BEEN holding gold/silver for over a decade, adding to it here and there. Lately I’ve been bringing up my food supply to over three years and trying for five years. Stashing guns away from my house in the mountains nearby. Planning on insurgency. I’ll die but at least I’ll go out fighting.

Curse Important Observation

Ironically, the curse is imaginary as the above Tweet discusses. It’s the strive to remove the curse that’s damaging.

If having reserve currency status allows funding of large deficits then watch out world if the $ is knocked off its perch.

It is just the opposite, having large deficits allows for a reserve currency status.

What comes first?

Well in the case of the US, it was being the reserve currency due to Bretton Wood. But after dropping the gold standard, the US can only remain the reserve currency if it runs a large budget deficit, because that allows it to run a large trade deficit, which allows the world to have enough US dollars to keep in reserve.

“Nixon wanted to fight the war in Vietnam” — that’s not fully correct. After WWII, the decision was made (and one can insert in here who made that decision: American people, elite, business elite) to fight communism and become guarantor of capitalism and democracy throughout the world. But the US had just barely come out of a great economic trouble known as the Great Depression. Wealth and industry were not there. We took on a role we could afford by financing it with a reserve currency.

Kennedy was about to pull out when he was shot in Nov. 1963. LBJ ramped it up into war in Vietnam. Old LBJ’s wife owned a million dollars worth of Brown and Root stock at the time. B&R made over a billion dollars building military bases in Viet-NAM.

“the Reserve Currency Curse”

I was reading the other day that the dollar is the one currency that has never been cancelled.

Apparently, currency is a curse. No country has permanently been on a gold standard. Apparently, a gold standard is a curse.

There is no winning.

I’m taking bets that the Whistleblower is Peter Stzrok. Current odds are 1:1.

“Many expect China to overtake the US and for the yuan to replace the dollar as the world’s reserve currency.

Such talk is nonsense. The reserve currency holder needs to meet several requirements of which China meets none.”

On August 14, 1971, the U.S. was on the gold standard. On August 15 it was not. Currently China meets none, but as has been seen before, things can turn on a dime when an inflection point occurs.

Martin Armstrong talks of the financial center of the world moving from west to east after 2032, which is still a lucky 13 years away.

Bretton Woods was destined to fail. Under a gold reserve system, the US can only be the reserve currency if the US is at least a slight net exporter. It was a strong net exporter following WWII, which kept the value of the dollar high enough to balance the price of gold. By the late ’60’s , Europe had rebuilt from WWII, there factories were newer and their technology better, and the US was obviously destined to become a net importer.

The gold standard had to be dropped so that the US could devalue its currency and become a long-term net importer. The only other option was for a cultural change in executive management of America’s industrial corporations to focus on constant capital, engineering, and process improvements. That wouldn’t happen for another 30 years.

OK, so an agreement resulted in the US$ becoming the world’s reserve currency. If this is so problematic for the USA, what practical steps can the USA take to take away the reserve currency status? What are the implications?

I don’t think you get it. How on God’s earth will the US afford the colossal military budget without the USD being the reserve currency? The bottom line is that the US cannot afford for the USD not to be the reserve currency. Think about the implications of that for a second.

I don’t disagree, but if the US$ being a reserve currency is a problem, and the US$ NOT being a reserve currency is also a problem, that what is the practical solution? Kicking the can down the road just result is a bigger dislocation when it happens….

Entire global economy feels it. US not running a large deficit will hit everyone.

It would seem the act of reserve status is itself doomed from the first. To peg a reserve currency, you tie the performance of many assets and players together. Skulkers drag it down; high performers have every reason to convert. In other words, you are matching the angular momentum of a huge system to a rtructure of comparatively low moment of inertia, and it spins out of control.

We have now done the same to our government; and it too spins out of control.

Here’s a key thought: partial socialism is socialism, with all its attendant failures. Period.

This article best explains the root cause of today’s global imbalances. Very few will accept the arguments made here.

