Another Bazooka to Nowhere

In yet another act of Fed desperation, Big Banks Get Blessing to Extend Leverage.

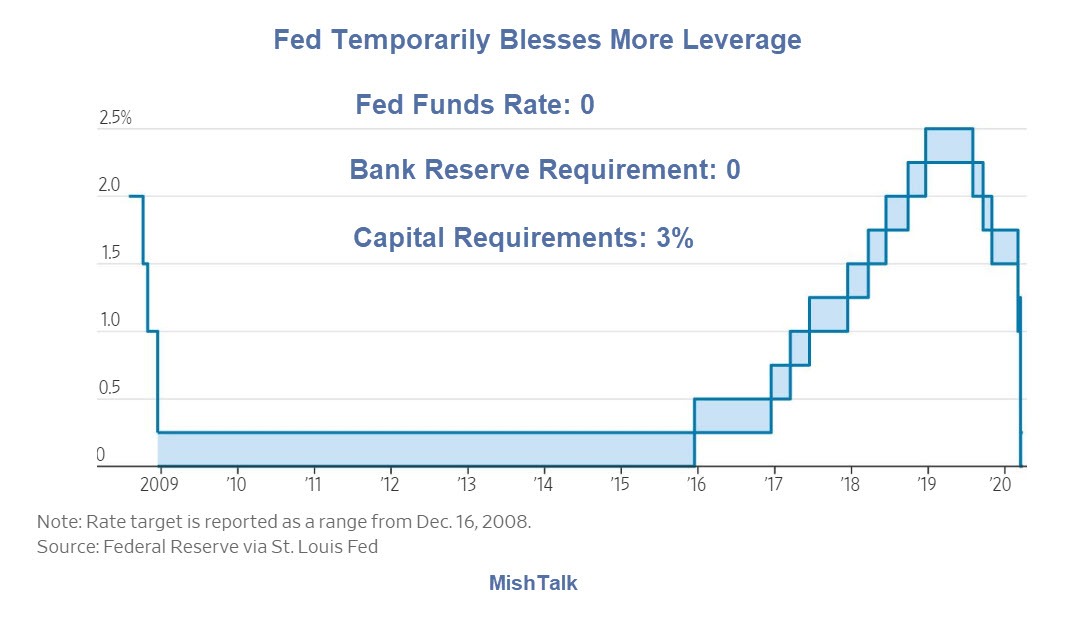

To ease strains in the Treasury market resulting from the coronavirus and increase banking organizations’ ability to provide credit to households and businesses, the Federal Reserve Board on Wednesday announced a temporary change to its supplementary leverage ratio rule. The change would exclude U.S. Treasury securities and deposits at Federal Reserve Banks from the calculation of the rule for holding companies, and will be in effect until March 31, 2021.

Liquidity conditions in Treasury markets have deteriorated rapidly, and financial institutions are receiving significant inflows of customer deposits along with increased reserve levels. The regulatory restrictions that accompany this balance sheet growth may constrain the firms’ ability to continue to serve as financial intermediaries and to provide credit to households and businesses. The change to the supplementary leverage ratio will mitigate the effects of those restrictions and better enable firms to support the economy.

As the Board has previously stated, financial institutions have more than doubled their capital and liquidity levels over the past decade and are encouraged to use that strength to support households and businesses. The Board is providing the temporary exclusion in the interim final rule to allow banking organizations to expand their balance sheets as appropriate to continue to serve as financial intermediaries, rather than to allow banking organizations to increase capital distributions, and will administer the interim final rule accordingly.

The supplementary leverage ratio generally applies to financial institutions with more than $250 billion in total consolidated assets. It requires them to hold a minimum ratio of 3 percent, measured against their total leverage exposure, with more stringent requirements for the largest and most systemic financial institutions. The change would temporarily decrease tier 1 capital requirements of holding companies by approximately 2 percent in aggregate.

The change will be effective immediately and the public comment period will be 45 days.

Effective Immediate With 45-Day Comment Period

Why bother with comments?

Oh wait, I get it.

Banks will ask to make this permanent . They will also seek even greater leverage.

The Problems are Debt and Leverage

Excuse me for pointing out that the problems are debt and leverage.

So, how does encouraging banks to take on more debt with more leverage help?

Temporary?

And what about this “temporary” thing?

Will banks reduce capital ratios now if they believe they will have to go out and raise capital later?

Explaining the 3% Capital Requirement

If banks increase leverage then suffer a 3% loss, they will be wiped out.

Will they?

My best guess is banks have already taken huge capital losses but are hiding them under mark-to-fantasy options.

Recall that regulators suspended mark-to-market rules in March of 2009 and never restored them.

Estimating Bank Losses

The Fed increased the amount of leverage banks can have because banks have likely already taken a 1-2 percentage point hit to capital, if not far more.

If so, the Fed is not really encouraging more leverage. Rather the Fed just blessed the increased leverage that has already taken place.

Why?

So that banks will not be forced to raise more capital at this time.

What Can Possibly Go Wrong?

For starters, the Covid-19 Recession Will Be Deeper Than the Great Financial Crisis.

Also, please see Nothing is Working Now: What’s Next for America?

Mike “Mish” Shedlock

Reader Q: “is this just allowing the banks to make more loans, or does this allow the banks to actually buy more assets like Treasuries for their own account?”

Banks make loans under three conditions. All must be true.

The Fed can encourage but it cannot change the conditions

We´re gonna need a bigger chart…

This is the core reason behind the panic.

