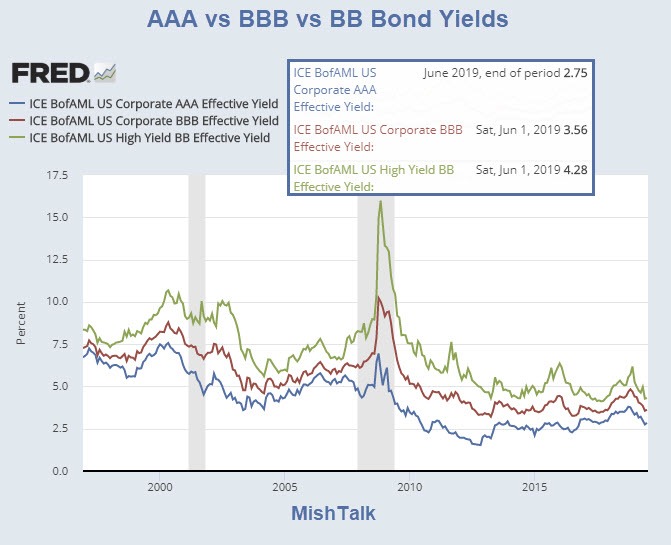

The highest grade AAA corporate bonds yield 2.75%. BBB-rated corporate bonds, just one step above junk, 3.5%. BB-rated bonds yield just 4.28%.

Corporate Bond Spreads

The spread between Prime AAA bonds and lower-medium grade bonds (see chart below) is just 0.77 percentage points.

The spread between BBB lower-medium grade bonds and non-investment grade, speculative BB-rated bonds is just 0.69 percentage points.

The spread between BBB and BB-rated bonds hit six percentage points in the great recession.

Bond Rating Steps

Chart from Wikipedia’s Bond Credit Ratings.

Volume of Negative-Yielding Debt Rises Sharply

In the real world, yields would never be negative. In the Central Banks’ bubble-blowing world, the Volume of Negative-Yielding Debt Rises Sharply.

- From a low last October of just under USD 6 trillions the value of the Bloomberg Barclays Global Aggregate Negative-Yielding Debt Index has more than doubled, increasing in value by over USD 7 trillions over the last 8 months to establish an all-time record of USD 13.2 trillions earlier in late June.

- The current situation is a manifestation of the inability of global financial markets to emerge from the era of ultra-low bond yields that central banks engineered in the wake of the global financial crisis.

- Non-conventional policies pursued by central banks in recent years have lead neither to a rise in sluggish rates of economic growth nor to an end in the disinflationary trends within the global economy.

Leverage on the Rise

Also, please note a $1 Trillion Powder Keg Threatens the Corporate Bond Market

Levered Up

- After a decade-long buying spree, many companies have pushed their leverage to levels that are typical of junk-rated borrowers in their sectors.

- Bloomberg News delved into 50 of the biggest corporate acquisitions over the last five years, and found more than half of the acquiring companies pushed their leverage to levels typical of junk-rated peers. But those companies, which have almost $1 trillion of debt, have been allowed to maintain investment-grade ratings by Moody’s Investors Service and S&P Global Ratings.

- This M&A-fueled leveraging of corporate balance sheets contributed to a surge in debt rated in the bottom investment-grade tier and now represents almost half of the outstanding market, Bloomberg Barclays index data show.

The above article and chart is from October 11, 2018. The leverage (and bubble) is bigger today.

BBB-Share Keeps Expanding

Wolf Richter explains What Happens When BBB-Rated Companies Try to Dodge a Downgrade to “Junk”.

In the next downturn, many bonds in the BBB-category will transition to junk, and many junk bonds but also some investment-grade bonds – if the past is any guide – will transition to default. Two-notch downgrades are not uncommon: one day you wake up, and your “BBB” investment-grade bond is a “BB+” junk bond.

To avoid a downgrade to junk, companies will try to shore up their balance sheet. This means curtailing or stopping share buybacks and slashing dividends.

This is a process GE went through. After blowing nearly $14 billion on share buybacks in the four years through 2017 to prop up its shares, GE stopped on a dime and transitioned to dismembering itself to pay down debts. The share buybacks stopped cold. Then it slashed its dividends to near-zero. And its shares have plunged.

GE now sports a credit rating of “BBB+” with negative outlook, three notches from junk, after getting hit by a round of two-notch downgrades late last year. Despite having already cut off some major limbs to reduce its debts, GE still has $97 billion in long-term debt. And GE is still trying hard to dodge further downgrades.

Richter’s article is from April 9, so again the situation is worse now than as-reported then.

Ultimate Oxymoron Alert

The Wall Street Journal provides the Ultimate Oxymoron Alert: Some ‘High Yield’ Bonds Go Negative

In the latest sign of financial markets going into uncharted territory, more than a dozen junk bonds, which usually carry high yields, now trade in Europe with a negative yield.

It is a stark illustration of how ultraloose monetary policies have turned debt investing into a choice about how to lose the least amount of money.