I think the world should go back to the classical Gold standard. However, this seems unlikely because the powers that be, will not easily give up their ability to “print” currency, and thereby, wield power and influence. The Gold standard also imposes discipline. I think todáy’s citizenry themselves will reject discipline (but foolishly accept the inevitable socialist destitution; e.g. Venezuela).

My only quibble is the about the trade war with China: Trump’s trade is about more than deficits; it’s about IP theft also. Yes, trade wars are unwinnable. But something needs to be done about IP theft. So, if tariffs are not the solution, then something else must be suggested. Doing nothing is no longer an option.

Being the global reserve currency has its benefits and risks. FWIW no system is perfect. Every system is an experiment. Gold was tried and failed because there wasnt enough of it to grow the economy. As long as recessions are allowed to happen and there can be settlement of net debt via BIS there is a chance the current banking system stays entrenched. If not you will likely get some form of MMT2/3.

“…Not enough of it to grow the economy” is the biggest croc of sh!t I’ve ever heard. Sorry, but anyone espousing this argument has no clue. You don’t understand how the monetary system works. Quite clearly.

The monetary system doesn’t work. Pick any monetary system and I will show you eventual failure. Go ahead. Pick one.

Inquiring minds may wish to read about the Failure of the 1960s London Gold Pool for more interesting details.

“…foreign governments could no longer exchange their dollars for gold.”

Some that American citizens had been denied since 1933. In fact, American citizens were not even permitted to own gold bullion, here or abroad. I’m very glad Nixon closed the gold window to foreign governments – as it had long been closed to American citizens.

“Nixon wanted to fight the war in Vietnam…”

Let’s not forget that Nixon didn’t start the Vietnam War. He ended it (and the draft) – the last president to end a war. The peace movement certainly didn’t end the war as McGovern got drubbed.

Let’s also not forget Johnson’s ‘Great’ Society spending. We’re still suffering from that. Of course, when you start a war, you have to help the poor as they are the ones who do most of the fighting.

Minor point – Paul Volcker replaced G William Miller who replaced Arthur Burns.

“In fact, American citizens were not even permitted to own gold bullion, here or abroad.”

Land of the Free, indeed.

Nixon ran on getting the US out of Vietnam. And he did just that.

“Nixon wanted to fight the war in Vietnam…”

Here is a campaign Nixon commercial:

I think it was Henry David Thoreau who first wrote “That government which governs least, governs best”. Thomas Jefferson and John Locke wrote similar sentiments but not quite those words.

Thoreau reportedly wanted zero government, whereas Jefferson was more practical and wanted minimal government.

The United States forgot the lessons of history when socialists like Woodrow Wilson and Franklin Roosevelt abused national tragedies in their selfish quest for more and more power. US economic growth has been slower and slower, as government gets bigger and bigger. Not a coincidence.

Want to know why the people of the United States are at each other’s throats? because big government means big politics. Big politics (to paraphrase Carl von Clauswitz) means big wars. Its been that way throughout human history, and this time is no different.

I can’t find Thomas Jefferson’s essay on the subject, but he was quite a bit more practical than Henry David Thoreau. Jefferson said (words to this effect, since I can’t find the essay) — a certain amount of government is a necessary evil. Any more than that is just evil. And quite a few of the founding fathers wrote similar sentiments, having observed first hand the impact of big government on the UK.

Even though@[Mish Editor] keeps calling this “the Nixon shock”… the reality is Nixon was merely the guy keeping the seat warm when the #$% hit the fan.

It was the cumulative effect of spending beyond our means that forced Nixon to close the gold window. Not really Nixon’s decision (alone), but the decision of every voter, every president, every congress.

We have seen the enemy, he’s right there in the mirror looking at us.

That chart is all credit not just consumer credit but it is amusing. Will do another post on this. Working on more charts.

Thanks to Shamrock for pressing the issue and prodding me into a better discussion even though he had the wrong idea.

And you wonder why every single bank has to be bailed out every single night,take a guess who’s on the hook for all this dept that no one’s ever goin to paying back !

People who own Treasury bonds. People who own MBS bonds. People who own corporate bonds.

