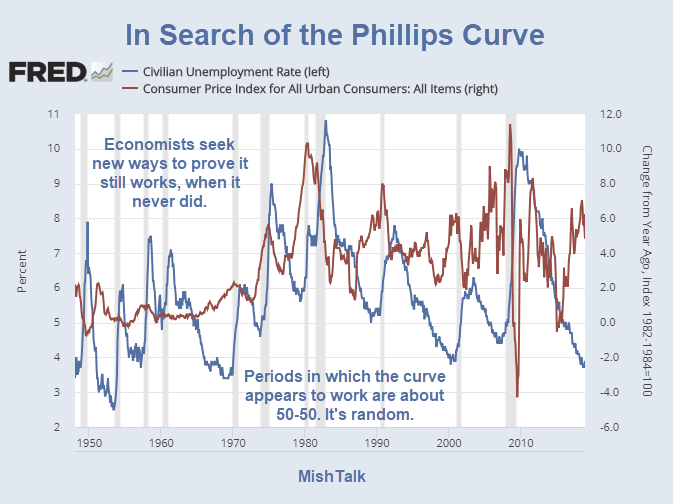

The Phillips Curve, an economic model developed by A. W. Phillips purports that inflation and unemployment have a stable and inverse relationship.

This has been a fundamental guiding economic theory used by the Fed for decades to set interest rates. Various studies have proven the theory is bogus, yet proponents keep believing.

For example, in March of 2017, Janet Yellen commented the “Phillips Curve is Alive“.

Cato noted the Phillips Curve Is Dead (except in Federal Reserve and CBO models).

On August 29, 2017 I noted that a Fed Study Shows Phillips Curve Is Useless. Yet, economists keep trying.

Low-Unemployment States vs High-Unemployment States

A new San Francisco Fed study released this week asks Does Ultra-Low Unemployment Spur Rapid Wage Growth?

The idea behind the new study was that we may not see wage growth inflation because we are looking in the wrong places.

The new theory was that wage inflation may be expanding faster in states where labor supply was tightest and unemployment the lowest. Check out the conclusion.

Conclusion

In sum, a careful look at the wage Phillips curve across states yields little evidence supporting the contention that wage growth sharply rises as the labor market reaches especially tight conditions. Of course, the current period may be different from the past. For instance, the typical pattern of local wage growth in a tight local labor market may differ when all other nearby labor markets are experiencing similar tightness, as is currently the case. As a result, geographical labor mobility—which can mute wage pressures in tight markets as workers are attracted to higher-wage areas—may be playing less of a restraining role. With this caveat in mind, given the historical experiences of states in recent decades, we do not foresee a sharp pickup in wage growth nationally if the labor market continues to tighten as many anticipate.

Notice how economists still cling to the notion that something may be different now. In reality, the Phillips Curve isn’t dead, it was never alive to begin with.

Absurd Inflation Discussion

In response to Absurd Inflation Discussion by Fed Jackasses, Pater Tenebrarum at the Acting Man blog pinged me with this comment:

“It is de facto not possible to measure price inflation or a general level of prices. The latter is simply nonsense, it doesn’t exist. Both money and goods are subject to changes in supply and demand, hence there is no yardstick by which the purchasing power of money could be measured. And this is before we get to the fact that adding up and averaging the prices of disparate goods simply makes no logical sense.”

Brandolini’s Law

It’s not just the Phillips Curve either. Keynes thought inflation and recession could not happen at the same time. Yet, people still cling to that too. This leads to:

The bullshit asimmetry: the amount of energy needed to refute bullshit is an order of magnitude bigger than to produce it.

— Alberto Brandolini (@ziobrando) January 11, 2013

The Phillips Curve isn’t dead, it was never alive to begin with. None of the models the Fed relies on works. Repetitive bubbles are proof enough.

Mike “Mish” Shedlock

Pretending economics can ever, under any circumstance, in any fashion, be treated as an empirical science, is nonsensical from the get go. It’s not just the Phillips Curve which is nonsensical. But rather all of it.

For empirical economics to make any sense at all, even theoretically, it would at a minimum deal with relations between directly empirically measurable quantities. Not with abstract quantities which are only arbitrarily defined stand ins for such.

Yet there will never be a quantity called “unemployment” lounging about which one can measure. Nor another one called inflation which has any at all inevitable relation to prices of arbitrarily and ever changing relative prices of goods and services.

So instead, despite pretending to be all sciency about what they do, empirical economics proponents never actually do anything other than make up contrived models, which always deviate from the true real world. Then set about “proving” relationships between facets of said models. Which never amount to more than proving prejudices bakes into the arbitrary definitions underpinning the models to begin with.

And it’s not as as if there’s the problem stems from a lack of raw brainpower. Plenty of highly sophisticated math has been thrown at it. Instead, the problem is simply that economics isn’t an empirical science to begin with. There are no atoms. No universal forces. No stable relations. Any economic actor can, and will, change his actions 100%, if empirical economists were ever to “prove” that doing so could never happen, in order to gain a competitive advantage. Every new discovery, of any kind, will be taken into consideration by actors pondering their next action. Including “economic” ones. Hence, the only constants economics can rely on, are the first principles, like scarcity of resources and utility maximization. Anything not logically deducible from those, are either simple curve fitting, or accidents of history.