There are about 14 companies with junk bonds worth more than €3 billion ($3.38 billion) that are trading with negative yields, according to Bank of America Merrill Lynch. They include telecom giant Altice Europe NV and tech-equipment company Nokia Corp.

Everything Bubble

- Stocks

- Bonds

- Consumer Confidence

- Buybacks

- Faith in Central Banks

The “everything bubble” has at its roots central bank policy of yield suppression.

Central banks made it easy for corporations to borrow money for leverage buyouts, to buy back shares, and for zombie corporations to get enough funding to stay alive.

Investors (speculators actually), especially retiring boomers, are as optimistic as they were in 2007 when they viewed their own house as a retirement vehicle, not a place to live.

Investor Faith

Investor faith in central banks has never been higher.

At the individual level, baby boomers see the stock market is up so they buy a car and have a nice vacation.

Corporations borrow money to buy back their own shares or to make insanely leveraged buyouts.

Hedge funds buy low-yielding junk bonds in belief yields will get even more ridiculous.

Deflation Coming

The Fed is hell bent on producing inflation. The sad part is they do not now how to measure it. Inflation is all around us: In junk bonds, in equities, and in home prices.

The Last Chance for a Good Price Was 7 Years Ago

The Fed re-blew the housing bubble.

Those who fail to spot inflation in the above chart are clueless about inflation.

Bubbles B Goode

“Maybe some day, your name will be in lights, saying Powell cut rates tonight.”

Bubbles B. Goode: Musical Tribute to the Fed – MISH PRODUCED VIDEOhttps://t.co/fFT1wtxAdI

— Mike “Mish” Shedlock (@MishGEA) June 6, 2019

Equity Bubble Will Burst

The equity bubble will burst. I can even tell you when.

Unfortunately, my answer is useless: The equity bubble will pop when the junk bond bubble pops.

When is that? I don’t know.

Several years ago I thought we were in the 9th-inning. If we we were, then it’s the 12th inning now with all eyes on Powell.

But what Powell does now is irrelevant. The bubbles will pop and one rate cut or even four will not make a damn bit of difference.

Another very destructive asset bubble deflationary collapse is baked in cake.

Mike “Mish” Shedlock

God, grant me the liquidity to refinance,

The courage to pay for a negative yield,

And the wisdom to price the difference

I happened to take a look at Moodys (MCO) own debt/equity ratio, and gulped when I saw it at 43x. Can someone please explain how that works, before my head explodes.

CCC spreads have widened. Once the default rate ticks up, you’ll see the Bs and BBs widen as well. Unlike in prior recessions, nearly 40% of the leveraged loan market is rated single B. It used to be closer to 20%. As most of these are covenant light, they won’t have covenant defaults, but they will have payment defaults. I think things will start getting ugly in loan land this year.

The bubble is in govt debt and hubris. How can equities crash when capital is still transitioning from public to private?

In Jan expect a cost-push inflationary cycle, driven by currency and crop failures.

Your timing is off because you ignore cycles, and the influence of foreign capital and the invisible hand, just like the gold bugs who thought the dollar would crash and gold soar due to QE.

With negative govt. bond yields in Europe, are European corporates also trading with negative yeilds?

Deflation is a good thing in all of those sectors as long as your lifestyle isn’t dependent on high prices. The majority of especially young Americans would be happy seeing lower housing and equity prices. And none of these things actually effect the provisioning of goods and services, so who cares other than some bankers and stock brokers?

Deflation is bad because it feeds upon itself. Debt default, low demand, high unemployment, more debt default, etc. You get low prices because demand is low, money ceases to circulate and goods, services and assets are sold at bargain prices. If you owe a bunch of money or your money is tied up in assets then it becomes a scary time. If you are flush with cash and very liquid then you are king.

That’s the theory, and it proved out in the Great Depression. Now suppose the government used its efforts to limit the impact to the financiers and propped up the wealth production part of the economy instead of vice-versa?

Nothing to fear. Capital destruction already has happened, it only has to come to light.

The bubble has already burst in the energy sector.

Soon, the latest consumer item will be safes to avoid this problem… but why save a dwindling currency?

Because it is all we have.

What if the fed launches another round of QE in which they buy stocks and bonds all along the curve? That should keep the can rolling for another decade or three. Will anyone really be surprised if they do that?

Deflation is certain but I think “emergency” MMT (aka helicopter money or HM) can change that in a hurry. One scenario – the Fed (pressured by Trump), cites deflation as a reason to print and gives that $ to the Treasury, who sends it out as checks. The rapid increase in money supply would temporarily arrest the deflation.

In the same way the Fed was encouraged by the outcome of the original QE (to do more rounds of QE), so they would likely be encouraged by the initial “success” of HM. So after the effects of HM1 wear off and deflationary pressures re-emerge, there would be HM2.

You see where all this is going: WeimarBabwe

I suggest we are still far from the 19th-inning where EU/Japan are today. Wake me up when the game ends! LOL.