And for those who think only “the rich” own these things… take a guess what your pension is invested in. Take a guess what ultimately funds the tax revenue that backs future social security payments.

Sorry the idiots in the media don’t spell this out, but no one said brains/understanding was required to write newspaper articles

I can’t help but notice there is a LOT more credit in the system than when we started Ray Dalio’s “beautiful deleveraging” …as Bernanke “saved the world” by stealing his child’s credit card.

“Would it be possible to re-open the gold window at this point, or is there no going back”

At a minimum, It would take a global currency crisis. I believe one is coming but I doubt it happens still.

Keynes wanted the “bancor”

It looks like the failed Target2 system of the ECB

It doesn’t matter if one uses gold or “bancors” or unicorn hooves… it no one even pretends to obey the rules, then the rules don’t matter.

Gold keeps the politicians somewhat honest, because they can’t print gold. They can print bancors like drachma or pesos, so bancors are a stupid idea

A global currency crises would be the circumstance that may force a reopening of the window, but I guess I’m wondering if Mish were elected president, what would prevent you from ordering that the window be re-opened? Is the problem just that we haven’t had a president with the will to do it? Or, is there a bigger reason, like taking away the ability to deficit spend, or something else that prevents it?

Sorry, if this is a dumb question for this forum.

Would it be possible to re-open the gold window at this point, or is there no going back? Are we just too addicted to deficit spending, or some other reason why it’s impossible at this point?

Or maybe we don’t have the reserves to cover all of the dollars?

There’s always enough gold, it just depends on the price. The Treasury could float the price of gold at the window to reach a price at which gold was not flooding into or out of the treasury.

Well, that doesn’t seem right. If there was only one bar in reserves, all those dollars would be practically worthless. Seems like there needs to be some balance between the number of dollars and the amount of gold in reserves. What am I missing?

… if we were to go back to the gold standard, and maintain the current buying power of dollars, I mean.

Franny is right, the ‘not enough gold’ argument is bullshido. It all boils down to is the ‘price’ settled upon. If you don’t understand that please don’t get involved in this discussion.

Probably there’s no going back. Fractional order chaotic system: See the graph of a simple one here:

Imagine that you have to follow the line, spiraling out, then switching to the inside of a different spiral….

Basically, trying to go back disrupts enough actors’ supply chains, that the economy and political system breaks to a very different system.

Probably there’s no going back. Fractional order chaotic system: See the graph of a simple one here:

Imagine that you have to follow the line, spiraling out, then switching to the inside of a different spiral….

Basically, trying to go back disrupts enough actors’ supply chains, that the economy and political system breaks to a very different system.

Creditors owe Germany close to a trillion Euros.

Someone tell me how that will be paid back

Pay back by denuding debtors of their sovereignty.

All part of creating a single supra-national entity that serves Germany well.

Debtors can’t go anywhere and neither can the creditor.

It might cost more if the tried to achieve the result via other means. A trillion might be a bargain.

Well I remember when 2300 lira in Italy bought a lot and was only worth £1. We’ve all seen the pictures of a couple of trillion Reichmarks in a wheelbarrow going to buy a loaf of bread. There wouldn’t be much civilisation left. Perhaps all those 1%ers know what they are doing buying remote farms in New Zealand.

Mish asked “Creditors owe Germany close to a trillion Euros. Someone tell me how that will be paid back”

Carl von Clausewitz explained that war is merely an extension of politics. When you get big government, you get big politics. When you get big politics, you get big wars.

If history is any guide, Europe usually settles its debts with a nice friendly continent-wide war.

WW1 wasn’t the first EU war. Napoleon et al wasn’t the first EU war either.

It can only be paid back if Germany is willing to spend the money. Otherwise it appears practically and mathematically impossible. If the other countries paid it back where would the funds go? Realistically, as long as Germany chooses to run a current account surplus it cannot be paid back, because it continues to bring in extra money that is unspent and therefor, forced into the banking system. It appears that due to the Germans fear or hatred of debt that they would rather lose the money than spend it. In order to spend the excess private savings someone in Germany (e.g. the government) needs to borrow some of the excess German savings and spend it on things to benefit the German people. But this is deemed unacceptable, and instead the excess German savings must be forced into other countries who cannot repay unless Germany is willing to spend.

