The Econoday economists missed the mark badly once again in their housing estimates.

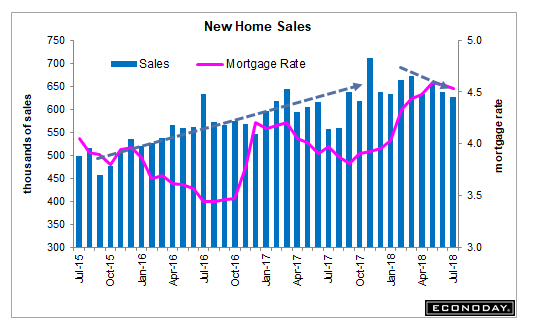

Sales in July slipped to 627,000 units seasonally adjusted annualized (SAAR), well under consensus and even lower than the bottom estimate of 630,000.

A revision took June from 631,000 to 638,000 but May was revised lower by 12,000 to 654,000.

By Region

- Northeast: -52.3%

- Midwest: +9.9%

- South: -3.3%

- West: +10.9%

Good News Parrot

Despite the obvious weakness in the report, the Econoday parrot found plenty of good news items to cheer about.

> Now the good news. Supply moved into the market, up 2.0 percent to 309,000 new homes for sale which is the best showing since 2009. More homes for sale gives buyers more choices in what will be a likely positive for sales in the coming months. Relative to sales, supply is at 5.9 months vs 5.7 and 5.5 in the two prior months.

> Another positive is a rise in prices, up a sharp 6.0 percent on the month to a median $328,700 for what is still, however, a modest 1.8 percent year-on-year increase.

> Regional data show both the West and Midwest posting strong monthly gains with yearly rates at 18.5 percent and 18.2 percent respectively. The yearly rate for the South is at 17.2 percent with, however, the Northeast, which is by far the smallest region for new housing, down nearly 50 percent.

> The overall year-on-year rate of growth is at 12.8 percent which if sustained would point to a badly needed uplift for the housing sector in general going into the second-half of what has been a very subdued 2018.

Supply and Price

The parrot is crowing about supply. It rose from 303,000 to 309,000. These are homes built on speck, that no one bought. Why? Most likely no one can afford them.

The parrot is crowing about the rise in price despite the fact that people are stretched to the limit already. Recall that NAR chief economist Lawrence Yun moaned yesterday that builders were not building enough homes.

Here’s my simple question: Who does not have a house that wants one and can afford one?

Year-Over-Year Fantasies

The parrot takes the cake on this one.

IF we had a sustained move of 18.5% year-over-year, not only would there be a boost to housing, the economy would be overheating.

The parrot never bothered to analyze WHY sales are up so much year-over-year.

Even if sales rebound in November to 650,000 units from 627,000 units today, the year-over-year percentage will be -8.7%.

Hurricane Distortions

Please recall that 2017’s three monster hurricanes — Harvey, Irma and Maria — Among Five Costliest Ever.

From January to July of 2017 sales were declining. Then there was an enormous artificial boost of new home sales and construction activities (repairs), in general.

Now what?

Yesterday I noted Existing Home Sales Decline Fourth Month.

Now builders are sitting on the most spec homes since 2009. Good luck with that.

Mike “Mish” Shedlock

If you build .. they will come. That works until the demographic that can afford what you build runs out. But, if credit is loosening like it is now they’ll find someone to put in the homes, and the banks are cool with that, since they more or less own the property, RE moguls, even Warren Buffet have purchased many local RE companies and are waiting in the wind to scoop them up when/if the time comes. No sweat, whale investors will come to the rescue of the next RE crisis if/when.

Even though RE is really booming, it’s still a buildup in borrowing/debt.

These economists seem to have a worse short term memory than my dog, who can’t remember where he left his tennis ball thirty seconds ago, let alone what garbage he was barking about last month.

They went on and on talking about how the ONLY problem is lack of “inventory.” Now all of the sudden inventory is piling up in terms of both new and pre-existing (used) homes, and that’s a “good thing?” What happened to all that “pent up demand” that was just waiting for all that sweet inventory to hit the market?

The explanation seems to be “great now the inventory is here, it’s gonna sell off over the next few months.” Um…that’s not how it works, if the demand was high inventory would not have a snowballs chance to “pile up” in the slightest, it’d be flying out the door faster than a Chinese foreign investor could unsnap his suitcase full of cash during a 2016 open house.