The Definition of Monthly

When the Fed stopped weekly reporting of money supply numbers I told a friend “they still report monthly”.

Yesterday, I pulled the latest numbers and I noted we need a new definition of monthly. The reports were nearly two months old.

I updated the chart just now and the data is now just a month old.

Here is the new schedule of Money Stock Measures.

“These data are released on the fourth Tuesday of every month, generally at 1:00 p.m. Publication may be shifted to the next business day when the regular publication date falls on a federal holiday.”

Two Month Lag

The Fed reports “monthly” data of numbers that it actually knows instantaneously, with a 1 to 2 month lag.

Changing Definitions

In addition to changing the frequency of reporting, the Fed changed the Definition of M1.

Seasonally adjusted M1 is constructed by summing currency, demand deposits, and OCDs (before May 2020) or other liquid deposits (beginning May 2020), each seasonally adjusted separately.

OCDs are Other Checkable Deposits. Other liquid deposits includes OCDs as well as money market deposit accounts.

What’s the Fed Hiding?

Steve Hanke, Professor of Applied Economics at Johns Hopkins University discusses the setup.

Key Quotes

- Before we get started let me remind you of President Bill Clinton’s maxim: ‘It’s the economy stupid.’ My maxim is ‘It’s the money supply stupid.’

- The reason is, money supply determines the course of nominal GDP. And nominal GDP includes real growth and the inflation rate.

- Chairman Powell has very explicitly claimed that money doesn’t matter in recent testimony. He’s basically said that money and the measurement of money doesn’t really matter because it’s unrelated to inflation.

- In principle, they don’t think [this data] is important. They want to deep-six the monetarists, basically and push them off to the sidelines. They want to bury Milton Friedman once and for all and be done with it, and their preference would probably to not report any monetary statistics.

Hello Fed, Inflation is Rampant and Obvious

Yesterday I commented Higher Prices at the Grocery Store as Ag Futures Surge the Most in 8 Years

More importantly, year-over-year home prices are up 11.2%, some cities even more. The Fed does not see this or count it if they do.

For discussion, please see Hello Fed, Inflation is Rampant and Obvious, Why Can’t You See It?

The problem for the Fed is bubbles burst, and this set is the biggest yet. Expanding bubbles constitute inflation. Popping is the reverse.

With nearly everyone looking for stronger inflation and higher bond yields please consider The Fed Wants to Stimulate Bank Lending, Charts Show the Fed Failed.

For further discussion of disinflationary trends please see comments from Lacy Hunt in my post Expect Inflation to Accelerate? Here’s 8 Reasons to Expect Decelerating Inflation.

Something has to give.

Mish

Some of you might enjoy this interview with Robert Schiller.

Inflation only occurs in consumable goods. The increase in the price of houses is not inflation, it is “appreciation,” because houses are assets, not consumables. I learned that in economics school. When the price goes up, if it’s a consumable it’s inflation, if it’s an asset it’s appreciation. You now have one leg that is longer than the other. Your leg is an asset, so your leg did not inflate, it appreciated.

I don’t think I’d appreciate having one leg longer than the other. 😉

There are two parts to rising house prices. There is “real appreciation”, which is independent of inflation, and then there is “inflation-dependent price appreciation”.

Real appreciation happens because land prices in good areas go up over time due to demand….and costs of building go up because of labor and materials cost.

Inflation is actually a multiplier for real appreciation. When they both happen at the same time, you can get some huge gains over a short period.

Anyone else see their cable/internet bill go up by 20% this last month? My spectrum bill did and they did not even bother to announce it, the bill was just higher.

I will have to cancel the TV, I only watch a few hours per week anyway, and that is just Saturday evening PBS. And news, but I can get that from the net.

I have a rule, whatever the government (Veterans disability and social security) gives as a COLA for my annual raise if we even get a raise at all, is the maximum I will pay in increased prices for the things I have to spend money on.

If it is something that I am compelled to purchase like auto insurance which by law I have to buy, and that goes up by 13% as mine did in February, then I still have to buy it, but I will look for a cheaper source, and if I cannot find it then I have to cut out other things. Or, like my homeowners insurance that rose 24% in April for no explained reason. Now cable up 20%, but at least part of that bill I can live without, I do have a library card.

