Negative-Yielding Debt in Bloomberg Index

New Records

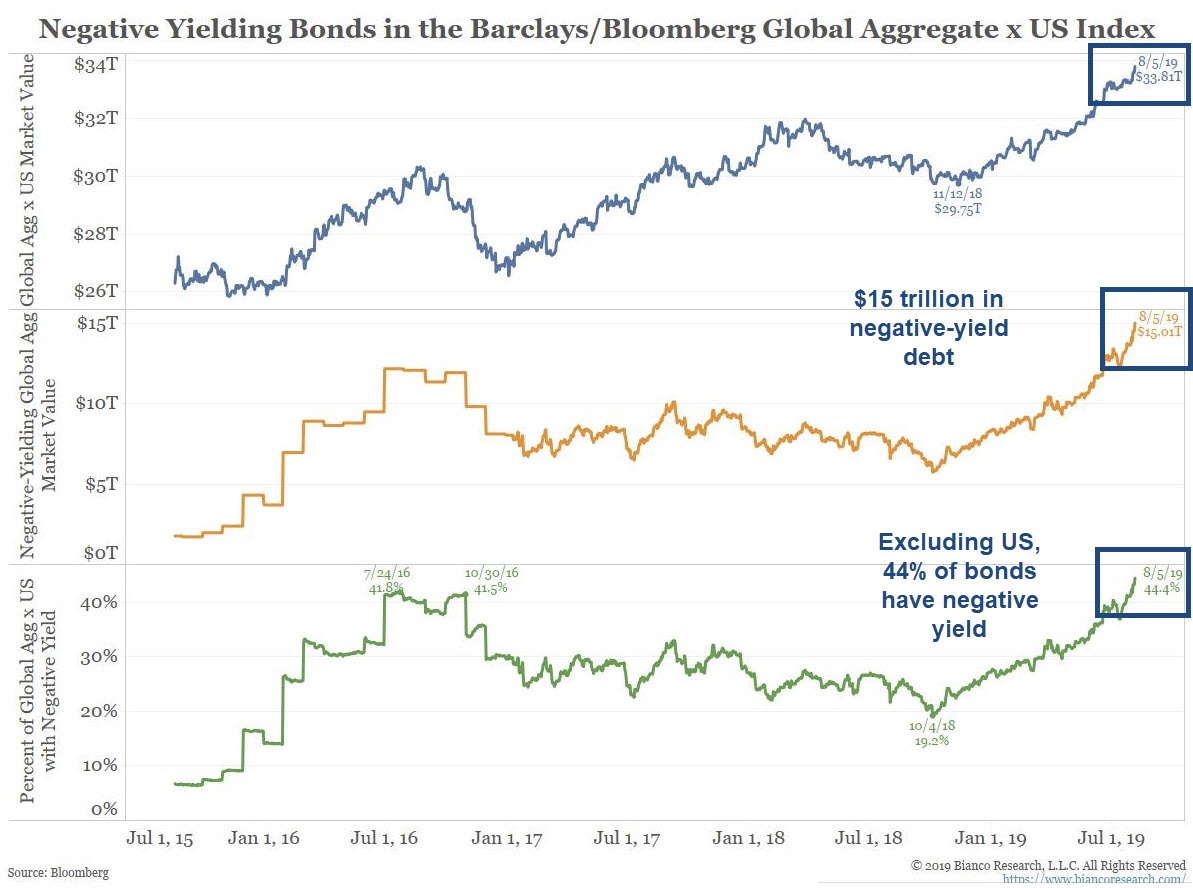

Negative debt topped $15T today (record), up over $1T in two business days.

Negative debt now 27% (record) of all developed country sovereign debt.

Negative debt now 44% of of all developed country x US sovereign debt.@MishGEA pic.twitter.com/XXNBcgHD02

— Jim Bianco (@biancoresearch) August 5, 2019

Highlights from Jim Bianco at Bianco Research.