There are a number of reasons for investors to buy negative yield bonds:

There are a lot of scenario’s in which all of these reasons could blow up in their face.

And NONE of those are good reasons.

Just rationalizations.

But the rationalizations are turned into economic reasons, by central banks and governments promising to rob those not playing along with the nonsense, sufficiently that not dancing yields even more negative than keeping on dancing.

The West have been in the seedcorn burning phase of its secular decline for at least half a century now. The only game in town, is trying to be on the beneficiary side of the Junta’s seed corn redistribution rackets.

London house prices are cratering, I suspect this indicates a wider UK and international trend

-4% on insane high prices …..You call that cratering?

That`s just the beginning of a downtrend..

It’s always comforting to see the rating agencies on top of things as always. Oh my stars and garters, what would we do without the great analytical work by Moody’s and S&P!

Moody’s, and S&P did the same thing with mortgage bond

ratings. Propping the ratings up before the meltdown.

Three surefire signs you are dealing with clueless idiots:

yeah, reminds me of Goldman Sachs cooking Greece’s books in order to get Greece into the Eurozone and the subsequent cheap debt availability. S&P rated Greece A+ at the time …..and then it went bankrupt. Do trust the agencies !

Re: “The equity bubble will pop when the junk bond bubble pops.”

I would suggest that the equity bubble, the real estate bubble, and the junk bubble will all pop after the crypto bubble. Equities have real value, as they are a share of ownership of a company. Real estate obviously has value as well (well, most real estate). Even junk bonds have value, as they are promise to be paid by a company, a promise that might not be fulfilled, of course. In the end, cryptos are a data file. They aren’t backed by anything or anyone. The only value they have is that someone is currently willing to pay for them. Heck, even tulips had value – you could always plant them, and they were pretty.

With cryptos on a recent tear, I don’t see a collapse in equities, junk bonds, or real estate happening soon.

Could be a blow off top in cryptos will be the best indicator

?

When the fear comes in the next crisis, I expect cryptos to get a huge, but short-lived, boost based on the safe haven narrative. But no I’m not betting a dime on that, just a guess.

“Cryptos” is a worldwide “market” of all of 12 cents or thereabouts.

Also, none of the other pseudo “markets” have any value either. A share of some value destroying zombie, is net negative. Only covered up by central bank and regulatory theft. Ditto “real estate” priced to the point where even property taxes alone outstrips it’s intrinsic value, absent debasement mediated theft. And ditto bonds. Bring the dollar back to a hard gold peg of $20/oz, as the founders intended, and see how much value any of the above have, after debt service…..

All any of current so-called “markets”, are simply bets on central banks and governments being able to keep on stealing on behalf of their favored welfare queens, for just a bit longer. Chuck Prince keeping on dancing, IOW.

OTOH, the “value” of crypto, is that the “datafile” can be made sufficienly complicated to untangle, to render the crass, official theft underpinning near all the supposed “value” of the other “markets”, harder for the thieves to perpetuate.

Eventually, people do get tired of being robbed on behalf of privileged, idle, halfwits dumb enough to believe five year planning and picking lottery numbers is some form of useful economic activity. And, even if sufficiently heavy handed and universal indoctrination may stave off that day for a while: At the very least, negative value add thieves eventually do run out of the productive people they depend on robbing to keep the delusion alive.

“Equities have real value, as they are a share of ownership of a company.”

Ever hear of WorldCom, Enron or Lehman Brothers?

There’s so much fraud in the system and so many Zombie companies that there is far less “value” than perceived..

Yes, the market is not 100% efficient. Some companies are valued far too high, but it doesn’t detract from the point that when you own a stock, you own a proportional share of a company.

I would argue that the cryptocurrency market is far too small to matter. In part it is probably driven by excess liquidity, just as other financial markets are, but there is actually fairly little debt secured with crytpo assets compared to traditional asset markets. Also, I’m not sure how sensible it is to even compare cryptocurrencies to stocks or bonds, since the former are aiming to become media of exchange, while the latter are investment assets. Lastly, the often heard assertion that the lack of a tangible backing means cryptocurrencies have “no real value” does not withstand scrutiny either imo. First of all, cryptocurrency markets exist, seem to be quite lively and are growing at a fast pace (growth of the market is not just a function of prices – there are other indicators, such as e.g. the number of active wallets). These markets have developed due to the voluntary decisions of what are by now 10s of millions of participants – and I strongly doubt that they are all delusional. The value of a currency or any form of money is a result of the subjective value judgments of market participants. It does not matter whether the features that attract said market participants and are evaluated by them´are tangible or intangible. Of course it may one day turn out that the estimates of market participants regarding the proper valuation of cryptocurrencies are/were wrong – we will just have to wait and see. But the assertion that they “have no real value” is obviously erroneous, since a value is assigned to them 24/7.

Time to roll out 50, 100, and 1000-year bonds. It’s not that it makes any sense, but at this level of lunacy, why not? It will be repaid in convertible pebbles and shells…