If food goes up too much then I cut out that which rises unreasonably. For example frozen peas for some reason have gone up to more than double what they were last year at this time. And I do not accept Covid as an excuse since we have now had more than a full year for producers to figure out production and transport.

Unfortunately I have to do a home repair that will require some heavy timbers and those have gone up by more than 300% in the last year, and I cannot avoid that expense. Just as gasoline is up by almost 50%, I can try to drive less, but there is little hope of driving less when I already drove little.

In general I am estimating that my cost of living has risen in excess of 22% in the last year. But I have seen some spectacular increases that are well over double the price they were pre pandemic, I think the virus is being used as an excuse to gouge throughout the economy, it started small enough but as some gouged others had to increase prices to pay for that, pretty soon everyone was raising prices for everything till it took on a sort of auction mentality towards prices. That is they raise prices to the point where sales fall off dramatically then slowly and incrementally lower them to a point where sales start to recover and leave them there.

But I agree with Mish here and will say this is just the beginning of a hyperinflation wave. It is looking like people are planning to simply stop producing and lay employees off rather than accept anything less than maximum markups.

And there is an insidious side effect of inflation now taking place, a few things are not included on the CPI that have devastating consequences for Americans, housing is the largest item in most monthly budgets and that is up 12-22% in areas where most Americans live. This means the most fundamental item driving people into poverty is screaming upward at double digits.

I also believe that the so called poverty rate for a single person is now closer to double the official poverty rate which is still around $12k per year. If you make $24k you are one step above homeless in 80% of the nation. And in most urban regions you are already there.

I won’t use Spectrum for this exact reason. Around here they are known for giving people lowball starting rates, then jacking the price up, to astronomical rates. I’ve gotten offers from them for as little at $16.99, though more typically it is $29.99, but from people I work with, I know that it will go to as high as $60 for the same thing over a year or two. Some people like playing the game, and then when the rate gets too high, they call Spectrum and tell them they got an offer for $29.99 from some other company, and the cycle starts over. Spectrum cuts them to $29.99, then starts jacking it up.

I prefer not to play that game, so I use other service providers that are higher than Spectrum’s “teaser” rate, but which stay the same, month after month. If you do want to keep Spectrum, then you need to play their game. Find a teaser rate, from them, or some other competitor, and call them and demand they match it. They will … for awhile.

I don’t have cable and I don’t watch TV, other than the occasional movie on Netflix, using one of my kid’s account.

As a result I’ve never even watched networks like Fox, which came along after I quit TV. I don’t think I miss much by not watching TV. But I do get that entertainment is an important part of most people’s budget.

You’re probably spot on as far as the real poverty rate. I wouldn’t call this a hyperinflation, but it is significant.

Living overseas has the benefit of not being sucked into the usual news outlets or popular TV shows. Most of my news comes from wider sources with input from non-US origins. I know it’s hard to believe but I have never seen an episode of the West Wing nor Oprah Winfrey or Fox.

I gave up TV in 1985, so I hear you. The prices I was quoting above were for internet only. Specturm wants to you “bundle” your internet along with TV and a phone line, at which time they will try to push you towards $180/month.

1985!

That’s way before I bailed. I was gifted with free cable by a property manager friend for several years, but we let it go when our youngest was in middle school. Maybe 20 years ago now.

That roughly coincides with the time I was studying hypnosis, which I did for a couple of years. That was an eye-opener for me in terms of how TV uses hypnosis to affect one’s subconscious.

I always like to recommend this little essay by Richard Sutphen, who is (I think he’s still alive) a great hypnotist. I always wanted to study with him but never got around to it,

The Nine Points remind me of how it is working for a big company to the tee. or just about any large organisation for that matter.

If you live in rural America, your only choice for TV is DISH or DirecTV

…unless you are lucky enough to have affordable high-speed internet in the middle of nowhere.