Key Points

- Negative debt topped $15 Trillion today on Monday, up over $1 Trillion in two business days.

- Negative debt is now 27% of all developed country sovereign debt, a new record.

- Negative debt now 44% of of all developed countries excluding US sovereign debt.

Excluding US

Negative Yield Bond Matrix

Negative Bond Yields through…

50 yrs: Switzerland

30 yrs: Germany, Netherlands

20 yrs: Denmark

15 yrs: Japan, Austria, Finland, Sweden, France, Belgium

10 yrs: Slovakia, Ireland, Slovenia

8 yrs: Spain

7 yrs: Portugal

5 Yrs: Malta

3 yrs: Cyprus

2 yrs: Italy

1 yr: Bulgaria pic.twitter.com/YX3u0QgGPZ— Charlie Bilello (@charliebilello) August 5, 2019

Swiss 100-Year Bond

Uh … No thanks

You firts https://t.co/Ozfmh9mMQY— Mike “Mish” Shedlock (@MishGEA) August 5, 2019

Germany

With German govt bonds, only one thing is certain: you will lose money w/them until you don’t find another fool who buys the paper from you at a higher price before maturity. 97% of the €1.3tn outstanding German Bunds carry negative interest rates, @BarkowConsult has calculated. pic.twitter.com/GCqEv2GnOI

— Holger Zschaepitz (@Schuldensuehner) August 4, 2019

Global Bond Bubble

Bond bubble keeps inflating. Value of global bonds has hit a fresh high of almost $55.3tn as global CenBanks concertedly are cutting interest rates. pic.twitter.com/SZ6T0Rm9tR

— Holger Zschaepitz (@Schuldensuehner) August 4, 2019

Thought of the Day

Globally coordinated monetary policy is morphing into globally competitive monetary policy.

From a macro perspective that may be the most important concept investors must understand.

— Michael Lebowitz, CFA (@michaellebowitz) August 1, 2019

Another Thought of the Day

Good Morning from #Germany where bond markets have Japanized more quickly than in #Japan. Germany’s 10y govt bond yields reached 0% in one-third the time Japan required. pic.twitter.com/Qfyk5Oslfi

— Holger Zschaepitz (@Schuldensuehner) July 31, 2019

Thread of the Day

Logically Impossible

Negative debt implies a negative time preference. In the real world, that cannot happen.

In easy to understand terms, negative time preference means someone would rather have 90 cents ten years from now than a dollar today.

Such a construct is only possible with massive central bank intervention.

Anger

So the ECB, BOJ, SNB and Riksbank have negative interest rates but we determine that China is the currency manipulator whose currency is down a whopping 2.5% this year vs the dollar. Anger is now driving the approach towards China, certainly not economic logic.

— Peter Boockvar (@pboockvar) August 5, 2019

In regards to the above Tweet, please see US Treasury Declares China a Currency Manipulator Under Orders From Trump

Mike “Mish” Shedlock

The simple truth is that most of these countries can’t possibly pay off their bond debt so all they can do is keep interest rates as low as possible(negative bond yields are the result) for as long as they can. At some point the bond bubble will burst, as will many other economic bubbles, and the resulting defaults and economic collapse will be beyond what most people can imagine. All bubbles burst sooner or later.

All these “markets” are driven by speculation and “total return” metrics.

Irredeemable money has led to the proliferation of all those derivatives (an endless regress of mutual liability attempting to find a rocky bottom in the murky waters).

The gravity of this cloud of digital money coursing around the globe has led to a monetary vortex, or black hole. We may be beyond the event horizon, about to discover what happens when it is crushed and comes out in another dimension. One thing is certain, water will not change course and start running uphill.

Here’s your crappy job: A bond salesman in a negative debt country. “No one will answer the phone!” “He keeps hanging up!” (Nod to Pink Floyd.)

