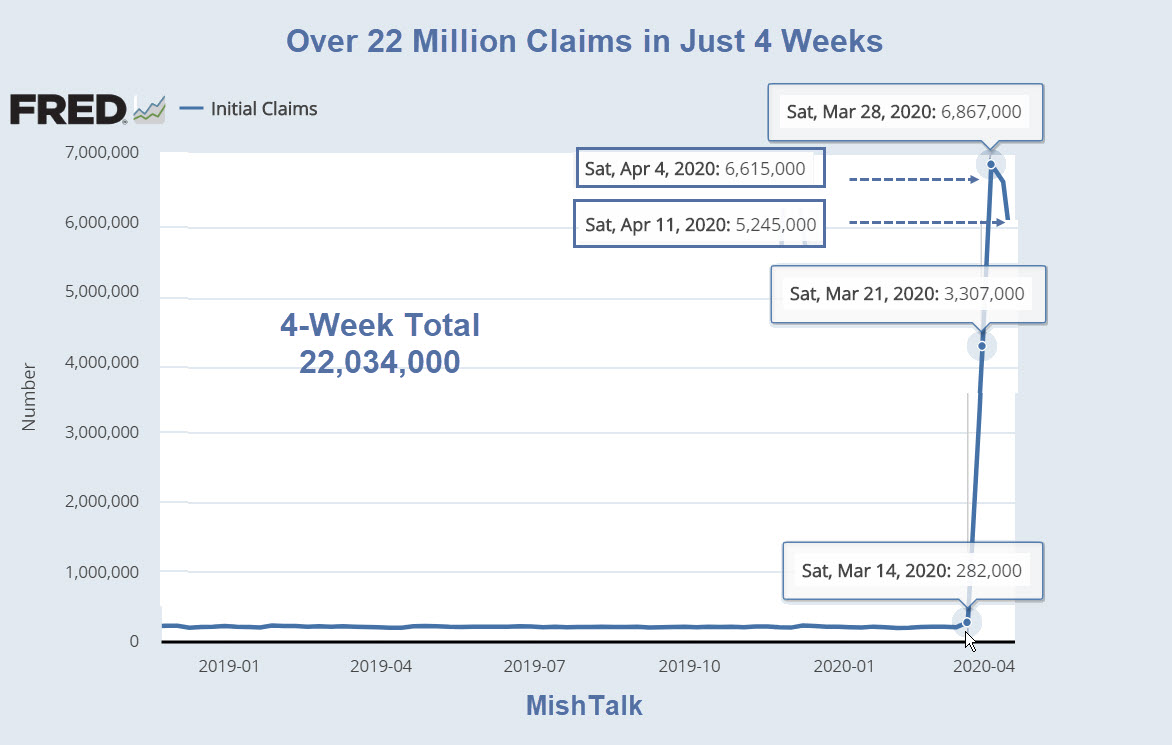

With each passing week the grim stats add up. But it also makes it easier to estimate the unemployment rate for April.

Let’s crunch the numbers starting with totals from the March Jobs Report and my understatement Unemployment Rate Jumps to 4.4% But Worst is Yet to Come.

Household Survey Numbers

Unemployment Rate Calculations

The unemployment rate does not come from caims. Rather, it comes from a phone survey in the week that contains the 12th of the month. That makes the current reference period April 12-18.

The March unemployment rate of 4.4% was wildly low (and will later be revised), because the reference week was before the mass layoff started. That will not be the case in April.

Estimate of Claims to Come

There are two more weeks left in the month. I estimate there will be another 6 million new claims in the next two weeks.

Estimate of the Unemployment Rate

If we assume claims approximate Household Survey answers and further assume the next two weeks of claims were unemployed in the reference period We can estimate the unemployment rate as follows:

(New Claims + Existing Unemployed + Estimate of Claims to Come) / Labor Force

22.034 Million + 1.353 Million + 6 million / 162.913 Million = 18%

I have done three such estimates in the past 4 weeks and this is the most optimistic one yet. My ranges have been in the 19-22% range.

Michigan Unemployment Rate

Michigan has been swamped with claims. Over a million people have filed for unemployment claims, out of a labor force of under 5 million.

A recent number crunch on Michigan yields an unemployment rate of 24%-29%, truly a disaster.

For details, please see Over 25% of Michigan Workforce Filed For Unemployment.

What’s Next?

For a 20-point discussion of what to expect, please see Nothing is Working Now: What’s Next for America?

The huge fear now is How Do I Pay the Bills?

This is the second crisis in 12 years. These scars will last.

No V-Shaped Recovery

Add it all up and you should quickly arrive at the correct viewpoint: The Covid-19 Recession Will Be Deeper Than the Great Financial Crisis.

Mike “Mish” Shedlock

Of the thirty million small businesses in America, only 1.7 million received money from the 2.3 trillion dollar aid package. The promise of help from the Paycheck Protection Program delayed mass firings from the 54 million Americans employed by small businesses but now that the government has failed to come through the carnage is about to begin. More details in the article below.

There is an assumption that the current infection surges will run their course and then the economy can open up, tough we need to be wary of a second surge. But much of Europe is supposedly in lock down. The rate of infection growth has slowed, but there is no indication it is under control. In some countries including the USA it may be too late to ever arrest the initial surge and the virus is now permanently in the wild, same as flu and rhinovirus. But more deadly.