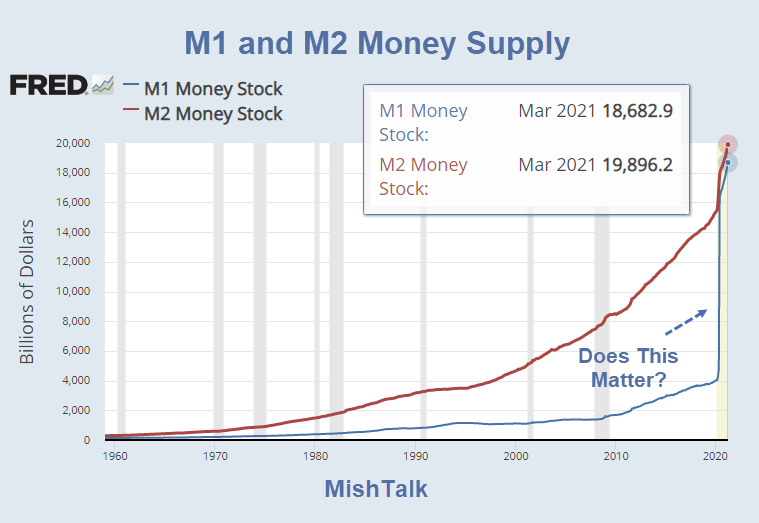

Hi Mish, on the chart you ask “Does this matter?” but don’t really answer the question.

I don’t think the question should be rhetorical given that the majority (IIRC) of the vertical leap in M1 your question addresses is due to the recent reporting change, rather than an increase in money supply.

If the arrow on the chart was pointing to the M2 uptick, I would say “Yes, it does matter”. Pointing at the M1 vertical, I would say “Not as much as this chart suggests”.

Things are crazy enough at the moment as they are, but I think that pointing to that M1 vertical without explaining the context is misleading.

Matt

The chart doesn’t only show the large increase in money supply, it also shows M2 has almost dissapeared. By that I mean that because M2 includes M1, almost all time deposits have gone, now replaced with cash or cash equivalent. This is really odd, and an explanation would be good.

That’s a good question.

The explanation is that M1 is a subset of M2, and a few months ago a reporting change was made that brought a whole bunch of extra savings from the ‘M2 but not M1’ part into M1.

So that big vertical leap (of which Mish asks “Does this matter?”) is a combination of real money supply growth (which probably does matter) and a reporting change (which probably doesn’t).

So the M2 chart is the one to focus on, if and when you can get an updated version.

Perhaps my previous answer doesn’t hit the spot because, rereading the question, I see you recognise that M2 includes M1.

So I will have another go..

The justification at time, as I remember it, was that restricted savings accounts (with limits on the timing of withdrawals) had become a much less significant part of the savings market, such that the majority of savings should be considered much more liquid, and therefore reported in M1 with the checking accounts.

So a sudden reporting change reflecting an organic shift in the nature of savings products.

The outcome is that there is very little difference between M1 and M2, which is how they justified dumping M1.

The FED is ramping up money supply to generate liquidity to help keep assets and debts from deflating. They don’t care about money supply-whatever they print or ease just gets stuck in keeping asset prices inflating so debt holders can get out with a net positive price. MOST OF THIS MONEY NEVER MAKES IT TO THE GENERAL ECONOMY AND THEREFORE gets stuck in assets. If assets go down in price, it’s money heaven. Deflation. Everyone is getting hung up on PRICE inflation. Not monetary inflation and velocity of money. Depending on what you buy itmay or may not be more expensive. I got a chopsaw for 170 bucks…thats cheap! Lumber is very expensive but that is due to migration issues and forest fires out west.

If m1 or m2 money supply determined “price inflation” we would be paying $100 bucks a gallon for gas looking at m1. Something is very wrong out there…so much sloshing money and its not getting out at all

What i think is ridiculous is the way housing is excluded from inflation measurements and owner equivalent rent is used instead (although names of this may be different for US and UK).

People rent shelter.

People own shelter + -inflation hedge- and its the inflation hedge that is increasing in price.

Does the argument that the increasing price of an inflation hedge is not actual inflation hold water? You could make that argument but I would disagree because we can see increases in shadow inventory i.e. that people will not sell because they fear debasement of the cash proceeds. These are all aspects of the cost of saving for a real income in the future is itself increasing in price.

What is worse is that (the extremely wealthy) Ray Dalio actually laughed when asked if he held treasuries, but these treasuries are forced onto the lower income demographic as a pension vehicle. Not to blame him of course.

This begs the question, if money doesn’t affect inflation, what does?

“When it becomes serious, you have to lie”

— Jean-Claude Juncker; Former EU President

Who wants to be guy who crashed the world economy.

I suppose this writing has been on the wall since the Fed stopped publishing M3 fifteen years ago.