Stuki

Economists claim to do science from Adam Smith/Karl Marx onward to the “Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel”. Fact is, though, that economics is a failed/fake science or what Feynman called a cargo cult science.

The problem does NOT lie in the subject matter but in the fact that economics is a science without scientists. Economics has been hijacked early on by political agenda pushers. These stupid/corrupt folks have produced NOTHING of scientific value in the last 200+ years. They do not understand to this day the elementary mathematics that underlies macroeconomic accounting.#1

Economists can always explain why they are still at the proto-scientific level. You, too, repeat merely worn-out slogans from the long list of lame excuses.#2

The scientific incompetence of economists consists of the fact that it is beyond their means to realize that NO way leads from the understanding of Human Nature/motives/behavior/action to the understanding of how the economic system works. What makes things worse is that there is NO scientifically valid knowledge of Human Nature/motives/behavior/action, to begin with.#3

What has to be done is (i) to get rid of all stupid/corrupt agenda pushers, (ii) to execute the Paradigm Shift from false Walrasian microfoundations and false Keynesian macrofoundations to true macrofoundations.

Egmont Kakarot-Handtke

#1 DrainTheScientificSwamp

#2 Failed economics: The losers’ long list of lame excuses

#3 Economics is NOT about Human Nature but the economic system

If every single atom changed all it’s behavior in order to optimize it’s own standing among it’s peers in response to every new discovery in physics, physics wouldn’t be an empirical science neither. Repeatability sits at the very core of all science. Without it, there is, nor can be, none. Beyond the very limited deductions summarized in Man, Economy, and State, lies only charlatanism.

Stuki

You say that economics cannot be a science. This is simply false.

Economics has been hijacked early on by political agenda pushers. These stupid/corrupt folks have produced NOTHING of scientific value in the last 200+ years.

The problem of economics is that it is a science without scientists. For details of the big picture see cross-references Failed/Fake Scientists

Egmont Kakarot-Handtke

False economic theory makes bad economic policy

Comment on Mish Shedlock on ‘Yet Another Fed Study Concludes Phillip’s Curve is Nonsense’

Mish Shedlock summarizes: “Proponents of the Phillips Curve keep looking for ways in which it works. Yet, another study concludes it doesn’t. The Phillips Curve, an economic model developed by A. W. Phillips purports that inflation and unemployment have a stable and inverse relationship. This has been a fundamental guiding economic theory used by the Fed for decades to set interest rates. Various studies have proven the theory is bogus, yet proponents keep believing.”

The Phillips Curve (better: bastard Phillips Curve) is the centerpiece of standard employment theory. Economists get employment theory wrong for 200+ years. The Phillips Curve has always been the highly visible landmark of economists’ scientific incompetence.

“In order to tell the politicians and practitioners something about causes and best means, the economist needs the true theory or else he has not much more to offer than educated common sense or his personal opinion.” (Stigum)

The materially/formally inconsistent Phillips Curve has to be replaced by the correct macroeconomic Employment Law. For details see

• NAIRU, wage-led growth, and Samuelson’s Dyscalculia

• Keynes’ Employment Function and the Gratuitous Phillips Curve Disaster

• NAIRU and the scientific incompetence of Orthodoxy and Heterodoxy

• Full employment, the Phillips Curve, and the end of Gaganomics

Egmont Kakarot-Handtke

In the last article the last paragraph roughly states that policy makers can use parameters to obtain full employment w/o inflation. In theory there is no difference between practice and theory , in practice there is. The Ivy league trained PhD’s with no real world business experience or expertise(Powell being the only exception) have no business setting interest rates. The free market can accomplish this more efficently without the govt help. THe only function of the Ivory tower theoriticans should be to provided liquidity in the case of a liquidity crisis NOTHING else. Their policies have enriched the 1% and allowed the govt to deficit spend with no consequence. They are completely incompetent.

I recall disputing this nonsense in an econ class at UC Berkeley and being marked wrong on an exam. Just look at UE and inflation under Clinton. It’s a sociology, not real science, and folks like Yellen get ahead by reiterating dogma. Gibberish.

What I find shocking is a fed study that refutes common sense. Again, ask anyone in the real world that employes real people and you will find universally that they are raising wages becasue of a tight labor market. Guess what, this will never show up in the fed data because they don’t want it to. Another propaganda lie from the monetary politburo to keep financing costs so they can keep pissing money away for the military and to keep the free shit army placated. I feel like I am living in altered reality because everyone believes this garbage.

Once conclusive relationship.

Cheap and easy money (QE) + ZIRP + massive deficits = housing and stock bubbles

With those closest to the spigot getting rich.

Milton Friedman correctly stated that the Phillips Curve was bogus 40-50 years ago.