A decline in gasoline prices pushed the Consumer Price Index Survey into negative territory for March.

CPI Month-Over-Month Key Points

- The Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.1 percent in March on a seasonally adjusted basis after rising 0.2 percent in February.

- A decline in the gasoline index more than outweighed increases in the indexes for shelter, medical care, and food to result in the slight seasonally adjusted decline in the all items index. The energy index fell sharply due mainly to the 4.9-percent decrease in the gasoline index.

- The index for food rose 0.1 percent over the month, with the indexes for food at home and food away from home both increasing. The index for all items less food and energy increased 0.2 percent in March, the same increase as in February.

- Along with shelter and medical care, the indexes for personal care, motor vehicle insurance, and airline fares all rose.

- The indexes for apparel, for communication, and for used cars and trucks all declined over the month.

CPI Year-Over-Year Key Points

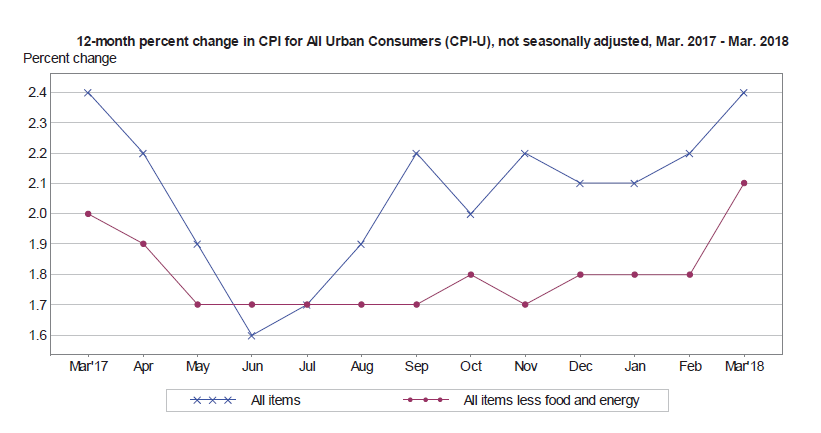

- The all items index rose 2.4 percent for the 12 months ending March, the largest 12-month increase since the period ending March 2017 and higher than the 1.6-percent average annual rate over the past 10 years.

- The index for all items less food and energy rose 2.1 percent, its largest 12-month increase since the period ending February 2017.

- The energy index increased 7.0 percent over the past 12 months.

- The food index advanced 1.3 percent over the past 12 months.

US Treasury Yields

The bond market responded with a big yawn to year-over-year inflation.

Mike “Mish” Shedlock

moar cooked, manipulated.completely fraudulent numbers coming from the ministry of truth n propaganda

There will only be one place to hide (financially), and it won’t be Bitcoin.

The fact that the Fed is raising rates in this anemic global economy is proof enough that not even blood letting can save pensions, or any other entity that has been forced to hold treasuries (i.e. insurance funds, social security, etc).

plenty of other articles, like this – link to ipe.com

useless – link to ft.com

Anyone thinking that treasury yields and CPI will be highly correlated over the next few years will be separated from their money faster than those thinking stock prices are a gauge of economic strength. What happens when confidence in govt collapses and blue chip stocks become the safe haven? Is it possible that investors may choose assets with actual collateral, versus nothing but hot air and lies? Look no further than Italy as a signpost along the way to the land of sovereign defaults, where fundamentals and technicals will be