When BLS manipulation isn’t enough, the next step is to hide the raw data.

Money does not cause inflation like guns don’t kill people. Money in the hands of people and businesses demanding goods and services at a rate that pushes the supply/demand balance out of equilibrium causes inflation.

The Fed obviously thinks hiding the stats, and changing the definition, is more important than the reduction of people’s trust in them. I doubt they care. They seem to be trying to make it more difficult for people to analyse and assess their actions. My trust in Central Banks has just gone down another notch or three.

Looks like the loopholes are going to be targeted. 99.6% of people don’t even know these exist.

“99.6% of people don’t even know these exist.”

That’s because we live in a country that is financially illiterate. What the Forbes article is talking about is “Wealth-Building 101”.

The problem I have, and the thing you should all think about….is not whether we should soak the rich….but rather do you want to live in a country that no longer has any upward mobility, because eliminating EVERY tax break that exists basically eliminates the ability of a motivated, smart individual to ever get above the level of what the Forbes article calls “the rich” (as opposed to the REALLY rich).

I get the impression at least, that many commenters here are younger high income professionals that fit into the first category. What Biden wants to do means you can never do better than that, because you won’t be able to make investments that have the kind of wealth multipliers that exist now.

You can’t easily save your way to financial freedom, no matter how hard you try. You can only INVEST your way there. And if the stock market is the only game in town, sooner or later most of you are going to be bag holders.

I’d say it’s more because most people don’t have enough money to make those loopholes worth pursuing.

Nearly half the rental units in this country are owned by individual investors. It will significantly affect ALL of those people if the “stepped up basis” comes to fruition. That’s not just billionaires. It’s widows and elderly people who might own a single rental unit.

“Most people” never had anything and never will have anything. The fact that many people are broke is not a reason for me (or you) to be broke.

What I’m talking about is that in this country we’ve always believed that through hard work, saving, and investing, that we can significantly improve our lot in life. The potential has always been there.

Raising taxes always makes it harder, which is one reason why it’s harder for young people now than it was for me. It was harder for me than for guys in my father’s generation.

When my grandfather was a young man, absolutely ANYBODY who could make change for a dollar could start his own business, and do okay. Today that’s a pipe dream. Taxation is the primary reason, along with regulation.

Whelp, his proposal today makes it official he wants to close all the loopholes that you and many others are using to create and pass on wealth.

I hope your going to start getting serious about a trust now (something I alluded to needing a month or so ago when Biden started spending and taxing).

He’s now theoretically spent 7 trillion dollars in less than 100 days. Trump barely spent that in 4 years!

I’m on it with the trust. I was on my way to that a few years ago but my lawyer got sick….people keep dying on me. (He made it but he drinks his beer through a tube now).

The way this is being sold is pure crap. This claim that it will only affect the uber rich is complete and total bullshit. See my comment this morning on the Biden Tax Proposal thread.

This is a major change that will impact markets significantly. I won’t sell out, but I am tempted to…just take all my gains and maybe buy some physical gold.

Hopefully this gets defeated. It’s sheer idiocy.

Because the first page of the 400 pages of the tax law says: Income from all sources is taxable. Then begins the 399 pages of exceptions.

“Chairman Powell has very explicitly claimed that money doesn’t matter in recent testimony.”

Money doesn’t matter- until it does. After all, the housing crisis was confined to subprime- until it wasn’t.

That was a lending problem. You can have money creation without the money really going anywhere but the stock market. That is what we have now.

Didn’t John Law also claim money didn’t matter. Then it depreciate to the point of being more valuable to start Paris fires.

The real question for me is “what happens to inflation when all the exported debt comes home to roost?”

That’s what I really really want to know. I suspect.

Seen what houses cost lately? It’s been coming back for a decade.

Pesky facts are so inconvenient when they interfere with the narrative the Fed wants to propagate. The CDC has been facing similar problems.

Well now I feel better… my two uncles and friend of 40 years died of a myth.

Not sure I understand your point. I’m not suggesting that Covid is a myth, if that is what you are implying.

Well, that did sound like the opening line of the typical “Covid is a myth” guy!

Only a conspiracy theorist could read that into my post. It seems like half the population believes anyone who would dare criticize ‘venerable’ institutions like the CDC or the Fed must be a raving lunatic.