Bloomberg comments on the Unstoppable Surge in Negative Yields.

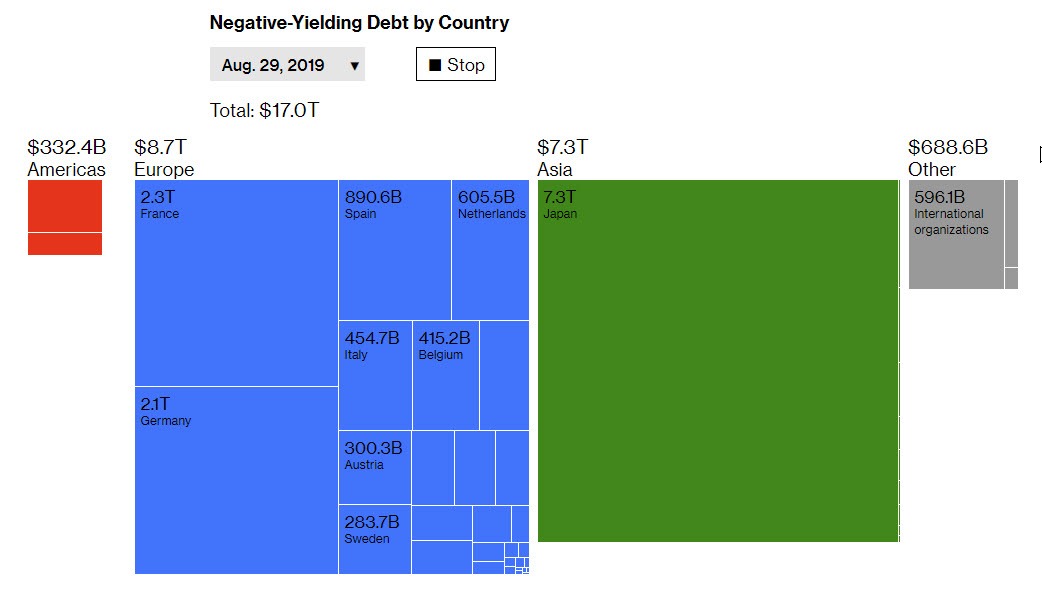

The global stock of negative-yielding debt is now in excess of $17 trillion as rising market volatility lends extra force to this year’s unprecedented bond rally.

Thirty percent of all investment-grade securities now bear sub-zero yields, meaning that investors who acquire the debt and hold it to maturity are guaranteed to make a loss. Yet buyers are still piling in, seeking to benefit from further increases in bond prices and favorable cross-currency hedging rates—or at least to avoid greater losses elsewhere.

The negative-yield phenomenon is turning financial markets on their head—raising the specter of a bond bubble, draining pension funds of a valuable source of income and incentivizing riskier companies to mortgage their assets. At the same time, banks are having to reassure citizens that they won’t suddenly start charging customers to store their money.

Negative-Yielding Debt On December 31, 2018

The article has a nice autoplay month-by-month graphic of the rise of negative-yielding debt.

Since December 31, 2018

- Negative-yielding debt in the Americas has fallen from $332.4 billion to $40.3 billion, a decline of $291.1 billion.

- Negative-yielding debt worldwide has risen from $8.3 trillion to $17.0 trillion, an increase of $8.7 trillion.

30% of investment-grade (non-junk) debt now has a negative yield.

Amazing.

This is of course an amazing bubble. But for now, there is no catalyst to pop it.

Mike “Mish” Shedlock

“Negative-yielding debt in the Americas has fallen from $332.4 billion to $40.3 billion, a decline of $291.1 billion.”

Looks like it is the other way around.

How quickly Bloomburg has forgotten his “secret” pal (Obama), is the one causing all those “Trillions” to be spent when they infiltrated and over ran our government with the “Third World Coop”. We all know how the “Brown express and other packaging companies were used to over load the eastern part of the U.S. with Nancy Pelosi and her,..AHEM… FEMALE JUNIOR League LEADERS of the Third World Coop (Crew) with all the democrats and traitorous Septic Pool Republicans. Or maybe he has developed Alzheimer’s?

The amount of attention given to the absurd condition of negative yields means the bond bubble is close to popping.

Every unit of fiat currency, every bond floated, every derivative on any market, every option, all of it everywhere, is owned at all times, but the owner can change through mutual transactions. What we really need is more owners!

We should allow robots to own and trade debt instruments. Just think, a whole new class of greater fools’ that we can create from next to nothing!

Elon Musk, where are you?

Mish: Any idea what will finally pop this bubble?

Is there anything left but bubbles? Sovereign bonds now. Later, gold. Then the rules change, good luck guessing how.

Mish, something is reversed on the Americas.

To negative infinity and beyond!

This article should make clear why the Fed wants to lower rates. It has nothing to do with our economy, or Trump, and everything to do with int’l influence. The Fed has become the world’s CB; and pensions, SS, and savers are being sacrificed. I guess the establishment believes older people can’t fight back.

Central banks are the only buyers of all that worthless paper,why?Because they have acres and acres of flourishing money trees,where bill fall off like leaves,that ‘s why they own all bonds,most stocks,all the gold’silver on the planet,biggest buyers of oil and virtually all commodities for over a decade.The central banks and there printing presses will eventually own……….well….everything………until they don’t!