Got it in one. I don’t know how you persuade the Germans to drop the habits of generations though. Most North Europeans-Dutch, Finns, swedes Danes and Norwegians are broadly the same, thrifty beyond belief.

That view is false. What Germany owns is a pile of Target2 debt created by credit given to various EU countries. What you are suggesting is to create more German debt, funded by other EU countries, so that the Target2 balance appears equal.

The only “proper” way to redress this circumstance is for Germany to buy in trade from other EU countries, and for that flow of payment to be used by those countries to repay their debt, which Germany holds. This means that Germany must give up its competitive model of production. This is not likely, plus it would take a long time, plus other countries might not repay anyway, plus it is a private choice of German citizens not government policy that ultimately decides. For now Germany has ECB negative rates pushing money through the financial system to keep everything solvent, including payment of credit Germany issued directly or indirectly to other countries.

You view does fit in with recent financial advice that Germany must spend more or be without national debt within twenty years, all in the name of combating (artificially created btw) “crazy negative yields” . Actually I don’t think Germany is keeping public debt to gdp low because it is caught up on savings, after all it funded vast amount of debt to other countries, which are actually an investment with liability until repaid . I think it is a tactical move, if not limited by own constitution.

Your comment on gstegen is a distinction without a difference. He is saying that Germany will have to spend money. You are saying that Germany must buy stuff. What we have is the theory of surplus value written in spades. Until Germany recycles the money then the EU, and the world, stays as is is-not a good prospect. How you persuade the Germans to spend is a whole other problem.

I am not saying Germany has to do anything.

You are confusing existing debt and money, new government domestic spending based on further debt creation, and private spending to abroad from deposits and private savings and earnings, as opposed to on domestic produce.

I suggest you take your economic and monetary perspective back to square one.

Debt is money. On one side it is credit on the other side it is liability. I am saying that Germany has to do something. It has the money already and does not need to spend by increasing borrowing, it can spend its reserves. Germany does not need to have a government surplus of €26 billion, or a current account surplus of €240 billion. Perhaps we need to think in terms of the EU providing a counterbalance to the BRI?

It won’t be paid back. Period.

“BTW I think it has been said before, but the vast majority of Germany’s exports are to other EU countries”

Even assuming that were true, this is not as if someone in California owes someone in Illinois $100

Germany, Spain, and Italy etc., all have central banks

The Target2 liabilities in the Eurozone are monstrous. It is a measure of capital flight.

There is no way these debts can be paid back and precisely why Draghi wants the countries to commingle debt – in violation of the treaty that created the Eurozone

Mish — I was not BSing the figures about trade. I was surprised by the initial comment that Germany would be more affected because my recollection was that the vast majority of Germany’s trade was with the rest of Europe. So I checked the figures directly from the EU’s central bank statistics. so I find your comment of “even Assuming that were true” frankly cheap and beneath your usual standard (BTW you could have checked yourself…)

The near neutral balance of trade that exists between EU and rest of world is due to German exports to ROW. Most other countries are negative. Meaning if German exports to ROW decline there is a big economic effect as Germany no longer has nor supplies that neutralising position. Meaning it becomes just another EU country trying to sell its wares to others in EU, all caught in the same distressed market and debt imbalances.

I have an idea.

Let’s take credit, itself a measure if inflation, then inflation-adjust it so it seems the problem goes away.

Then you have whoever is assigned the credit staking claims with the new money, and everyone else paying for it via inflation, but as a whole it looks equal once inflation adjusted. The person with first access dissapears as a miniscule fraction compared to what everyone else experiences, therefore his profit gets ignored. Capitalism for socialists for you, money supply being a social phenomena in effect. Government debt and spending is a public version of this, but its debt is nowadays the reserve currency within the nation given it backs currency and can be effectively monetised by the central bank. How’s that for confusing, no wonder we all need to be managed /s !