This means heavy restrictions may have to be abandoned and people will just have to deal with social contact and travel being more dangerous that it used to be. Travel to countries where the virus is contained will be heavily restricted. And of course their may never be a vaccine, but presumably there will be treatments.

I hope governments are working on Plan B.

A lot of it will depend on if the household survey is close to the UI claims.

The unemployment numbers together with the stock ownership distribution by wealth shows pretty conclusively that the Fed and Wall Street are just laughing hysterically at the majority of people in the country as they poke fun at stories about “wealth gap” and keep on widening it to their hearts content.

“April’s employment numbers could be highly skewed since many companies surveyed for the BLS survey are on hiatus.”

The BLS does not survey companies or look at claims. It surveys individuals.

“Cantor Fitzgerald Slashes Jobs, Prepares To Cut More Amid Economic Downturn”

Another addition to the unemployment line.

week over week claims dropped by 1.4 million, could that be the largest drop ever?

This is probably why the stock market has been going up!

The economy is roaring back! This is absurd….

April’s employment numbers could be highly skewed since many companies surveyed for the BLS survey are on hiatus.

“This is the second crisis in 12 years. These scars will last.”

What scars?

As soon as the economy opens, it will be like letting out a megaton of starved people on a buffet. In fact, people will be prone to over-consume and get all their desires out of the way in case there’s a second wave.

There will be an initial surge in retail once things re-open. Long term there has been major damage to household budgets. All of the paycheck-to-paycheck people and those with insufficient savings are wiped out and many will give up lattes, Netflix, and anything discretionary.

anoop, your point is valid; I heard one Chinese woman, purportedly able to shop (I have VERY little faith in Chinese data/information), again, saying, “I’m going on a revenge-buying spree.” Interestingly, just before C-19 was finally regarded an enormous issue, I read an article explaining that Chinese consumer debt levels were high enough to significantly negatively affect Chinese GDP, and soon. How much debt can Chinese consumers handle before that buffet can offer only Spam and Raman?Interesting that C-19 began just afterward.

Landlords in denial as deflation beckons

Economists warn double digit house price inflation is about to turn into double digit house price deflation, almost overnight. Some landlords are even being advised to get out as aspiralling unemployment pressures rents lower https://www.newsroom.co.nz/2020/04/16/1129745/houses-of-pain-if-you-need-to-get-out

Debt deflation is on its way. Bankruptcy filings will go up overall both for businesses and individuals. Can these businesses take government bailouts and then declare bankruptcy and never have to pay back the zero interest loans they took out ? That would be the quickest way to a recovery imo.

The Fed will buy everything. Don’t worry. And the sheeples will be voting for it, not realizing that billionaires with massive liabilities will now be billionaires outright.

Welcome to Banana Republic: USSA.

That would be an interesting topic. Who is bidding up the market? There are always going to be some speculators who bid or gamble either up or down. But I have a hunch that this is more than just those individuals. Where are they getting the money from?

Not all stocks need to go down. Two that I own which are doing well are Clorox and General Mills.

Microsoft soared 30% since the bottom, while Apple has jumped 25%, Amazon has risen 24%, Facebook is up 21% and Alphabet surged 20%.

A large portion of these market moves are driven by ETFs and index funds.

Half of the 10 largest firms in the S&P 500 are IT or consumer discretionary comapnies.

The FED.

as self employed worker I filed yesterday for the $600 per week

my business is way down since no one can move and apartments don’t need much work done

besides I don’t want to go into their petri dishes of living

I’m seeing local businesses starting to shut down permanently. A gas station and fast food place (with drive-through) most recently.

The Trump plan to re-open the economy actually looks promising. Bill Deblasio’s statement about waiting until August to begin reducing restrictions in NYC would be a disaster. People will not stay inside all summer in New York, it just won’t happen.

Exactly. Many small, local businesses aren’t coming back. I keep hearing idiots say “well they can get a loan”. LMAO stupidity abound. Not to mention where are all these people going to get jobs when many places won’t open up? The govt has 2 choices: keep paying or pitchforks. And you might get both.

Pitchforks? You mean guns, right??

I agree with that. I don’t think people will stay inside anywhere all summer. Support will wane the longer this goes on. It seems the government should be ramping up its capacity to test and trace in order to manage reopening to some degree by early to mid-May. I’m not sure it’s being done though. Germany is looking at gradually reopening because it does have a good testing regime in place.

The trump plan has a date?

well, trump does have a date… with Stormy Daniels.

Oil < $18 barrel

I filled up at the local Wally World and paid $1.68 a gallon. I’m sure it will go lower.

My father told me he paid $1.44 in the Sioux Falls area. The closest station to me in California was $3.40 yesterday. I’m guessing the California price includes many things other than the cost of oil.

10 bucks and I’ll be loading up.

Buy that F-250 in a few weeks when the dealers get desperate.

“A recent number crunch on Michigan yields an unemployment rate of 24%-29%, truly a disaster. “

…

Explains the protests there to open up business.

Whatever the number, it will get worse.

As illusions of V recovery are dashed.

The cash burn has to be downright awful now.