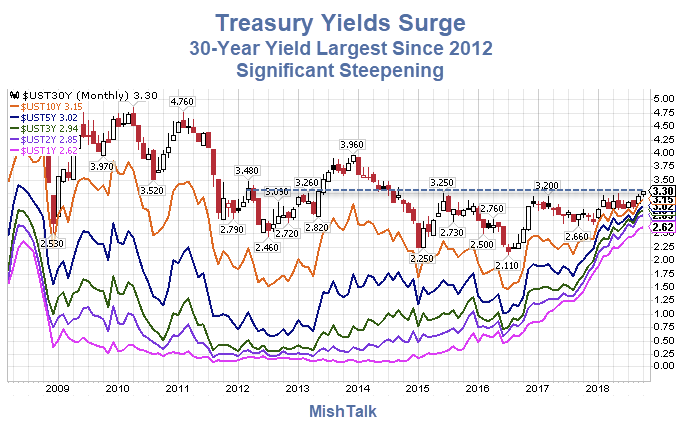

US Treasury yields jumped significantly today. The action was downright ugly for treasury bulls. And yields continued their rise into the evening, albeit slightly.

US Treasury Yield Action October 3

Six Reasons Yields May Be Rising

- The economy is getting stronger. The ADP jobs reports says the economy expanded by 230,000 jobs in September.

- Amazon hiked its minimum wage. Some expect the Phillips Curve to kick in.

- Fed chairman Jerome Powell is yapping about how strong and sustainable the US economy is.

- Hedging costs in Euros and Yen are high and rising. That makes US treasuries unattractive to foreign buyers who need to lock in gains in a currency other than dollars.

- Hedge funds are plowing into US treasury shorts.

- Trump closed a trade deal with Canada and Mexico

1) Economy is Getting Stronger

ADP says US Payrolls Expanded by 230,000 Jobs in September.

ADP runs hot and cold but that report could cause a yield surge. Jobs are a very lagging indicator, but the market focuses on the here and now.

2) Amazon

Amazon hiked its minimum wage. Some expect the Phillips Curve to kick in. The Phillips Curve theory is that there is a direct relationship between hiring and inflation.

The Phillips Curve is proven nonsense. A Fed study came to that conclusion, but it was obvious all along.

That does not matter one iota. What does matter is people believe in it. Janet Yellen was among the believers, despite the Fed study.

3) Jerome Powell Yapping Today

The New York Times reported today Fed’s Powell Says Strong Economic Path ‘Not Too Good to Be True’.

The Wall Street Journal reports Fed Chair Powell Sees ‘Remarkably Positive Set of Economic Circumstances’

4) Hedging Costs

Bill Gross says hedging costs make US treasuries unattractive for foreign buyers.

Zero Hedge has an interesting take and more charts in his post This Is Why Bonds Are Crashing, According To Bill Gross.

5) Hedge Funds Pile On US Treasury Shorts

Hedge funds are sort a record number of 10-year Treasury contracts. As long as shorts keep piling on, there is pressure on yields.

6) Trump closed a trade deal with Canada and Mexico

Part of the deal with Mexico involves and increase in Mexican wages that unions want. This is pretty feeble, as well as disputed, but some may believe it.

Assessing the Six Reasons

To assess the six reasons, we need to separate short-term factors from long-term factors.

Short-Term Reaction

To explain today, look at ADP, Jerome Powell, Amazon, and possibly Trump’s trade deal, in that order. The latter is the weakest of any of the theories.

Alternatively, move Jerome Powell into the top spot, ahead of ADP.

Long Term Reaction

Bill Gross may indeed be onto something with his hedging theory.

And clearly, a build-up in treasury shorts does not help.

Expect a Huge Snap-Back

Without a doubt, there will be a huge snap-back huge at some point.

Record numbers of hedge funds all believing the same thing as the Fed is 100% guaranteed to be wrong in a major way.

The only question, as always, is timing.

Mike “Mish” Shedlock

3.24 eek!

Maybe we are over analyzing all of this…

3.23 on Friday .. still high …..

Next day .. still at 3.19% 🙂 Killing the stock market today.

Once again, you miss the big driver – govt risk. Who wants to own long-term govt paper now? The sovereign debt crisis will ripple across EM, Europe, Japan, and then the US. Rates have been at a 5000-year low, and they will be going up for decades. Yes, they may retest the low, but they are going higher. The Fed has been raising rates because of the pension problem. It has nothing to do with the economy.

Perhaps bond traders fear that Bullard’s October 2nd editorial could become Fed policy? Did Bullard just join the ranks of Draghi and Bernanke?

Bullard: “The Risk of Yield Curve Inversion—and How to Avoid It”

Draghi: “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.”

Bernanke: “Deflation: Making Sure ‘It’ Doesn’t Happen Here”

This is all a temporary glitch. Is all this growth sustainable? I say no. Companies are guiding down. The Fed will tip the apple cart. When the US Gov tries to rollover all this debt at higher yields it is going to be a problem.

I agree. I’ve seen this played out many times. A sudden move in interest rates. People draw irrational conclusions. And then everything returns to normal.

It is also possible that the answer is None of the Above reasons. Traders can make — or lose — a lot of money on short-term moves, and so it is understandably a focus. It leads to a search for immediate causes, even though proximity does not guarantee causality.

Mish’s chart shows that yields have been rising for quite some time, over a period of 1 – 4 years, depending on what maturity one is interested in. That suggests the reason for the increasing rates is more likely to be secular than a response to today’s news. Maybe the steadily growing global debt is making investors more reluctant to hold government debt, requiring higher yields? Or maybe the reason is something else altogether?

My thoughts exactly. I guess we should increase the number of reasons to 7. Treasuries > deficit

“how strong the economy is” lol….that’s like maxing out a million dollars on 10 credit cards and callin yourself a millionaire !Which means a tsunami of moar money printing on tap……2 trillion (3)annual deficits ,soaring gov’t dependency,soaring prices,even chinamart raising prices……none of that is good!

Exactly. The economy is firing on all cylinders….unless you look at the hard data, the massive piles of debt, monetary and fiscal can-kicking that are propping it up. It will be interesting to see how the housing market reacts to this nice little bump in yields. Homebuilder stocks certainly were not amused.