Recent good interview with William White on the Hidden Forces podcast. Worth a listen. Unintended consequences abound in the CB, currency field.

Gold is a countermeasure.

BTW I think it has been said before, but the vast majority of Germany’s exports are to other EU countries. Sure US is $100 billion and China is #5 at 76 billion, but taking together Germany’s EU trade partners (including Switzerland) are nearly $500 billon. So yes its a problem but if the EU is one nation (hahaha) then It’s #1 & #5 account fo about $180 billion or about 10% of trade….not inconsequential but also not that bad either. Also while Germany exports $107 billion to the US it imports $187 billion — so again some stats have to be used with care

Yes, but the EU is in recession, so …

Yeah but we are talking about the impact of a “trade war” not a recession…it’s not the same thing, although workers may find that for them it feels the same. Nevertheless, Mish here was talking about the impact of a trade war — and that Germany would be hit worse than America or China (for different reasons).

Also, and this has been a big talking point for Trump’s crew that the trade imbalance favors America (when talking about China trade war), well the problem here is that the trade imbalance favors Germany; America’s producers have more to lose than German producers (BTW its all bad)

The Euro has had a relatively free ride (defended by IMF vs problems in Greece) and shielded massive exporter (Germany) whilst operating out of a market fairly closed to the rest of the world – tariffs etc.

The Yuan is not manipulated by comparison in my humble opinion.

Meanwhile Japan and the EU are bulking up with OTA (open trade area, not FTA) and now this – trying to help each other –

Though I agree with most of what is written there Mish , and that from a perspective of balance in terms of national economy (and therefore society) reserve status is a negative in many ways, to me the plain fact is that by outsourcing production using power of unlimited finance couple with a national and private debt boom, was chosen for the effect of wealth it created. I don’t say society chose this openly, in many ways people are just subject to offer, to economic reality and so will take the route that seems most rewarding presented to them in their day to day.

So as a genx roughly, I have watched who has accumulated wealth, which generation, and it happens to be the same that are now complaining that their investment doesn’t yield. It shouldn’t be that way, but I don’t feel too sorry for those in that position. Genx are almost a lost generation, millennials are coming out saddled with debt into a world with fewer realistic opportunities at forming any kind of stable household, and a large share are calling for extreme socialist solutions. It well and truly sucks.

The irony is that almost all of the above see easier money as the solution. They don’t want asset prices to drop, they want to roll their debt and then some, they want easier mortgages and the price rise will be someone else’s problem, and so on.

So reserve status was a purposeful tool, but the resulting reality is a trap where reliance is placed on financial and social management. Many countries have taken this route, reserve status or not. They say it is to float own economy, to counteract the devaluation others are undertaking. It is therefore already a currency war where different countries try to outfinance each other, reserve status is a bonus in that war. This whole creates a positive for combined corporate endeavour and political management of society via socialism, because of access to new money.

You would think all the top tiers of the various countries had schemed to create this reality, and if not then they all caught on to the same idea as solution.

Inflation adjusted credit has increased 1% a year over the last 48 years.

$1.7T in 1971 is $10.7T in 2019 dollars. Increasing that at 1% annually, compounded, gives a total of $18T.

Lol. Try $73 trillion, numbnuts.

Triffin Dilemma-Palooza!

“A currency crisis awaits as the current path is not sustainable.

Timing and conditions of the crisis are not knowable. It can start anywhere but I suspect the EU, Japan, or China as opposed to the US.”

…

Dominoes

With $US as the caboose

DXY sitting at 52 week high. King Dollar going nowhere anytime soon.

I have $25 chip down on China imploding first … based on population growth and employment / population … they need to create 10 million new jobs annually to keep status quo. Good luck, Xi … as global economy screeches to standstill.

Yup. I’ve always said the hardest thing for governments to do is to quell the population once the tide goes out on employment. It will be most difficult for China and India which represent the largest and fastest growing population as their age demographics necessitate more growth just to keep up.

It’s alright Tony, as Australia is importing heavily from both nations at present so will bring balance to the situation 😉