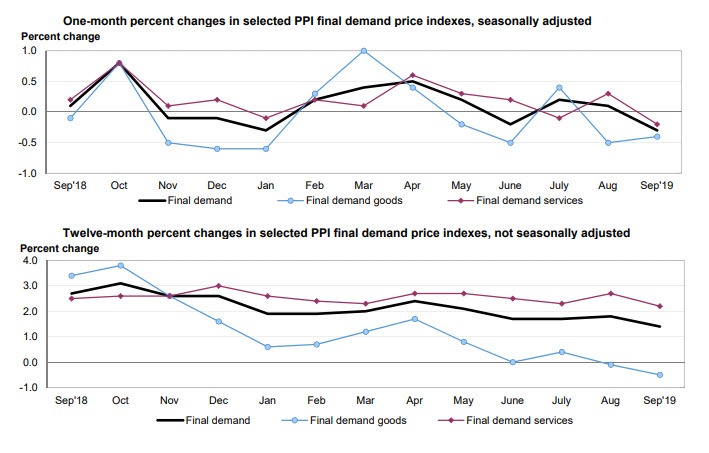

Economists in the Econoday survey expected the PPI to rise 0.1% and the core PPI (excluding food and energy) to rise 0.2%. Both measures fell 0.3%.

Inflation at the producer level had been flat and unexpectedly went into reverse in September, down 0.3 percent on the month both overall and when excluding food and energy. Year-on-year prices fell 4 tenths to 1.4 percent overall with ex-food ex-energy down 3 tenths to 2.0 percent. When excluding food and energy as well as trade services, which track input prices for wholesalers and retailers, prices were unchanged on the month and down 2 tenths on the year to 1.7 percent.

The BLS report on Producer Prices has more details.

Final Demand Services

- The index for final demand services fell 0.2 percent in September following a 0.3-percent increase in August. Leading the decline, the index for final demand trade services decreased 1.0 percent. (Trade indexes measure changes in margins received by wholesalers and retailers.)

- Prices for final demand transportation and warehousing services also moved down 1.0 percent. In contrast, the index for

- final demand services less trade, transportation, and warehousing climbed 0.3 percent. Product detail: Nearly half of the September decline in prices for final demand services can be traced to the index for machinery and vehicle wholesaling, which fell 2.7 percent.

- The indexes for automotive fuels and lubricants retailing; apparel, jewelry, footwear, and accessories retailing; airline passenger services; gaming receipts (partial); and professional and commercial equipment wholesaling also moved lower.

- Conversely, prices for hospital outpatient care rose 1.1 percent. The indexes for bundled wired telecommunications access services and for food and alcohol wholesaling also advanced.

Final Demand Goods

- The index for final demand goods decreased 0.4 percent in September after a 0.5-percent drop in August. Most of the September decline is attributable to prices for final demand energy, which fell 2.5 percent.

- The index for final demand goods less foods and energy edged down 0.1 percent. In contrast, prices for final demand foods moved up 0.3 percent.

- Three-fourths of the September decrease in the index for final demand goods can be traced to prices for gasoline, which fell 7.2 percent. The indexes for electric power, iron and steel scrap, basic organic chemicals, fresh and dry vegetables, and light motor trucks also moved lower.

- Conversely, prices for meats rose 1.9 percent. The indexes for liquefied petroleum gas and pharmaceutical preparations also increased.

Processed Goods for Intermediate Demand

- The index for processed goods for intermediate demand moved down 0.4 percent in September following a 0.7-percent decrease in August.

- Almost three-quarters of the September decline can be attributed to prices for processed materials less foods and energy, which fell 0.3 percent.

- The index for processed energy goods moved down 0.7 percent. In contrast, prices for processed foods and feeds advanced 0.7 percent.

- For the 12 months ended in September, the index for processed goods for intermediate demand decreased 3.4 percent, the largest decline since dropping 3.7 percent for the 12 months ended July 2016.

- Over half of the September decline in the index for processed goods for intermediate demand can be traced to prices for basic organic chemicals, which fell 3.8 percent. The indexes for gasoline, commercial electric power, fabricated structural metal, agricultural chemicals and chemical products, and residual fuels also moved lower.

- Prices for prepared animal feeds advanced 0.9 percent. The indexes for diesel fuel and for hot rolled steel sheet and strip also increased.

Unprocessed Goods for Intermediate Demand

- Prices for unprocessed goods for intermediate demand fell 1.4 percent in September following a 1.0-percent decline in August.

- Over half of the broad-based decrease in September can be attributed to the index for unprocessed foodstuffs and feedstuffs, which moved down 1.9 percent. Prices for unprocessed nonfood materials less energy fell 1.6 percent, and the index for unprocessed energy materials declined 0.8 percent.

- For the 12 months ended in September, the index for unprocessed goods for intermediate demand dropped 10.1 percent.

- A major factor in the September decrease in prices for unprocessed goods for intermediate demand was the index for slaughter cattle, which moved down 3.7 percent. Prices for iron and steel scrap, slaughter barrows and gilts, crude petroleum, slaughter chickens, and raw milk also fell. In contrast, the index for ungraded chicken eggs increased 55.2 percent. Prices for coal and gold ores also advanced.

The major story isn’t the headline numbers but rather what’s happening at the intermediate level. Eventually prices at the intermediate level make it to the final demand numbers.

Inflation-wise, this report was much weaker than it appears at first glance and as reported by most media.

Mike “Mish” Shedlock

SKILLED labor costs are skyrocketing… that is if you can find someone with skills who can also pass a drug test.

If a business doesn’t have the skilled labor to use the parts, then why the &*() would they buy inventory they can’t use? What are they supposed to do with a warehouse full of raw materials, and not enough skilled workers to assemble the raw materials into finished goods?

Financing raw materials doesn’t happen at fake Fed rates — creditors charge a LOT more, and if that the collateral is losing value (sitting on the shelf with no workers to use it) — the haircut on collateral value goes up, meaning financing costs are even higher.

The education system in the USA is broken, and filling another wing of each school with administrators and social workers is not going to teach the three Rs to anyone

I thought tariffs were supposed to be inflationary.

Velocity of money at an all time low is the reason prices are falling.

Well, when 0.1% of the population has 50% of the money, what do you expect?

And yet, I go to an American Supermarket this week and prices are higher than they were six months before, and there are even more signs of “Shrinkflation.”

The major story ….

…. “unexpectedly”

A month ago I predicted economy would worsen quicker than “experts” expected going into year’s end.

Economy so flat on it’s ass dead (collapsed)that with all this around the clock non stop money printing for over a decade,massively growing govt,that there’s no inflation?Hmmmmmmm!

Quick! Expand the government some more!!!

Is this socialism? Im confused…Farmers union president slams Trump’s boasting about billions in farm subsidies: ‘He’s bragging about socialism’ Von Ruden, President Trump’s boast that U.S. farms are getting billions of dollars in subsidies is “absolutely ludicrous.”

Von Ruden said the “majority of farmers want to get our income coming in from the marketplace, from the consumers. We don’t want government handouts.”

And payrolls are always non-farm. Imagine if they did include farmers who are getting a handout. All politicians are politicians before anything else.

Is this socialism? Im confused…Farmers union president…

A union is like socialism.

A bumper crop of irony?

When did farmers stop wanting handouts? I seem to remember quite a few farm bills and disaster assistance bills, sometimes for too much rain and sometimes for not enough rain.

Even when it’s perfect, there is always a farm bill and money flowing with it.