Every sane person has known that the collapse of the Great Pyramid of Bubbles (Some obscure Egyptian king I think) was going to result in a Greater Depression.

The Flu is the, not perfect but pretty bloody good, excuse. To quote the warmonger Rumsfeld : wrap it all up, related or not.

Mish: is this just allowing the banks to make more loans, or does this allow the banks to actually buy more assets like Treasuries for their own account?

Can we just admit that we have a nationalized banking system ? Same as many other countries do now. The idea that a bank isn’t backed by the government is kind of a running joke.

“With reserve requirements down to zero…”

Fog a mirror

The banks are going to be fine. Every dollar in the bailout will go through the big banks and they’ll take their cut. They’ll buy the trillions in new treasuries and flip them to the FED for a profit. I suspect JPM, BAC, Citi, etc.. will make at least $10b each off the new Quantitative easing. The FED will make sure of it. And the value of their current treasury holdings is going to go up in value.

“Recall that regulators suspended mark-to-market rules in March of 2009 and never restored them.” —Mish

Tells you all you really need to know.

Thanks for sharing. The take-away? Our financial system is now like “The Matrix”. A false universe where all interest rates are completely artificial and by extension all asset prices that move on the basis of borrowing and speculation. The bad part is that so many of us have plowed almost everything (look at what annuities, insurance companies, pension funds etc. own) into credit markets which could more-or-less go tits-up should there ever be honest price discovery for bonds and treasuries and what not.

“ So, how does encouraging banks to take on more debt with more leverage help?”

I guess the same way the thinking went 11 years ago. Can you believe we’re doing this again so soon? Wow.

Vault cash is gone. That is the problem at the banks right now.

You really do have to hand it to these dirty, evil bastards.

As US reserve currency status evaporates before our very eyes, they manage to keep the (paper) price of Gold ridiculously low.

WRONG! the US Dollar will remain the “Reserve Currency” for the foreseeable future.

Does anyone really think the Chinese Yuan is a better alternative?

Trust and value are still key…..

Value is predicated on trust… and we have elected an inept con man to lead the country. I live here, and I don’t even trust the dollar.

So why did the Governor of California say that Trump has been there for them? I guess he was lying….

The ‘con’ is China….

P.S. – how old are you? You understand what you’re talking about?

Not sure.

The US is largely a service economy that trades out its international position, so when international trade gets interrupted the US cannot claim that position ?

International reserves are held to access the US trade platform, if it is not working they might get dumped for something more tangible.

They aren’t suppressing anything. Do the math on the RMB price fixes for the Shanghai Gold Exchanges auctions. The SGE is the largest physical market in the world. These are physical gold transactions, not paper.

The fixes were $1559.68 / (troy) ounce and $1569.19 / ounce based on an RMB / $ conversion ratio of 0.140904 I used first thing this morning. So the fixes aren’t an exact conversion as the rate at the time of the fix would most likely be different but they will be off by less than $1 as outside of revaluations it moves very little.

The April GC contract LOW for all of yesterday was $1581.10. As I write this the bid/ask is above $1624 on both sides.

Paper is trading above what bullion in the non-retail dealer market is selling for.

Dear ALL,

If there was ever a picture of desperation, this is it! Having said that, the “Minsky Moment” is a LONG WAY OFF.

Life is a path of choices. The ‘Minsky Moment’ will arrive ONLY when the ‘greater fools than I’ realize that there is a viable alternative.

A viable alternative to the dollar requires many attributes, but one that is particularly important – it is safe and reliability. Meaning one can sleep at night without concern that what one thought they had, they actually still have.

Getting ready for debasing the dollar but the effects will take a LONG TIME.

I will not be making my credit card payment next month. Go leverage that.

“The Fed increased the amount of leverage banks can have because banks have likely already taken a 1-2 percentage point hit to capital, if not far more.”

…

I found quite interesting JPM most recent balance sheet revealed Treasury holdings grew around $60 billion to $70 billion … while loan growth stagnated. A “tell” that JPM sensed the jig about up on expansion … even without intrusion of virus.

*…and thus decided to flip the switch on the virus.

Fed preppin for TARP2.0 or the nationalization of banks,tens of trillions will be written off,credit card….$1trillion,autos $1 trillion,mortgages $1 trillion,REO’s /CRE’s…3-4$trillion,student loans….$2trillion,shale 2trillion and change,s,SBA’s…3tril (at least)…etc…etc..etc..and this after a decade of “recovery (lol)and a “booming”(LMMFAO)economy!

“Why?

So that banks will not be forced to raise more capital at this time.”

…

Yes … and kick the can a bit before TARP.2 comes in to play. Note that notice is for banks with $250 billion+ assets … ie: probably threshold for TBTF. Following last recession (and TARP) I read multiple articles from respected sources that Congressional members adamant (behind closed doors) to Treasury and Federal Reserve to do WHATEVER it took for them to ever have bail out big Wall Street banks. Again. Voters / taxpayers nearly revolted (I personally called / wrote probably a dozen lawmakers against TARP).

Fed needs to bribe those banks to help their fund raising efforts

And where was our wonderful federal government? Checking ratings on the daily press conference or managing WH infighting.

Say no more…

When all you have is a hammer, everything looks like a nail.

No ventilators? Cut rates and raise leverage.

No masks? Cut rates and raise leverage

Shortage of hospital beds? See the above.

Actually speaking of masks. Forbes has the following (TLDR, we’ve been exporting masks):