Economists expected 668,000 new homes would be sold in June. Instead, home sales fell 5.3% from a huge downward revision in May.

The initial report for May was 689,000. The revised number is 666,000. Thus, May’s reported 6.7% rise was 3.1%. But recall the jump in May was from a revised lower April.

A quick check of the Census Bureau New Residential Construction Report shows April was revised lower again today, from 646,00 to 641,000. The Census Bureau also revised March so taker all of the previous reported percentages with a heavy dose of skepticism.

Median and Average Sales Price Declines

Mortgage News Daily reports both median and average sales prices were down for the second straight month. The median price was $302,100 compared to $315,200 in June 2017. The respective average prices were $363,300 and $370,600.

Econoday Parrot Located

I located the Econoday parrot. He is alive and well on a new Econoday page.

Those of you expecting the parrot would find good news in this report will not be disappointed.

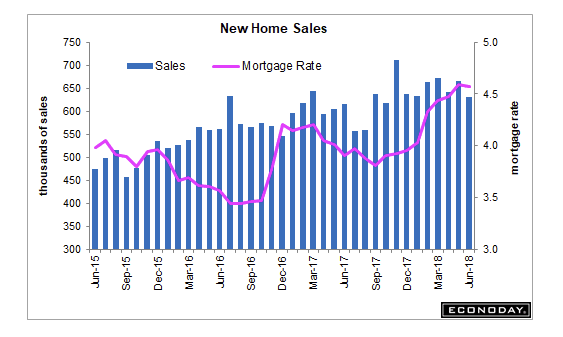

New home sales unfortunately join the host of housing data showing weakness. Sales fell 5.3 percent in June to a 631,000 annualized rate vs Econoday’s consensus for 668,000. The disappointment comes despite price concessions as the median fell a monthly 2.5 percent to $302,100. Year-on-year, the median is down 4.2 percent vs a 2.4 percent rise for sales.

But good news comes from supply which rose 1.7 percent to 301,000 new homes on the market. Relative to sales, supply is at 5.7 months vs 5.3 and 5.6 months in the prior two months.

Good News?

Supply is up because sales are down yet builders keep building on spec anyway. Supposedly that is “good news”.

Existing home sales appear to have peaked this cycle. New home sales my have joined the parade. For now,, the year-over-year trend is still positive.

Related Articles

- Housing Prices Hit “Breaking Point” Leading to Collapse in Demand

- Apartment Construction in 2018 Expected to Decline 11% After Strong 6-Year Run

- Existing Home Sales Decline Third Month Despite Rising Inventory

- Real Hourly Earnings Decline YoY for Production Workers, Flat for All Employees

- Housing Starts Unexpectedly Plunge 12.3% in June, Permits Down 2.2%

Today’s report adds one more bullet point that housing has peaked this cycle.

Mike “Mish” Shedlock

Good news if you want to buy a new home. Builders are wising up to the fact that most buyers have limited budgets. Affordability is still the key.

Any fresh data on mortgage defaults? 90 days delinquent?

Actually both interest rates and home sales have generally been trending up together. But correlation is not causation. People want homes despite the additional interest on their mortgage.

Real news/surprise would be a month/quarter in which prior numbers WEREN’T revised downward.

At this point, the initial reports/estimates can just be discounted 5% the moment they are released, as the belated downward revision is inevitable, like clockwork… you could set you watch by their regularity.

Could this be 2005 afa housing? This time round how bad can it get prices start falling.

“Supply is up because sales are down yet builders keep building on spec anyway. Supposedly that is “good news”.”

Yes, it actually is good news if affordability is desired, since an increase in supply will put pressure on prices. Now we just need to get the government/FED out of the marketplace and reinstate GAAP like it used to be and we might see houses priced as if the purchaser will eventually pay off the entire mortgage – like the old days!

When they put out these types of reports, do they speculate/allocate the root cause? Curious how much of this is driven by interest rates rising.