Okay, say you run a bond fund so you are expecting negative yields. Is the paradigm to take the least negative bond (for a given credit & mty) phone call? I presume so. Still, an awkward job to do.

Would think selling negative yield bonds would be an easy, stress free job. Since there’s not real (human) market for them, just rely on the artificial one. It’s like selling $1,200 coffee cups, no actual person would want them but the US military will be thrilled to take your whole inventory, then come back for more later. Gotta love the fake economy!

“In easy to understand terms, negative time preference means someone would rather have 90 cents ten years from now than a dollar today.”

Why? Because debt that can’t be paid, won’t be paid. And people who buy these bonds think that 90% will be more than what we will be paid 10 years from now on the “assets” (debt) they own. You’ve been yammering (correctly) about deflation resulting from the next collapse, and these yields are a clear indication that many capitalists agree with you.

Agreed, interest rates going negative reflects market expectations of mid- to long-term capital destruction. The world is getting poorer, pretending otherwise is getting riskier — and bond markets are catching on.

But…but… According to the BIS’ own Capital Adequacy Rules, these are RISK FREE “assets”. RISK FREE, except for the money you KNOW you are going to lose every year. LOL….

All bonds are a promise to pay. The current bond market, sovereigns included, are swamped by doubt and indifference. I doubt Argentine bonds and I’m indifferent to even AAA corporates due to the peanut returns.

I think bonds are now increasingly being used simply as capital storage bins, still better than a mattress.

I’ve abandoned the promise to pay in favor of the promise to continue to produce, this in the form of well-managed, out of fashion, corporations with long records of growth and profitability Central bankers and fiat currency have finally made a believer out of this sucker; I’m out of bonds and expect a massive drawdown with the coming, much-delayed recession.

Given the chaos that reigns at the moment is it any wonder that socialism is on the march? It may be wrong headed but at least it is coherent. There is very little that can be called capitalism or free enterprise in the current system. There is corporatism, there are rentiers and price gauges running amok, there is a system in place to keep zombie banks, companies, and countries going but precious little free enterprise.

Sorry for changing the subject but you’ve described the EU centrist gravy train.

“There is corporatism, there are rentiers and price gauges running amok, there is a system in place to keep zombie banks, companies, and countries going but precious little free enterprise.”

Lenin was right, and mighty prescient to boot: The best way to destroy capitalism, really turns out to have been simply debauching the currency.

We’re all living in just another socialist Utopia now. Where almost everyone is equal: Lliving under the boot in increasing squalor. While a few are party members; hence more equal. Living high not in any way from own effort nor talents not productivity, but simply due to receiving government welfare. Paid for by currency debauchment mediated, crass theft.

That is all that is left of the West now. Pretty much entirely without any exception. Hence, the sooner the Jihadis do to “our” “Utopia” what they did to the Soviet one, the better.

‘Capitalism…is no longer the progressive force described by Marx’; the free market era ‘has been followed by a new one in which production is concentrated in vast syndicates and trusts which aim at monopoly control’. Giant multinational technology companies ‘freeze out other competition to forestall independent technological innovation’. Financial control ‘has passed from the industrialists themselves to a handful of banking conglomerates – the creation of a banking oligarch”

Imperialism: The Highest Stage of Capitalism

Lenin

“With German govt bonds, only one thing is certain: you will lose money w/them until you don’t find another fool who buys the paper from you at a higher price before maturity.”

…

Not necessarily.

Folks ALWAYS forgetting the currency component. Carry trade of borrowing in a depreciating currency and buying an asset priced in an appreciating currency. Germany gets a bonus since some traders are betting at some point Germany will walk away from euro and its debt will be repriced in marks (which would SOAR to remnant of euro). Still kicking myself for not buying bunds 5 or 6 years ago when I was seriously considering.

That is the most concise explanation for negative yielding bonds that I have seen. Good job.

Ahh, perhaps the Euro failure is already being priced in…folks think the Swiss Franc will soar as well